Question: I need answer in number 6, here are the reference Chapter 15 PRACTICE SET ON VALUE-ADDED TAX Dolores Domingo invested P5,000,000 in her business on

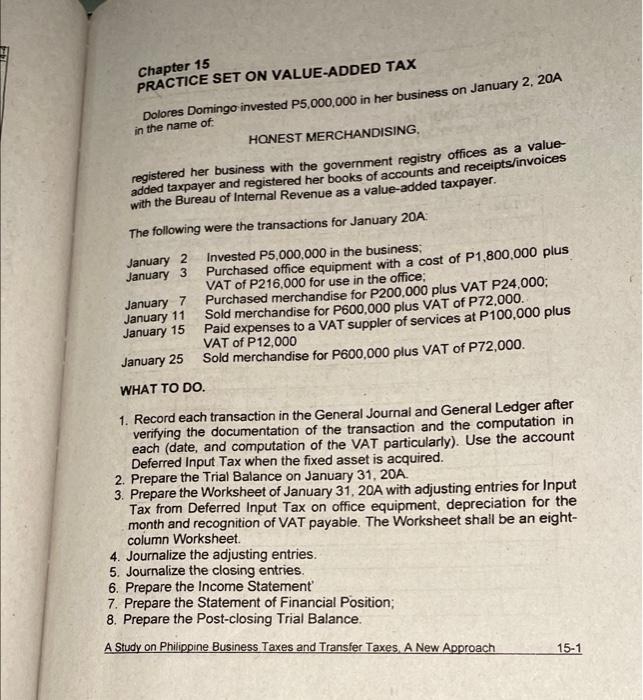

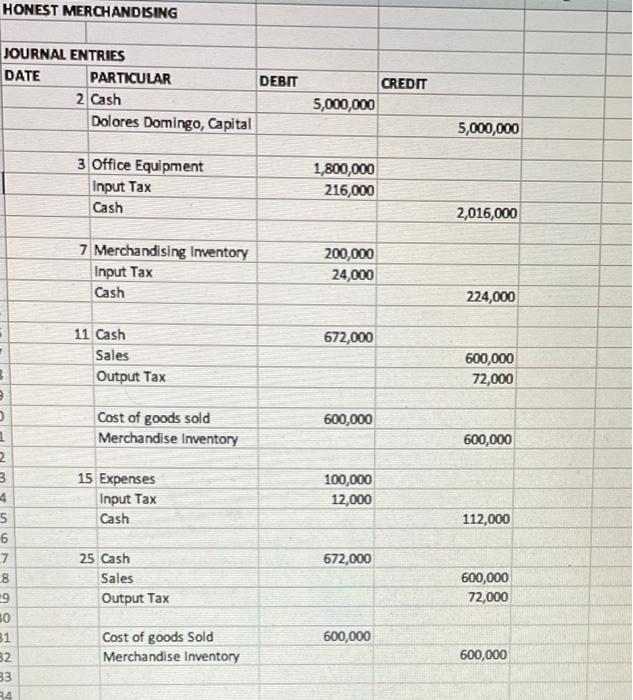

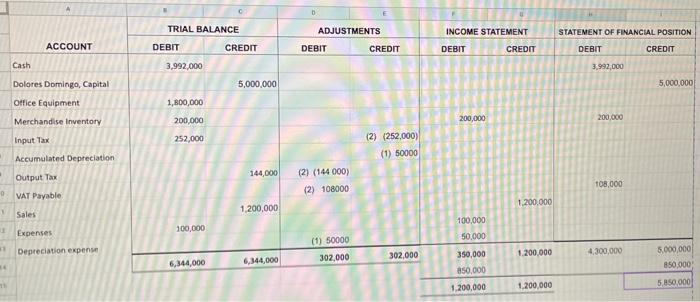

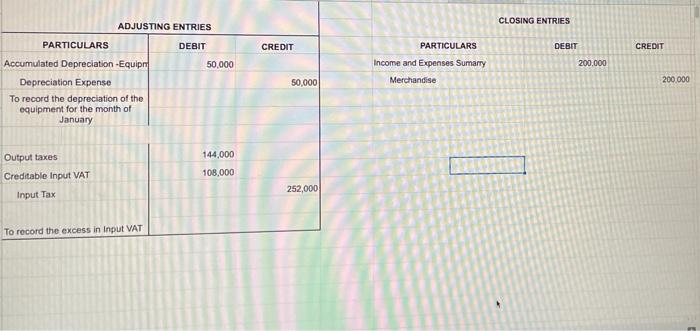

Chapter 15 PRACTICE SET ON VALUE-ADDED TAX Dolores Domingo invested P5,000,000 in her business on January 2, 20A in the name of HONEST MERCHANDISING, registered her business with the government registry offices as a value added taxpayer and registered her books of accounts and receipts/invoices with the Bureau of Internal Revenue as a value-added taxpayer. The following were the transactions for January 20A January 2 Invested P5,000,000 in the business January 3 Purchased office equipment with a cost of P1,800,000 plus VAT of P216.000 for use in the office, January 7 Purchased merchandise for P200.000 plus VAT P24,000; January 11 Sold merchandise for P600,000 plus VAT of P72,000. January 15 Paid expenses to a VAT suppler of services at P100,000 plus VAT of P12,000 January 25 Sold merchandise for P600,000 plus VAT of P72,000. WHAT TO DO. 1. Record each transaction in the General Journal and General Ledger after verifying the documentation of the transaction and the computation in each (date, and computation of the VAT particularly). Use the account Deferred Input Tax when the fixed asset is acquired. 2. Prepare the Trial Balance on January 31, 20A. 3. Prepare the Worksheet of January 31, 20A with adjusting entries for Input Tax from Deferred Input Tax on office equipment, depreciation for the month and recognition of VAT payable. The Worksheet shall be an eight- column Worksheet. 4. Journalize the adjusting entries. 5. Journalize the closing entries. 6. Prepare the Income Statement 7. Prepare the Statement of Financial Position; 8. Prepare the Post-closing Trial Balance, A Study on Philippine Business Taxes and Transfer Taxes A New Approach 15-1 HONEST MERCHANDISING JOURNAL ENTRIES DATE PARTICULAR DEBIT 2 Cash Dolores Domingo, Capital CREDIT 5,000,000 5,000,000 3 Office Equipment Input Tax Cash 1,800,000 216,000 2,016,000 7 Merchandising Inventory Input Tax Cash 200,000 24,000 224,000 672,000 11 Cash Sales Output Tax 600,000 72,000 600,000 Cost of goods sold Merchandise Inventory 600,000 15 Expenses 100,000 12,000 Input Tax Cash 112,000 1 2 3 4 5 6 7 8 9 50 31 32 33 34 672,000 25 Cash Sales Output Tax 600,000 72,000 wN00 600,000 Cost of goods Sold Merchandise Inventory 600,000 D TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT STATEMENT OF FINANCIAL POSITION ACCOUNT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Cash 3,992,000 3,992,000 Dolores Domingo, Capital 5,000,000 5,000,000 Office Equipment 1,800,000 200,000 200,000 200,000 Merchandise Inventory Input Tax 252,000 (2) (252,000) (1) 50000 Accumulated Depreciation 144,000 Output Tax (2) (144000) (2) 108000 108,000 0 VAT Payable 1,200.000 1.200,000 Sales 100,000 Expenses 100,000 50.000 (1) 50000 Depreciation expense 302,000 302,000 1.200.000 4,300,000 6,344,000 6,344,000 350,000 850,000 5.000.000 850,000 11 1.200,000 1.200.000 5,850,000 CLOSING ENTRIES ADJUSTING ENTRIES PARTICULARS DEBIT CREDIT CREDIT PARTICULARS Income and Expenses Sumarry Merchandise 50,000 DEBIT 200,000 50,000 200.000 Accumulated Depreciation - Equip Depreciation Expense To record the depreciation of the equipment for the month of January Output taxes Creditable Input VAT 144,000 108,000 252,000 Input Tax To record the excess in Input VAT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts