Question: I need answer urgently for this question because I have Test now in 2 hour. I will give the best rate for you. Thank you

I need answer urgently for this question because I have Test now in 2 hour. I will give the best rate for you. Thank you

Course: FUNDAMENTAL FINANCIAL ACCOUNTING AND REPORTING

Answer All Questions

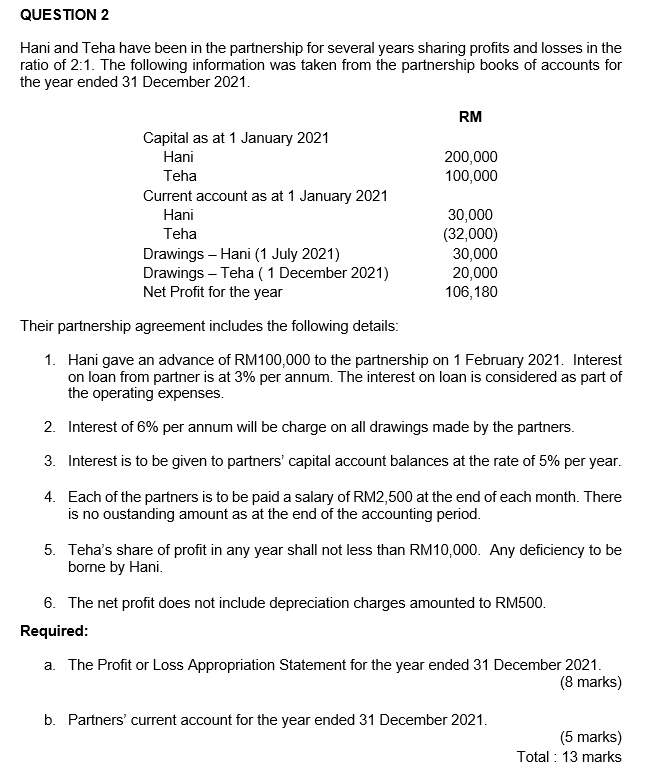

QUESTION 2 Hani and Teha have been in the partnership for several years sharing profits and losses in the ratio of 2:1. The following information was taken from the partnership books of accounts for the year ended 31 December 2021. RM Capital as at 1 January 2021 Hani 200,000 Teha 100,000 Current account as at 1 January 2021 Hani 30,000 Teha (32,000) Drawings - Hani (1 July 2021) 30,000 Drawings - Teha ( 1 December 2021) 20,000 Net Profit for the year 106, 180 Their partnership agreement includes the following details: 1. Hani gave an advance of RM100,000 to the partnership on 1 February 2021. Interest on loan from partner is at 3% per annum. The interest on loan is considered as part of the operating expenses. 2. Interest of 6% per annum will be charge on all drawings made by the partners. 3. Interest is to be given to partners' capital account balances at the rate of 5% per year. 4. Each of the partners is to be paid a salary of RM2,500 at the end of each month. There is no oustanding amount as at the end of the accounting period. 5. Teha's share of profit in any year shall not less than RM10,000. Any deficiency to be borne by Hani. 6. The net profit does not include depreciation charges amounted to RM500. Required: a. The Profit or Loss Appropriation Statement for the year ended 31 December 2021. (8 marks) b. Partners' current account for the year ended 31 December 2021. (5 marks) Total : 13 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts