Question: I need B. and C. Please help! OneChicago has just introduced a new single stock futures contract on the stock of Brandex, a company that

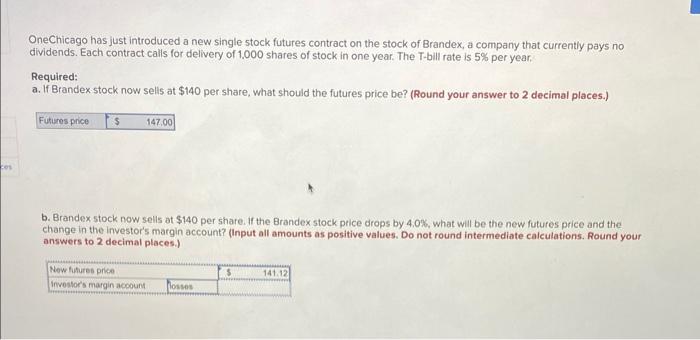

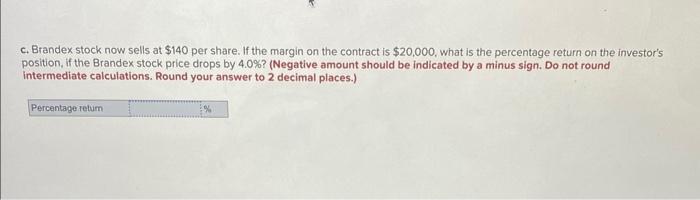

OneChicago has just introduced a new single stock futures contract on the stock of Brandex, a company that currently pays no dividends. Each contract calls for delivery of 1.000 shares of stock in one year. The T-bill rate is 5% per year. Required: a. If Brandex stock now sells at $140 per share, what should the futures price be? (Round your answer to 2 decimal places.) b. Brandex stock now sells at $140 per share. If the Brandex stock price drops by 4.0%, what will be the new futures price and the change in the investor's margin account? (Input all amounts as positive values. Do not round intermediate calculations. Round your answers to 2 decimal places.) c. Brandex stock now sells at $140 per share. If the margin on the contract is $20,000, what is the percentage return on the investor's position, if the Brandex stock price drops by 4.0% ? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts