Question: i need ans for these two questions below please show your work 2. [15 points] You start a private mortgage lending firm that targets high

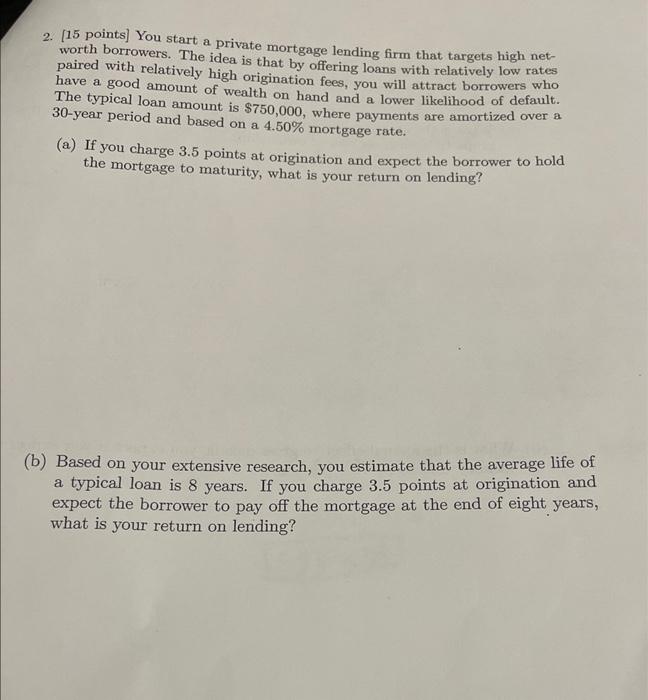

2. [15 points] You start a private mortgage lending firm that targets high networth borrowers. The idea is that by offering loans with relatively low rates paired with relatively high origination fees, you will attract borrowers who The typical loan a gount of wealth on hand and a lower likelihood of default. The typical loan amount is $750,000, where payments are amortized over a 30-year period and based on a 4.50% mortgage rate. (a) If you charge 3.5 points at origination and expect the borrower to hold the mortgage to maturity, what is your return on lending? (b) Based on your extensive research, you estimate that the average life of a typical loan is 8 years. If you charge 3.5 points at origination and expect the borrower to pay off the mortgage at the end of eight years, what is your return on lending

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts