Question: i need full mark in this question please my dear experts. Bonus Question (10 points) What is the value of derivative contracts to the managers

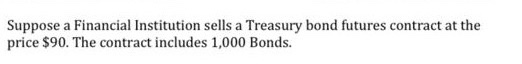

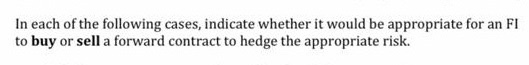

Bonus Question (10 points) What is the value of derivative contracts to the managers of Fis? Suppose a Financial Institution sells a Treasury bond futures contract at the price $90. The contract includes 1,000 Bonds. In each of the following cases, indicate whether it would be appropriate for an FI to buy or sell a forward contract to hedge the appropriate risk. Bonus Question (10 points) What is the value of derivative contracts to the managers of Fis? Suppose a Financial Institution sells a Treasury bond futures contract at the price $90. The contract includes 1,000 Bonds. In each of the following cases, indicate whether it would be appropriate for an FI to buy or sell a forward contract to hedge the appropriate risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts