Question: I NEED CALCULATION/PROCESSES TO UNDERSTAND IT. The balance sheets for Company A showed the following information. Additional information concerning transactions and events during 2019 are

I NEED CALCULATION/PROCESSES TO UNDERSTAND IT.

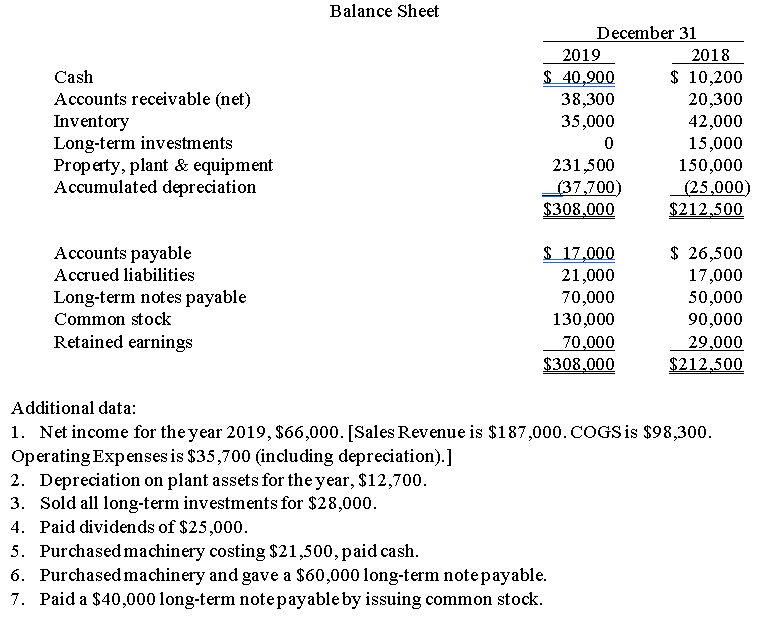

The balance sheets for Company A showed the following information. Additional information concerning transactions and events during 2019 are presented below.

Instructions:

Using the Balance Sheet and additional data for Company A above, prepare a Statement of Cash Flows using the indirect method and the Cash Flows from Operating Activities using the direct method.

- Prepare a statement of cash flows using the indirect method for 2019 for Company A.

Company A

Statement of Cash Flows (Indirect Method)

For the Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Prepare cash flow from operating activities for 2019 for Company A using the direct method.

Company A

Cash Flows from Operating Activities (Direct Method)

For the Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Cash Accounts receivable (net) Inventory Long-term investments Propaty, plant & equipment Accumulated depreciation December 31 2019 2018 $ 40,900 $ 10,200 38,300 20,300 35,000 42,000 15,000 231,500 150,000 (37,700) (25,000) $308,000 $212,500 Accounts payable Accrued liabilities Long-term notes payable Common stock Retained earnings $ 17,000 21,000 70,000 130,000 70,000 $308,000 $ 26,500 17,000 50,000 90,000 29,000 $212,500 Additional data: 1. Net income for the year 2019, $66,000. [Sales Revenue is $187,000.COGS is $98,300. Operating Expenses is $35,700 (including depreciation).] 2. Depreciation on plant assets for the year, $12,700. 3. Sold all long-term investments for $28,000. 4. Paid dividends of $25,000. 5. Purchased machinery costing $21,500, paid cash. 6. Purchased machinery and gave a $60,000 long-term notepayable. 7. Paid a $40,000 long-term notepayable by issuing common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts