Question: I need both of these problems solved please :) 2-4A. Statement of Casher fillews of cash fows using the indirect method. tive balance sheets as

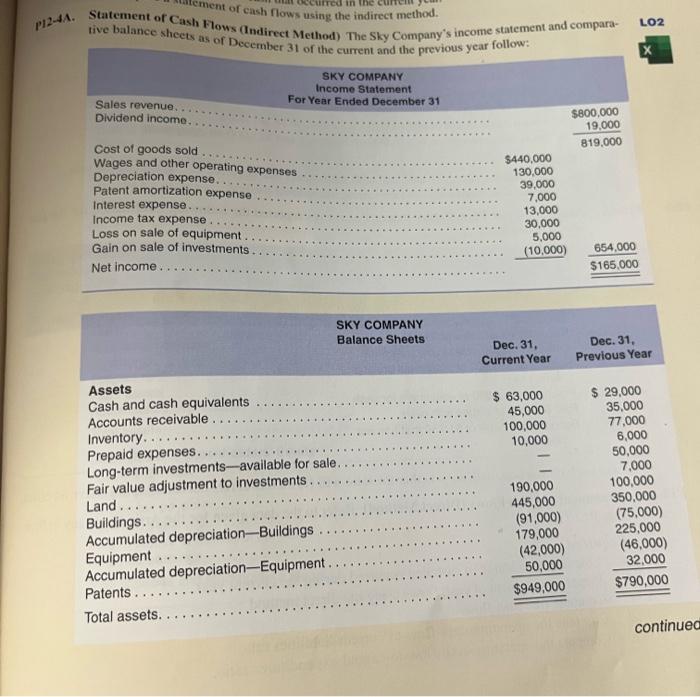

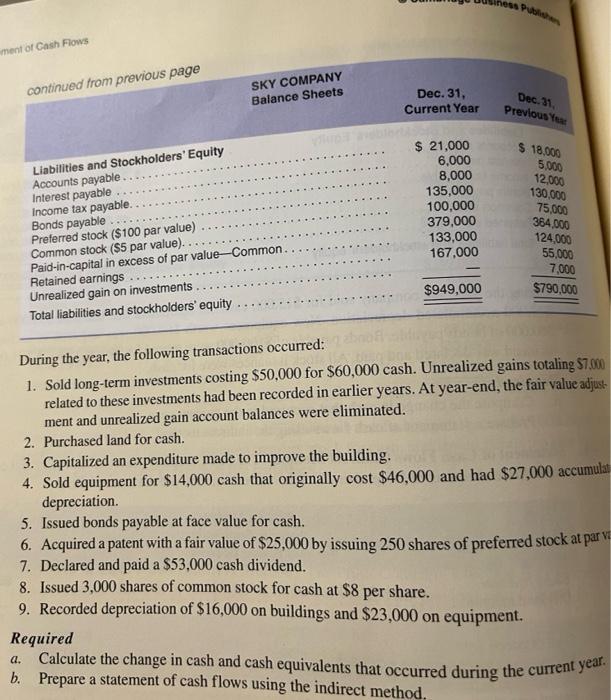

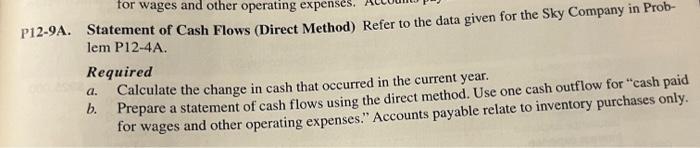

2-4A. Statement of Casher fillews of cash fows using the indirect method. tive balance sheets as of (Indirect Method) The Sky Company's income statement and compara- LO2. tive balance sheets as of December 31 of the current and the previous year follow: During the year, the following transactions occurred: 1. Sold long-term investments costing $50,000 for $60,000 cash. Unrealized gains totaling $7,000 related to these investments had been recorded in earlier years. At year-end, the fair value adjus ment and unrealized gain account balances were eliminated. 2. Purchased land for cash. 3. Capitalized an expenditure made to improve the building. 4. Sold equipment for $14,000 cash that originally cost $46,000 and had $27,000 accumulat depreciation. 5. Issued bonds payable at face value for cash. 6. Acquired a patent with a fair value of $25,000 by issuing 250 shares of preferred stock at par vi 7. Declared and paid a $53,000 cash dividend. 8. Issued 3,000 shares of common stock for cash at $8 per share. 9. Recorded depreciation of $16,000 on buildings and $23,000 on equipment. Required a. Calculate the change in cash and cash equivalents that occurred during the current yeat. b. Prepare a statement of cash flows using the indirect method. P12-9A. Statement of Cash Flows (Direct Method) Refer to the data given for the Sky Company in Problem P12-4A. Required a. Calculate the change in cash that occurred in the current year. b. Prepare a statement of cash flows using the direct method. Use one cash outflow for "cash paid for wages and other operating expenses." Accounts payable relate to inventory purchases only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts