Question: i need everything not in yellow. CHAPTER 7: Please read the chapter and watch the videos provided in el.eam to answer the questions 8. Investors

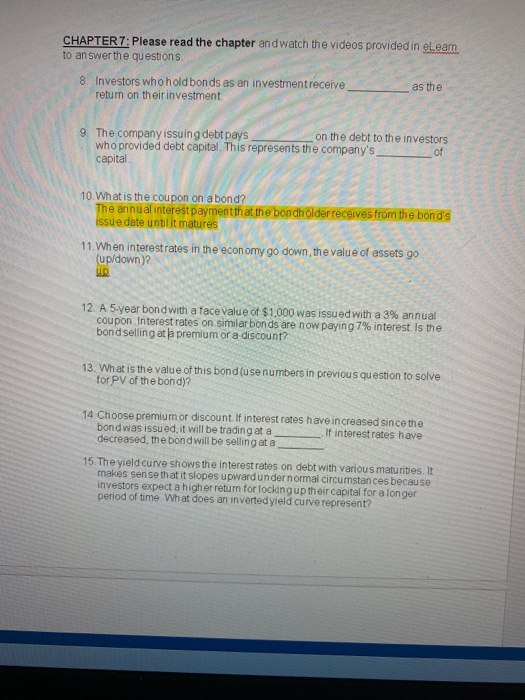

CHAPTER 7: Please read the chapter and watch the videos provided in el.eam to answer the questions 8. Investors who holdbonds as an investment receive as the return on their investment. 9. The company issuing debt pays on the debt to the investors who provided debt capital. This represents the company's _ Capital 10. What is the coupon on a bond? The annual interest payment that the bondholder receives from the bond's issue date unblit matures 11. When interest rates in the economy go down the value of assets go (up down) 12. A 5-year bond with a face value of $1,000 was issued with a 3% annual coupon Interest rates on similar bonds are now paying 7% interest. Is the bond selling at a premium or a discount? 13. What is the value of this bonduse numbers in previous question to solve for PV of the bond)? 14 Choose premium or discount. If interest rates have increased since the bond was issued, it will be trading at a If interest rates have decreased the bond will be selling at a 15. The yield curve shows the interest rates on debt with various maturities. It makes sense that it slopes upward under normal circumstances because investors expect a higher return for locking up their capital for a longer period of time What does an inverted yield curve represent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts