Question: I need explaination on how to do this problem. How to come up with 501206 for the asset retirement obligation? AP10-1 Smithfield mines purchased the

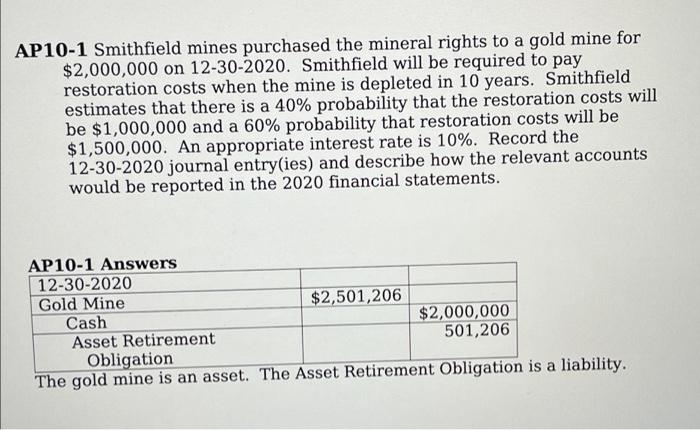

AP10-1 Smithfield mines purchased the mineral rights to a gold mine for $2,000,000 on 12-30-2020. Smithfield will be required to pay restoration costs when the mine is depleted in 10 years. Smithfield estimates that there is a 40% probability that the restoration costs will be $1,000,000 and a 60% probability that restoration costs will be $1,500,000. An appropriate interest rate is 10%. Record the 12-30-2020 journal entry(ies) and describe how the relevant accounts would be reported in the 2020 financial statements. AP10-1 Answers 12-30-2020 Gold Mine $2,501,206 Cash $2,000,000 Asset Retirement 501,206 Obligation The gold mine is an asset. The Asset Retirement Obligation is a liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts