Question: I need answer for first photo. I have provided a second photo containing a second related which shows the exact formula to use for a

I need answer for first photo. I have provided a second photo containing a second related which shows the exact formula to use for a correct answer. Please follow this, and the rounding instructions (in red) to get the correct answer. THanks!

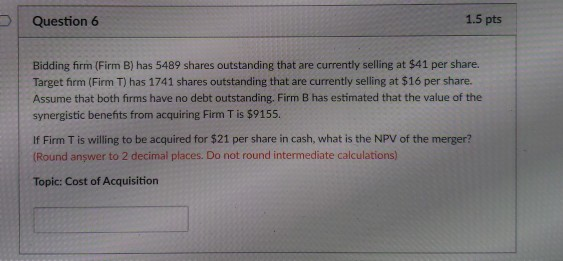

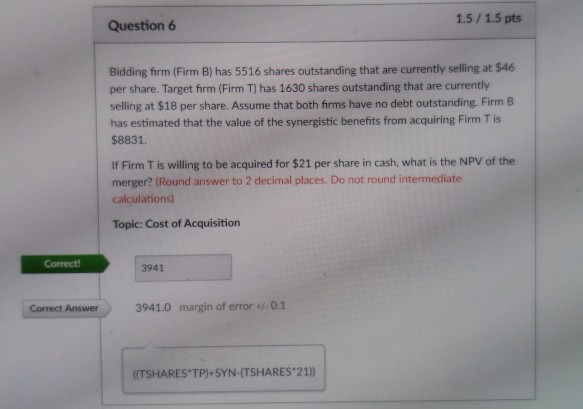

Question 6 1.5 pts Bidding firm (Firm B) has 5489 shares outstanding that are currently selling at $41 per share. Target firm (Firm T) has 1741 shares outstanding that are currently selling at $16 per share. Assume that both firms have no debt outstanding. Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $9155. If Firm T is willing to be acquired for $21 per share in cash, what is the NPV of the merger? Round answer to 2 decimal places. Do not round intermediate calculations) Topic: Cost of Acquisition 1.5/1.5 pts Question 6 Bidding firm (Firm B) has 5516 shares outstanding that are currently selling at $46 per share. Target firm (Firm T) has 1630 shares outstanding that are currently selling at $18 per share. Assume that both firms have no debt outstanding. Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $8831. If Firm T is willing to be acquired for $21 per share in cash, what is the NPV of the merger? (Round answer to 2 decimal places. Do not round intermediate calculations) Topic: Cost of Acquisition 3941 Correct Answer 3941.0 margin of error+-0.1 ITSHARES TP)+SYN-(TSHARES 21)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts