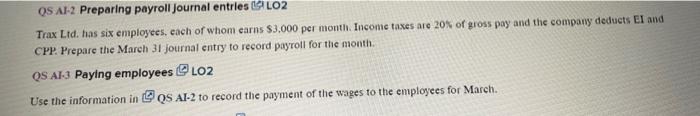

Question: i need ans for AI 3 QS AI-2 Preparing payroll joumal entrles ISLO2 Trax Ltd. has six employees, each of whom earns $3,000 per monti.

QS AI-2 Preparing payroll joumal entrles ISLO2 Trax Ltd. has six employees, each of whom earns $3,000 per monti. Income taxes are 20 R of gross pay and the company deducts EI and CPP. Prepare the March 31 journal entry to record payroll for the month. QS AI.3 Paying employees 4 LO2 Use the information in [ QS AI-2 to record the payment of the wages to the employees for March

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts