Question: I need explain please (2) Tesla Inc. has a plan to add a new production line with useful life of 5 years. The project is

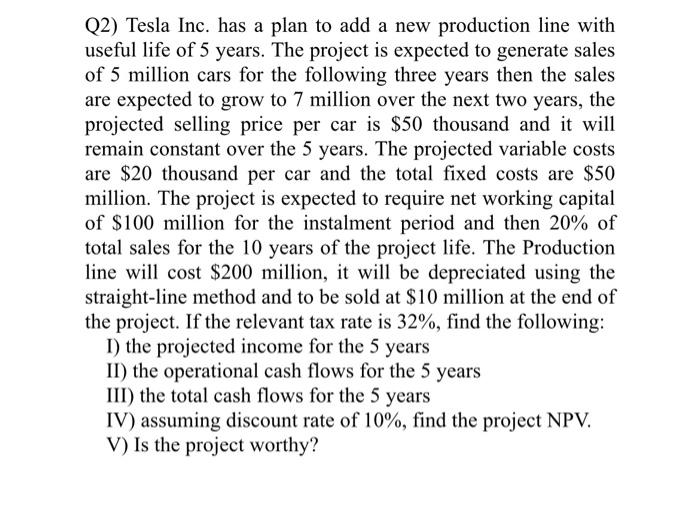

(2) Tesla Inc. has a plan to add a new production line with useful life of 5 years. The project is expected to generate sales of 5 million cars for the following three years then the sales are expected to grow to 7 million over the next two years, the projected selling price per car is $50 thousand and it will remain constant over the 5 years. The projected variable costs are $20 thousand per car and the total fixed costs are $50 million. The project is expected to require net working capital of $100 million for the instalment period and then 20% of total sales for the 10 years of the project life. The Production line will cost $200 million, it will be depreciated using the straight-line method and to be sold at $10 million at the end of the project. If the relevant tax rate is 32%, find the following: I) the projected income for the 5 years II) the operational cash flows for the 5 years III) the total cash flows for the 5 years IV) assuming discount rate of 10%, find the project NPV. V) Is the project worthy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts