Question: I need answer by 10am can anyone help me... Question 1 - Show your workings. a. A corporate bond has been issued on January 1,

I need answer by 10am can anyone help me...

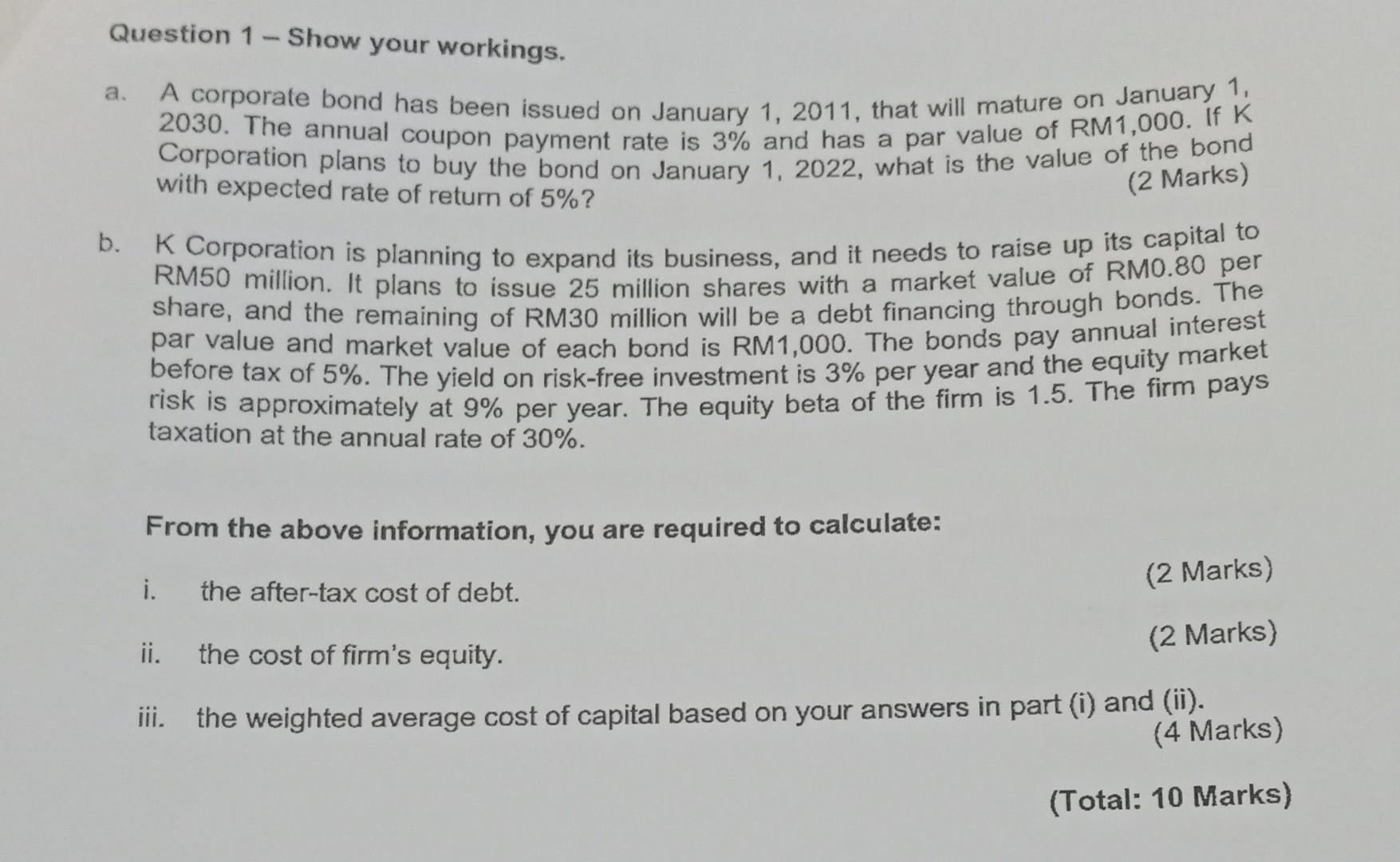

Question 1 - Show your workings. a. A corporate bond has been issued on January 1, 2011, that will mature on January 1, 2030. The annual coupon payment rate is 3% and has a par value of RM1,000. If K Corporation plans to buy the bond on January 1, 2022, what is the value of the bond with expected rate of return of 5%? (2 Marks) b. B.Corporation is planning to expand its business, and it needs to raise up its capital to RM50 million. It plans to issue 25 million shares with a market value of RM0.80 per share, and the remaining of RM30 million will be a debt financing through bonds. The par value and market value of each bond is RM1,000. The bonds pay annual interest risk is approximately at 9% per year. The equity beta of the firm is 1.5. The firm pays taxation at the annual rate of 30%. before tax of 5%. The yield on risk-free investment is 3% per year and the equity market From the above information, you are required to calculate: (2 Marks) i. the after-tax cost of debt. (2 Marks) ii. the cost of firm's equity. iii. the weighted average cost of capital based on your answers in part (i) and (ii). (4 Marks) (Total: 10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts