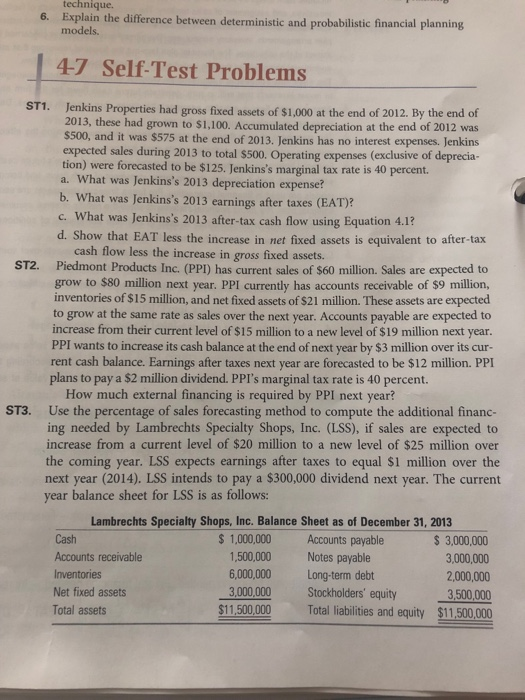

Question: I need assistance with question 4-7 technique 6. Explain the difference between deterministic and probabilistic financial planning. models. 4-7 Self-Test Problems Jenkins Properties had gross

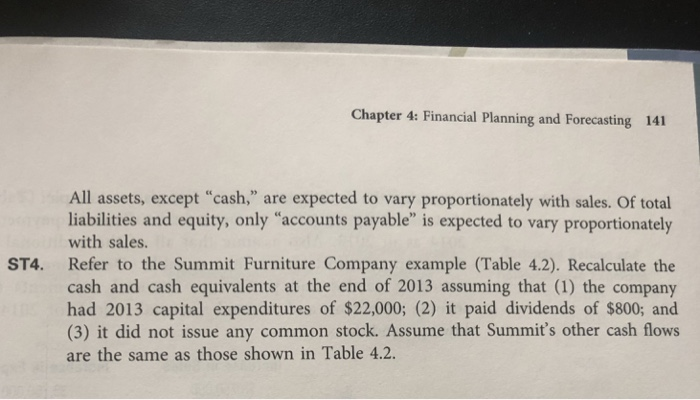

technique 6. Explain the difference between deterministic and probabilistic financial planning. models. 4-7 Self-Test Problems Jenkins Properties had gross fixed assets of $1.000 at the end of 2012. By the end of 2013, these had grown to $1,100. Accumulated depreciation at the end of 2012 was ST1. and it was $575 at the end of 2013. Jenkins has no interest expenses. Jenkins expected sales during 2013 to total $500. Operating expenses (exclusive of deprecia- tion) were forecasted to be $125. Jenkins's marginal tax rate is 40 percent. b. What was Jenkins's 2013 earnings after taxes (EAT)? c. What was Jenkins's 2013 after-tax cash flow using Equation 4.12 d. Show that EAT less the increase in net fixed assets is equivalent to after-tax cash flow less the increase in gross fixed assets. ST2. Piedmont Products Inc. (PPI) has current sales of $60 million. Sales are expected to grow to $80 million next year. PPI currently has accounts receivable of $9 milion, inventories of $15 million, and net fixed assets of $21 million. These assets are expected to grow at the same rate as sales over the next year. Accounts payable are expected to increase from their current level of $15 million to a new level of $19 million next year. PPI wants to increase its cash balance at the end of next year by $3 million over its cur- rent cash balance. Earnings after taxes next year are forecasted to be $12 million. PPI plans to pay a $2 million dividend. PPI's marginal tax rate is 40 percent. How much external financing is required by PPI next year? ST3. Use the percentage of sales forecasting method to compute the additional financ- ing needed by Lambrechts Specialty Shops, Inc. (LSS), if sales are expected to increase from a current level of $20 million to a new level of $25 million over the coming year. LSS expects earnings after taxes to equal $1 million over the next year (2014). LSS intends to pay a $300,000 dividend next year. The current year balance sheet for LSS is as follows: Lambrechts Specialty Shops, Inc. Balance Sheet as of December 31, 2013 Cash Accounts receivable Inventories Net fixed assets Total assets 1,000,000 Accounts payable 1,500,000 Notes payable ,000,000 Long-term debt 3,000,000 S 3,000,000 3,000,000 2,000,000 3,500,000 Stockholders' equity $11,500,000 Total liabilities and equity $11,500000 Chapter 4: Financial Planning and Forecasting 141 All assets, except "cash," are expected to vary proportionately with sales. Of total liabilities and equity, only "accounts payable" is expected to vary proportionately with sales. Refer to the Summit Furniture Company example (Table 4.2). Recalculate the cash and cash equivalents at the end of 2013 assuming that (1) the company had 2013 capital expenditures of $22,000; (2) it paid dividends of $800; and (3) it did not issue any common stock. Assume that Summit's other cash flows are the same as those shown in Table 4.2. ST4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts