Question: I need as soon as possible. Please provide the proper calculating steps! Part 1 On January 1, The Parts Store had a $570,000 inventory at

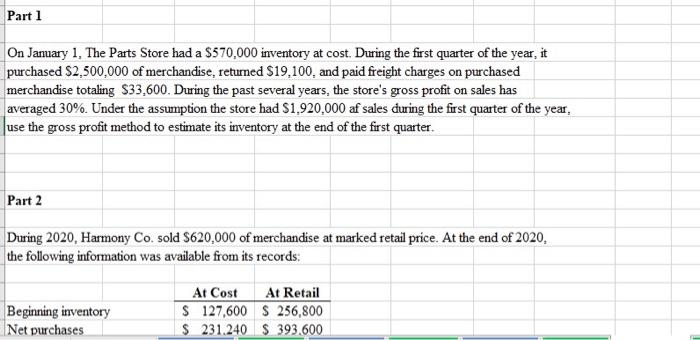

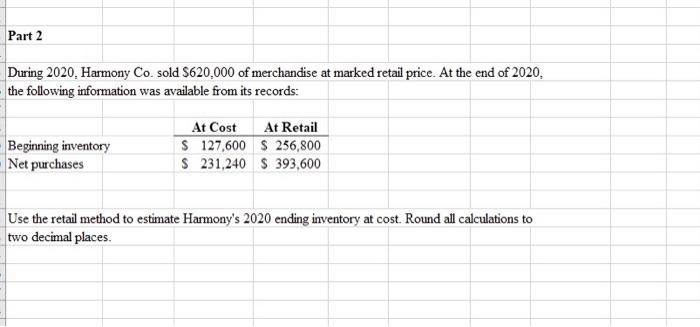

Part 1 On January 1, The Parts Store had a $570,000 inventory at cost. During the first quarter of the year, it purchased $2,500,000 of merchandise, returned $19,100, and paid freight charges on purchased merchandise totaling $33,600. During the past several years, the store's gross profit on sales has averaged 30%. Under the assumption the store had $1,920,000 af sales during the first quarter of the year, use the gross profit method to estimate its inventory at the end of the first quarter. Part 2 During 2020, Harmony Co. sold $620,000 of merchandise at marked retail price. At the end of 2020, the following information was available from its records Beginning inventory Net purchases At Cost At Retail S 127,600 S 256,800 $ 231.240 S 393.600 Part 2 During 2020. Harmony Co. sold S620.000 of merchandise at marked retail price. At the end of 2020, the following information was available from its records: Beginning inventory Net purchases At Cost At Retail $ 127,600 S 256,800 $ 231,240 S 393,600 Use the retail method to estimate Harmony's 2020 ending inventory at cost. Round all calculations to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts