Question: i need answer for part c and e. Q.5. (a) Kashif knows that the beta of his portfolio is equal to 1, but he does

i need answer for part c and e.

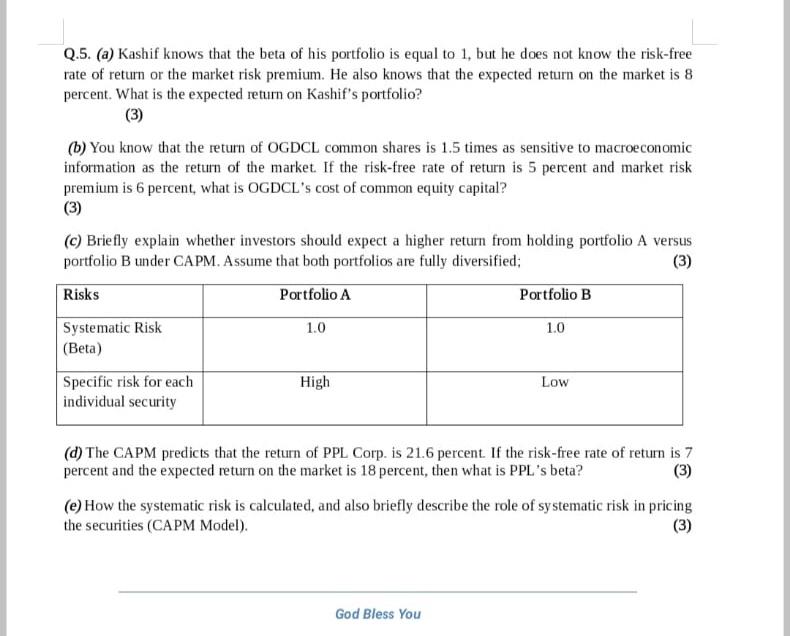

Q.5. (a) Kashif knows that the beta of his portfolio is equal to 1, but he does not know the risk-free rate of return or the market risk premium. He also knows that the expected return on the market is 8 percent. What is the expected return on Kashif's portfolio? (3) (b) You know that the return of OGDCL common shares is 1.5 times as sensitive to macroeconomic information as the return of the market. If the risk-free rate of return is 5 percent and market risk premium is 6 percent, what is OGDCL's cost of common equity capital? (3) () Briefly explain whether investors should expect a higher return from holding portfolio A versus portfolio B under CAPM. Assume that both portfolios are fully diversified; (3) Risks Portfolio A Portfolio B Systematic Risk 1.0 10 (Beta) Specific risk for each High Low individual security (d) The CAPM predicts that the return of PPL Corp. is 21.6 percent. If the risk-free rate of return is 7 percent and the expected return on the market is 18 percent, then what is PPL's beta? (3) (e) How the systematic risk is calculated, and also briefly describe the role of systematic risk in pricing the securities (CAPM Model). (3) God Bless You

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts