Question: I need calculation Process in excel Joe Levi bought a home in Arlington, Texas, for $137,000. He put down 20% and obtained a mortgage for

I need calculation Process in excel

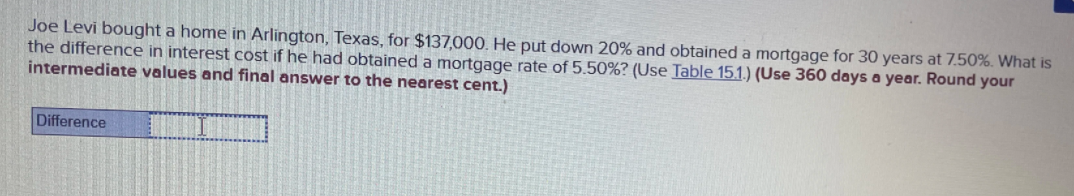

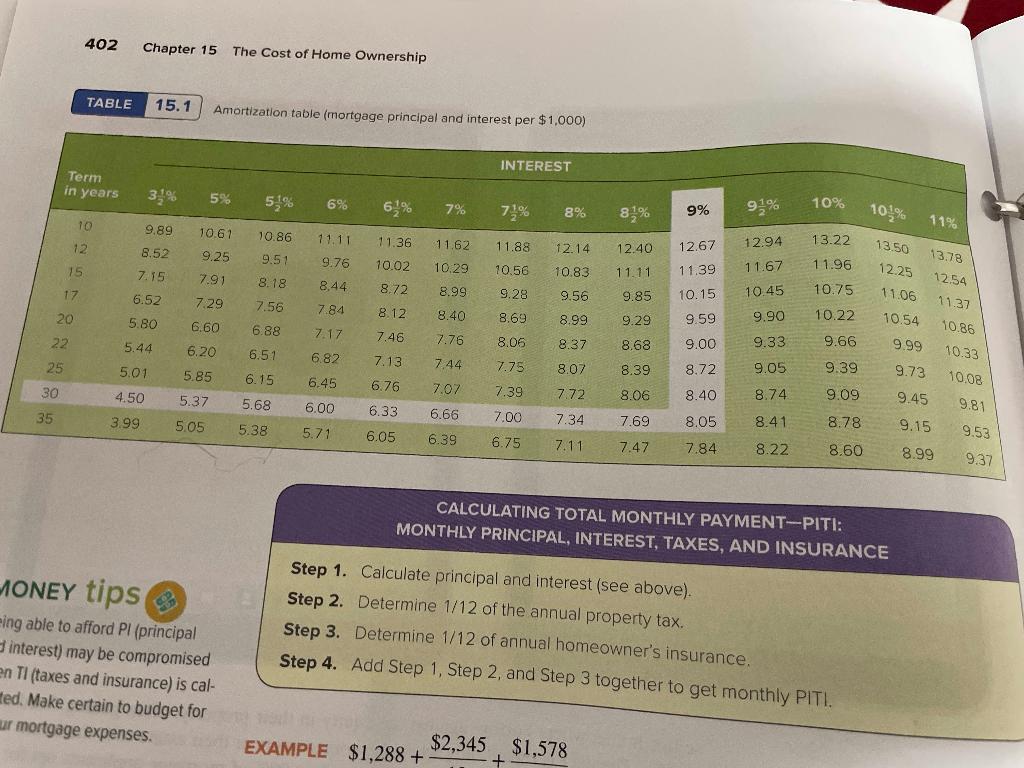

Joe Levi bought a home in Arlington, Texas, for $137,000. He put down 20% and obtained a mortgage for 30 years at 7.50%. What is the difference in interest cost if he had obtained a mortgage rate of 5.50%? (Use Table 15.1.) (Use 360 days a year. Round your intermediate values and final answer to the nearest cent.) Difference 402 Chapter 15 The Cost of Home Ownership TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) INTEREST Term in years 31% 5% 5.1% 6% 7% 10% 72% % 8% 81% 9% 101% 19% 10 9.89 10.67 10.86 11.36 11.62 12 13.22 12.14 12.94 11.11 9.76 12.40 12.67 8.52 7.15 9.25 7.91 9.51 8.18 10.02 15 10.29 11.88 10.56 9.28 11.96 10.83 11.39 11.11 11.67 8,44 13.50 13.78 12.25 12.54 11.06 11.37 10.54 10.86 17 8.99 6.52 9.56 7.29 8.72 8.12 9.85 7.56 7.84 10.15 9.59 10.45 9.90 20 8.40 5.80 8.69 10.75 10.22 9.66 9.29 8.99 6,60 6.88 7.17 22 7.46 7.76 5.44 8.06 8.37 8.68 9.00 9.33 6.20 9.99 6.51 6.82 10.33 7.13 25 7.44 5.01 7.75 5.85 8.07 8.39 8.72 9.05 9.39 9.73 6.15 6.45 10.08 6.76 30 7.07 4.50 7.39 7.72 5.37 8.40 8.74 9.09 5.68 9.45 6.00 9.81 6.33 8.06 7.69 35 6.66 3.99 7.00 7.34 5.05 8.05 8.41 8.78 5.38 9.15 5.71 6.05 9.53 6.39 6.75 7.11 7.47 7.84 8.22 8.60 8.99 937 CALCULATING TOTAL MONTHLY PAYMENT-PITI: MONTHLY PRINCIPAL, INTEREST, TAXES, AND INSURANCE JONEY tips eing able to afford Pl (principal interest) may be compromised en Tl (taxes and insurance) is cal- ted. Make certain to budget for ur mortgage expenses. Step 1. Calculate principal and interest (see above). Step 2. Determine 1/12 of the annual property tax. Step 3. Determine 1/12 of annual homeowner's insurance. Step 4. Add Step 1, Step 2, and Step 3 together to get monthly PITI. $2,345 $1,578 EXAMPLE $1,288 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts