Question: i need an answer urgently please,i will leave thumbs up.thank you in advance Nem Tandate e Card action 544 pages Home Page MML This course

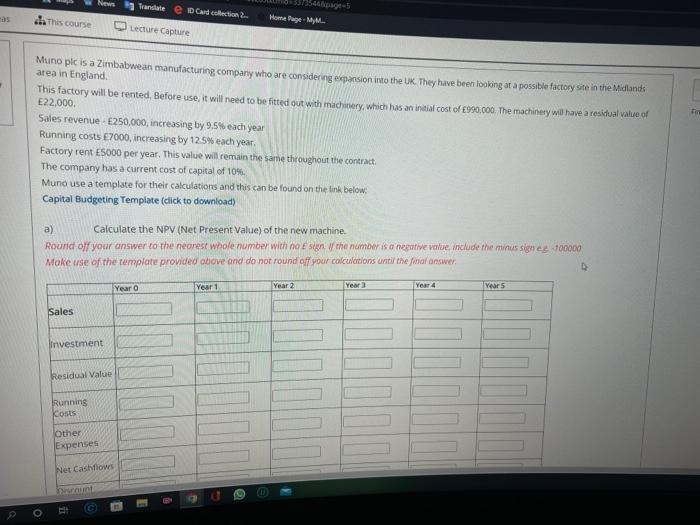

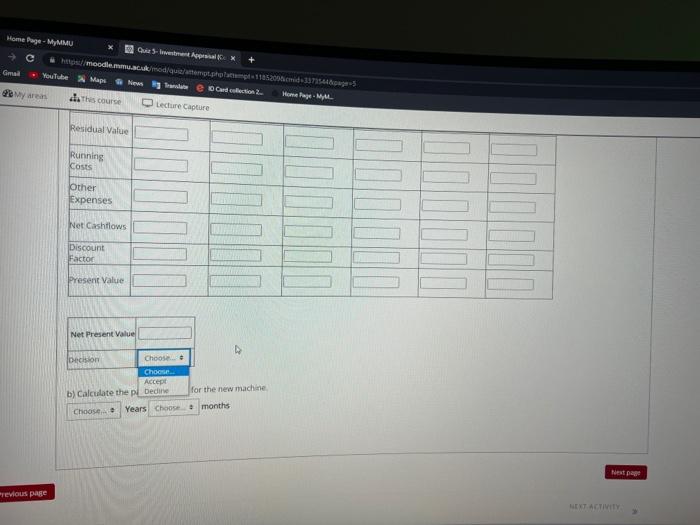

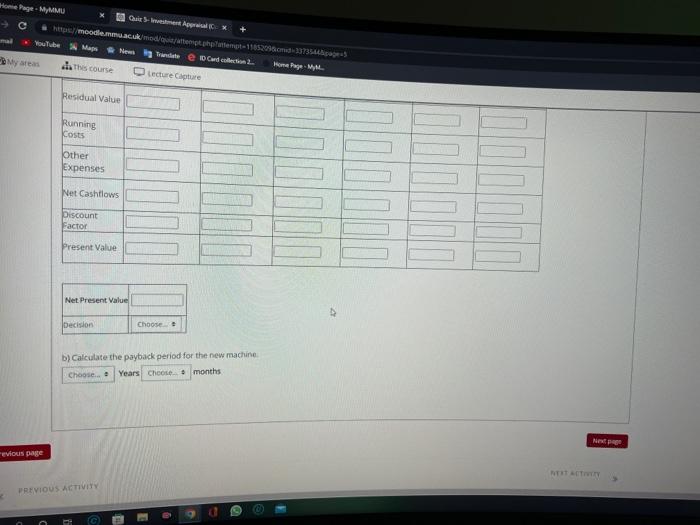

Nem Tandate e Card action 544 pages Home Page MML This course Lecture Capture Muno plc is a Zimbabwean manufacturing company who are considering expansion into the UK. They have been looking at a possible factory site in the Midlands area in England This factory will be rented. Before use, it will need to be fitted out with machinery, which has an initial cost of 990,000. The machinery will have a residual value of E22,000 Sales revenue E250,000, increasing by 9.5% each year Running costs 7000, increasing by 12.5% each year, Factory rent 5000 per year. This value will remain the same throughout the contract The company has a current cost of capital of 10% Muno use a template for their calculations and this can be found on the link below: Capital Budgeting Template (click to download) a) Calculate the NPV (Net Present Value) of the new machine. Round off your answer to the nearest whole number with no sign the number is a negative value include the minus signes 700000 Moke use of the template provided above and do not round off your calculations until the final answer, Year o Year 1 Year 2 Year Year 4 years Sales investment Residual Value Running Kosts Other Expenses Net Cashdows num O Home Page - MyMMU Gust - X Mg/moodlemmu.acmodiquitatemplom 110.200cm-33715445 Gmad - YouTube Maps N Tree Card cohesion 2 Homelage MAL der The course Lecture Capture Residual Value Running Costs Other Expenses Net Cashflows Discount Factor Present Value Net Present Value Decision Choose Cho Accept b) Calculate the pl bedre for the new machine Choose Years Choose months Net revious page ET ACTIVITY Home Page - MIMO Chels - Investment April //moodle.uk/mod/g/atteript.php ottempt-1150cm-337344 YouTube Maps New Tradate e Co2 Home Page ma le the course Lecture Capture Residual Value Running kosts Other Expenses Net Cashflows Discount Factor Present Value Net Present Value Decision Choose b) Calculate the payback period for the new machine Choose... Years Choose months evious page PREVIOUS ACTIVITY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts