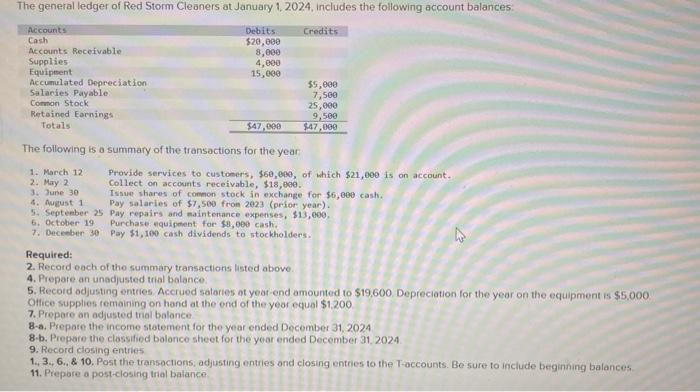

Question: I need all sections, please. The following is a summary of the transactions for the year: 1. March 12 Provide services to customers, $60,000, of

The following is a summary of the transactions for the year: 1. March 12 Provide services to customers, $60,000, of which $21,000 is on account. 2. May 2 Collect on accounts receivable, $18,069. 3. 3une 30 Issue shares of common stock in exchange for $6,000 cash. 4. Auadust 1 Pay salaries of $7,500 from 2023 (prior year). 5. Septenber 25 Pay repairs and mainterance expenses, $13,000, Recquired: 2. Record each of the summary transactions listed abovo. 4. Prepare an unadjusted trial balafce? 5. Record odjusting entres Accrued salaries at year-end amounted to $19,600 Depreciation for the year on the eciupment is $5.000. Othce supplies femaining on hand at the ornd of the year equal $1,200 7. Propare an adjusted tral balance 8-a. Prepare the income statement for the year ended Decomber 31,2024 8-b. Propere the classified balance sheet for the yoar ended December 31.2024. 9. Record closing entries 1. 3., 6., \& 10. Post the transocions, adjusting entries and closing entries to the T-occounts. Be sure to include beginning balances. 11. Prepare a post-closirig tral balance The following is a summary of the transactions for the year: 1. March 12 Provide services to customers, $60,000, of which $21,000 is on account. 2. May 2 Collect on accounts receivable, $18,069. 3. 3une 30 Issue shares of common stock in exchange for $6,000 cash. 4. Auadust 1 Pay salaries of $7,500 from 2023 (prior year). 5. Septenber 25 Pay repairs and mainterance expenses, $13,000, Recquired: 2. Record each of the summary transactions listed abovo. 4. Prepare an unadjusted trial balafce? 5. Record odjusting entres Accrued salaries at year-end amounted to $19,600 Depreciation for the year on the eciupment is $5.000. Othce supplies femaining on hand at the ornd of the year equal $1,200 7. Propare an adjusted tral balance 8-a. Prepare the income statement for the year ended Decomber 31,2024 8-b. Propere the classified balance sheet for the yoar ended December 31.2024. 9. Record closing entries 1. 3., 6., \& 10. Post the transocions, adjusting entries and closing entries to the T-occounts. Be sure to include beginning balances. 11. Prepare a post-closirig tral balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts