Question: I need EXCEL Solution in the templete. Thanks A company must make yearly payments starting at $100,000 and increasing by 6% every year for 10

I need EXCEL Solution in the templete. Thanks

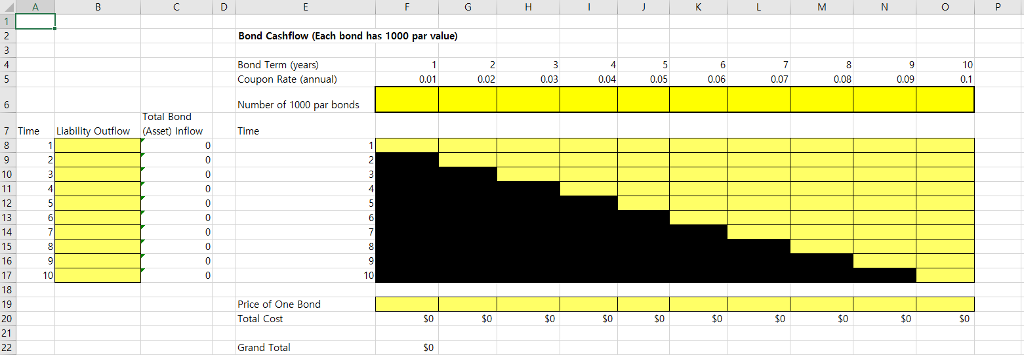

A company must make yearly payments starting at $100,000 and increasing by 6% every year for 10 years. Payments are due at the end of each year. They can invest in a portfolio of coupon-paying bonds that vary in term from 1 to 10 years (a total of 10 unique bonds). Each bond has a coupon rate equal to the term of the bond (i.e. the 10-year bond has a coupon rate of 10%, the 8-year bond has a coupon rate of 8%). They decide to do an absolute matching strategy to back the liability. At a yield rate of 5% how much would the company need to have available to purchase bonds for this absolute matching strategy?

In the templete.

Each Total bond (Asset) flow is SUM(F8:O8), SUM(F9:O9) ..... SUM(F17:O17)

Total Cost is F19*F6, G19*G6 .... O19*O6.

Grand Total is SUM(F20:O20)

Please provide the explain how to get the values.

Bond Cashflow (Each bond has 1000 par value) 10 0.1 0.06 0.07 0.08 0.09 Bond Term (years) 0.03 0.04 0.05 0.01 0.02 Coupon Rate (annual) Number of 1000 par bonds Time otal B 7 Time Llablility Otow (Asset) Inflow 10 13 14 15 Price of One Bond Total Cost 20 21 Grand Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts