Question: I need excel so i can copy please and correct answer i needed Problem 8-23 Recording and reporting stock transactions and cash dividends across two

I need excel so i can copy please and correct answer i needed

Problem 8-23 Recording and reporting stock transactions and cash dividends across two accounting cycles LO 8-3, 8-4, 8-5, 8-6

Skip to question

[The following information applies to the questions displayed below.]

Sun Corporation received a charter that authorized the issuance of 88,000 shares of $4 par common stock and 20,000 shares of $100 par, 7 percent cumulative preferred stock. Sun Corporation completed the following transactions during its first two years of operation:

2018

| Jan. | 5 | Sold 13,200 shares of the $4 par common stock for $6 per share. | |

| 12 | Sold 2,000 shares of the 7 percent preferred stock for $110 per share. | ||

| Apr. | 5 | Sold 17,600 shares of the $4 par common stock for $8 per share. | |

| Dec. | 31 | During the year, earned $316,800 in cash revenue and paid $244,000 for cash operating expenses. | |

| 31 | Declared the cash dividend on the outstanding shares of preferred stock for 2018. The dividend will be paid on February 15 to stockholders of record on January 10, 2019. |

2019

| Feb. | 15 | Paid the cash dividend declared on December 31, 2018. | |

| Mar. | 3 | Sold 3,000 shares of the $100 par preferred stock for $120 per share. | |

| May. | 5 | Purchased 400 shares of the common stock as treasury stock at $8 per share. | |

| Dec. | 31 | During the year, earned $250,400 in cash revenues and paid $177,300 for cash operating expenses. | |

| 31 | Declared the annual dividend on the preferred stock and a $0.25 per share dividend on the common stock. |

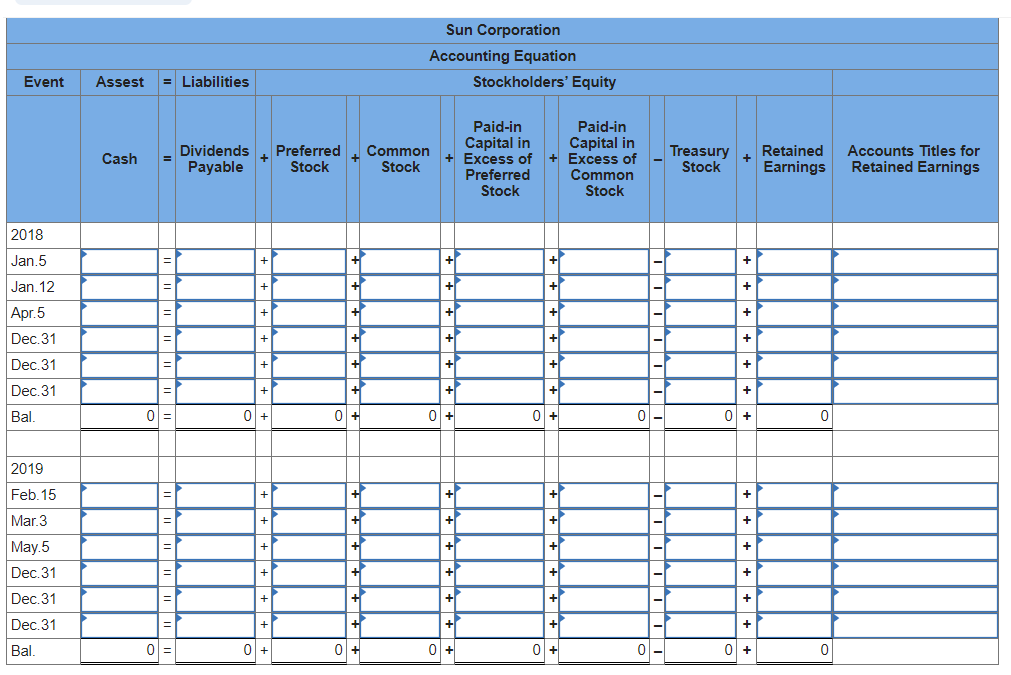

a) Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. Indicating to provide separate effect on accounting equation for Revenue, Operating expense, and "NA" for no effect.)

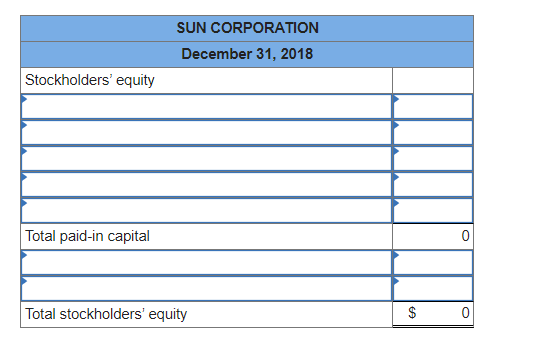

- Prepare the stockholders equity section of the balance sheet at December 31, 2018.

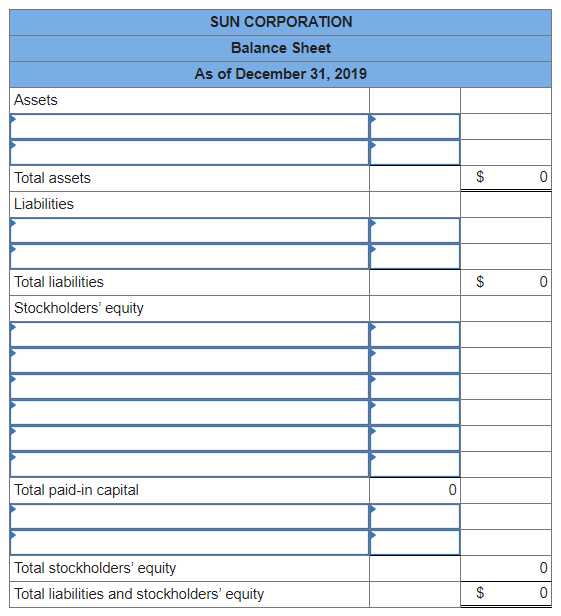

Prepare the balance sheets at December 31, 2019. (Negative amount should be indicated by a minus sign.)

Sun Corporation Accounting Equation Stockholders' Equity Event Assest = Liabilities Cash Dividends Payable Preferred Stock Common Stock Paid-in Paid-in Capital in Capital in + Excess of + Excess of Preferred Common Stock Stock Treasury Stock + Retained Accounts Titles for Earnings Retained Earnings 2018 Jan.5 + Jan. 12 + + + Apr.5 + + + + Dec. 31 + Dec. 31 + + + + Dec. 31 + + + + Bal. 0 = 0 + 0 + 0 + 0 + 0 0 + 0 2019 Feb. 15 + Mar.3 + + + + + May 5 Dec. 31 Dec. 31 + + + + + + Dec. 31 + + Bal. 0 = 0 + 0+ 0 + 0 + 0 0 + 0 SUN CORPORATION December 31, 2018 Stockholders' equity Total paid-in capital 0 Total stockholders' equity $ 0 SUN CORPORATION Balance Sheet As of December 31, 2019 Assets $ 0 Total assets Liabilities $ $ 0 Total liabilities Stockholders' equity Total paid-in capital 0 0 Total stockholders' equity Total liabilities and stockholders' equity $ 0 Sun Corporation Accounting Equation Stockholders' Equity Event Assest = Liabilities Cash Dividends Payable Preferred Stock Common Stock Paid-in Paid-in Capital in Capital in + Excess of + Excess of Preferred Common Stock Stock Treasury Stock + Retained Accounts Titles for Earnings Retained Earnings 2018 Jan.5 + Jan. 12 + + + Apr.5 + + + + Dec. 31 + Dec. 31 + + + + Dec. 31 + + + + Bal. 0 = 0 + 0 + 0 + 0 + 0 0 + 0 2019 Feb. 15 + Mar.3 + + + + + May 5 Dec. 31 Dec. 31 + + + + + + Dec. 31 + + Bal. 0 = 0 + 0+ 0 + 0 + 0 0 + 0 SUN CORPORATION December 31, 2018 Stockholders' equity Total paid-in capital 0 Total stockholders' equity $ 0 SUN CORPORATION Balance Sheet As of December 31, 2019 Assets $ 0 Total assets Liabilities $ $ 0 Total liabilities Stockholders' equity Total paid-in capital 0 0 Total stockholders' equity Total liabilities and stockholders' equity $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts