Question: I need expert answer for this requirements: Group Project Presentations Topics: Group Project Presentations Dulcinea Co . Valuation. Each team delivers a concise presentation (

I need expert answer for this requirements:

Group Project Presentations Topics: Group Project Presentations Dulcinea Co Valuation. Each team delivers a concise presentation approx minutes summarizing their approach and results for valuing Dulcinea Co They should cover key assumptions, the projected cash flows, the determined WACC, the calculated terminal value, and their final equity valuation implied share price as well as a brief sensitivity analysis eg value if WACC or growth varies

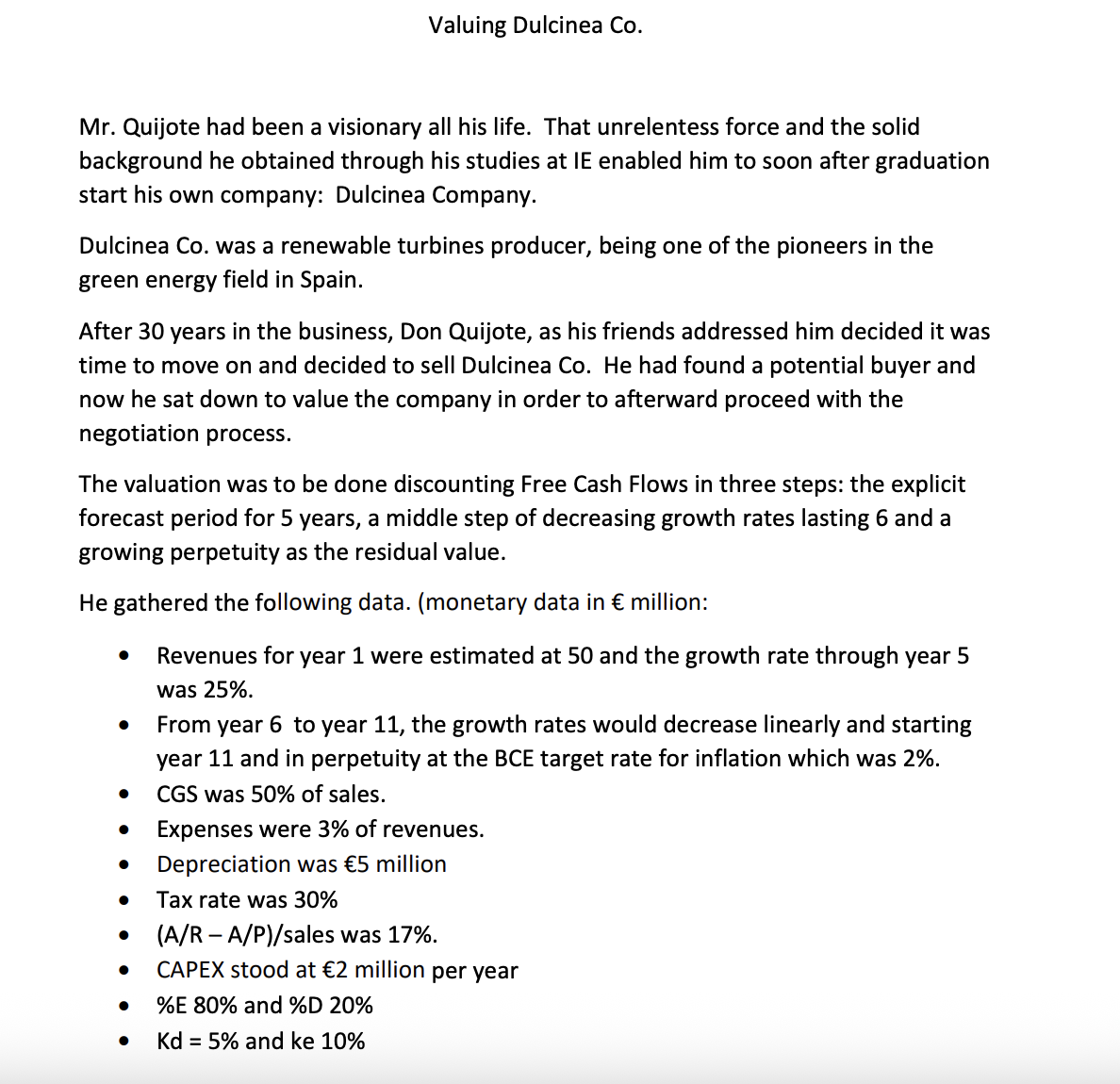

Valuing Dulcinea Co Mr Quijote had been a visionary all his life. That unrelentess force and the solid background he obtained through his studies at IE enabled him to soon after graduation start his own company: Dulcinea Company. Dulcinea Co was a renewable turbines producer, being one of the pioneers in the green energy field in Spain. After years in the business, Don Quijote, as his friends addressed him decided it was time to move on and decided to sell Dulcinea Co He had found a potential buyer and now he sat down to value the company in order to afterward proceed with the negotiation process. The valuation was to be done discounting Free Cash Flows in three steps: the explicit forecast period for years, a middle step of decreasing growth rates lasting and a growing perpetuity as the residual value. He gathered the following data. monetary data in million:

Revenues for year were estimated at and the growth rate through year was

From year to year the growth rates would decrease linearly and starting year and in perpetuity at the BCE target rate for inflation which was

CGS was of sales.

Expenses were of revenues.

Depreciation was million

Tax rate was

AR APsales was

CAPEX stood at million per year

E and D

Kd and ke

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock