Question: I need assitance with the following problem for financial reporting. Problem Dario Company reported net income of $1,000,000 in fiscal 2017. The company has a

I need assitance with the following problem for financial reporting.

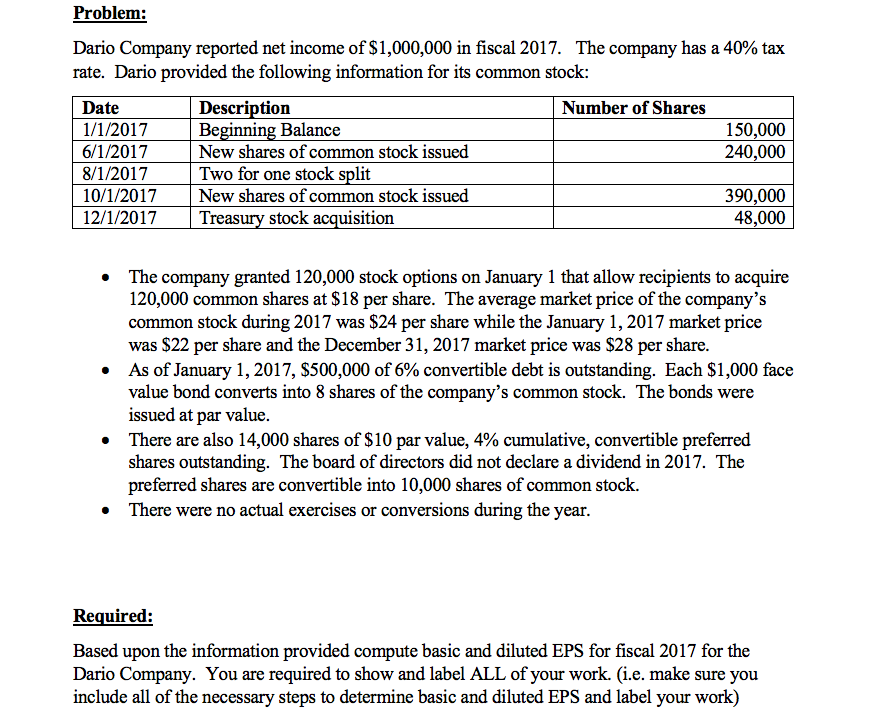

Problem Dario Company reported net income of $1,000,000 in fiscal 2017. The company has a 40% tax rate. Dario provided the following information for its common stock: Number of Shares Date 1/1/2017 6/1/2017 8/1/2017 10/1/2017 New shares of common stock issued 12/1/2017 Treasury stock acquisitior Description Beginning Bal New shares of common stock issued Two for one stock split 150,000 240,000 ance 390,000 48,000 The company granted 120,000 stock options on January 1 that allow recipients to acquire 120,000 common shares at $18 per share. The average market price of the company's common stock during 2017 was $24 per share while the January1 was $22 per share and the December 31, 2017 market price was $28 per share As of January 1, 2017, $500,000 of 6% convertible debt is outstanding. Each $1,000 face value bond converts into 8 shares of the company's common stock. The bonds were issued at par value There are also 14,000 shares of $10 par value, 4% cumulative, convertible preferred shares outstanding. The board of directors did not declare a dividend in 2017. The preferred shares are convertible into 10,000 shares of common stock. ,2017 market price . . . There were no actual exercises or conversions during the year. Required: Based upon the information provided compute basic and diluted EPS for fiscal 2017 for the Dario Company. You are required to show and label ALL of your work. (i.e. make sure you include all of the necessary steps to determine basic and diluted EPS and label your work)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts