Question: i need answer for question C and D please Zetatron Berhad. Project Evaluation t has been two months since you took a position as an

i need answer for question C and D please

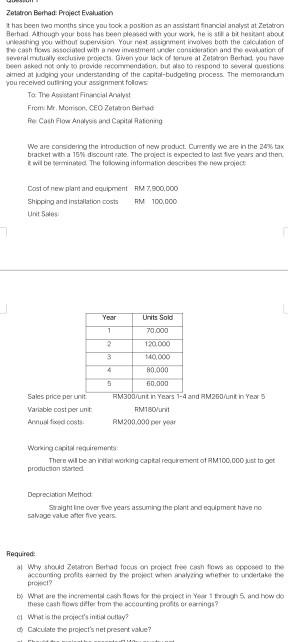

Zetatron Berhad. Project Evaluation t has been two months since you took a position as an assistam financial analyst at etatron Reshad Athough your bois has been essed with your work he sta bilhetan about washing you without supervision You nestassignment is both the condicion of Techowsociated with an investment under consideration and teevation of several mually exclusive project. Given your lack of real Zetaron Bed you have been asked not only drovide recommendation, but to respond to several Questions aimed at udging your understanding of the capital-budgeting process. The memorandum You received cutining your assignment follows To The Antical Analyst From Me Morison, CEO Zetse on Beated Pe Cash Flow Andys and Catong We are considering the introduction of new product. Currently we are in the 24% tax bracket with a 15% discount rate. The project is expected to last ve years and then will be red. The following information diese new project Cost of new plant and equipment RM 7.500,000 Shipping and installation costs RM 100,000 Year Units Sold 70.000 1 2 3 120.000 140.000 0033 4 Sales priceperunt Variable cost per un 60.000 RM300/unt in Years 1-4 and RM260/unt in Year RM180/unit RM200.000 per year Working corectement There will be annat working captal requirement of RM100,000 just to get production started Depreciation Method Sraightine over ve years assuming the plant and equipment have no salvage value after five years Required: Why should eaton Battan focus on projecte cash flows as to the accourcing profits were the price ralyng where to make the by What are the incrementachows for the project in Year 1 trough 5. and he do these cash flow differ from the courting profits or earnings? d What is the protect's india tay? Calculate the project's net present value? Zetatron Berhad. Project Evaluation t has been two months since you took a position as an assistam financial analyst at etatron Reshad Athough your bois has been essed with your work he sta bilhetan about washing you without supervision You nestassignment is both the condicion of Techowsociated with an investment under consideration and teevation of several mually exclusive project. Given your lack of real Zetaron Bed you have been asked not only drovide recommendation, but to respond to several Questions aimed at udging your understanding of the capital-budgeting process. The memorandum You received cutining your assignment follows To The Antical Analyst From Me Morison, CEO Zetse on Beated Pe Cash Flow Andys and Catong We are considering the introduction of new product. Currently we are in the 24% tax bracket with a 15% discount rate. The project is expected to last ve years and then will be red. The following information diese new project Cost of new plant and equipment RM 7.500,000 Shipping and installation costs RM 100,000 Year Units Sold 70.000 1 2 3 120.000 140.000 0033 4 Sales priceperunt Variable cost per un 60.000 RM300/unt in Years 1-4 and RM260/unt in Year RM180/unit RM200.000 per year Working corectement There will be annat working captal requirement of RM100,000 just to get production started Depreciation Method Sraightine over ve years assuming the plant and equipment have no salvage value after five years Required: Why should eaton Battan focus on projecte cash flows as to the accourcing profits were the price ralyng where to make the by What are the incrementachows for the project in Year 1 trough 5. and he do these cash flow differ from the courting profits or earnings? d What is the protect's india tay? Calculate the project's net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts