Question: i need an answer urgently please,i will leave thumbs up.thank you in advance mentals of Management Accounting (5K421006_2122_1F) 5 This course Lecture Capture ses >

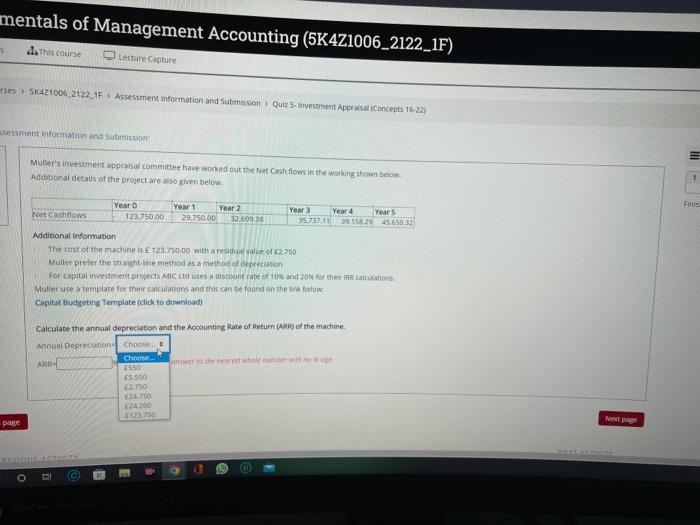

mentals of Management Accounting (5K421006_2122_1F) 5 This course Lecture Capture ses > SKAZ1006 2122_1F Assessment information and Submission Quiz 5. Investment Appraisal Concepts 16-22) ssessment information and Submission Muller's investment appraisal committee have worked out the Net Cash fows in the working shown below Additional details of the project are also given below Finis Year Year 1 Year 2 Year 3 Year 4 Years NetCashflows 123.750.00 29.750.00 32.60933 35,737,11 39.158.2945.650 30 Additional information The cost of the machine is E 123.750.00 with a residual value of 2.750 Muller prefer the straight line method as a method of depreciation For capital investment projects ADC Ldutes a discount rate at 10% and 20 for their calculations Mulier use a template for their calculations and this can be found on the link below Capital Budgeting Template (click to download Calculate the annual depreciation and the Accounting Rate of Retum (ARIO of the machine Annual Depreciation Choose ARR Choose 1550 me to the ones whole number im ES550 2.750 750 2400 1250 Next page page 0 o O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts