Question: . I need answer B Carla Vista, Inc., has issued eight-year bonds with a coupon rate of 7.215 percent and semiannual coupon payments. The market's

. I need answer B

. I need answer B

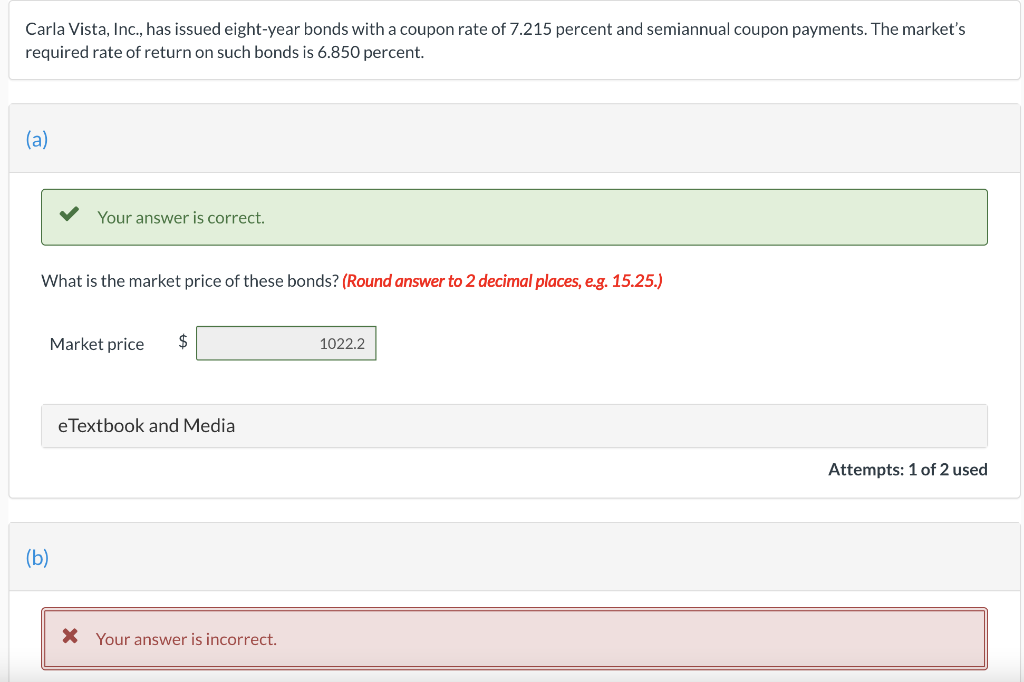

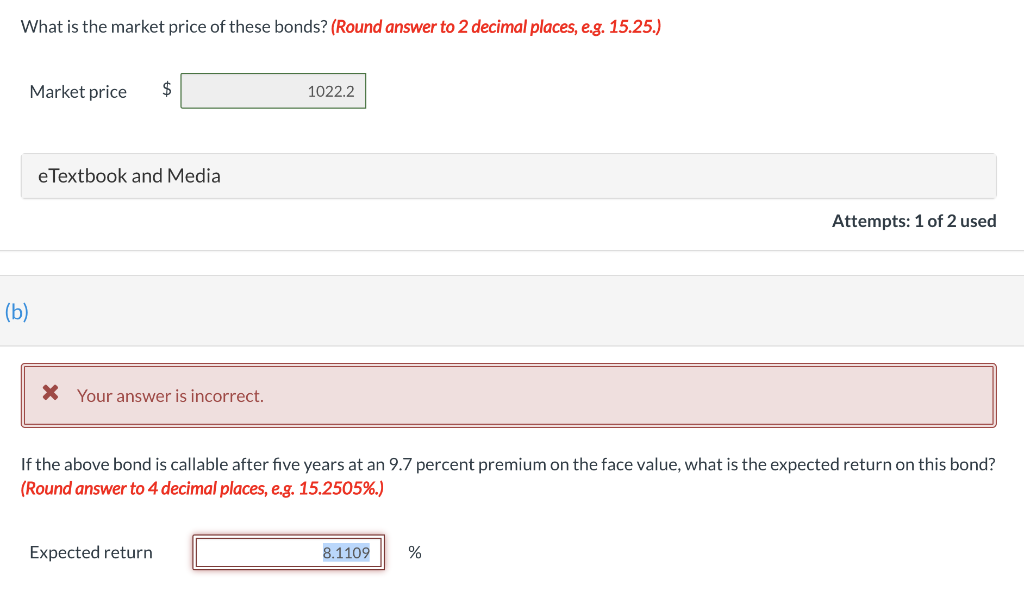

Carla Vista, Inc., has issued eight-year bonds with a coupon rate of 7.215 percent and semiannual coupon payments. The market's required rate of return on such bonds is 6.850 percent. (a) Your answer is correct. What is the market price of these bonds? (Round answer to 2 decimal places, e.g. 15.25.) Market price $ 1022.2 e Textbook and Media Attempts: 1 of 2 used (b) * Your answer is incorrect. What is the market price of these bonds? (Round answer to 2 decimal places, e.g. 15.25.) Market price $ 10222 e Textbook and Media Attempts: 1 of 2 used (b) * Your answer is incorrect. If the above bond is callable after five years at an 9.7 percent premium on the face value, what is the expected return on this bond? (Round answer to 4 decimal places, e.g. 15.2505%.) Expected return 8.1109 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts