Question: **I need handwritten solution NOT EXCEL solution for thumbs up. ** Do not copy paste other solutions on Chegg Question #1 (30 Points): A company

**I need handwritten solution NOT EXCEL solution for thumbs up.

**I need handwritten solution NOT EXCEL solution for thumbs up.

** Do not copy paste other solutions on Chegg

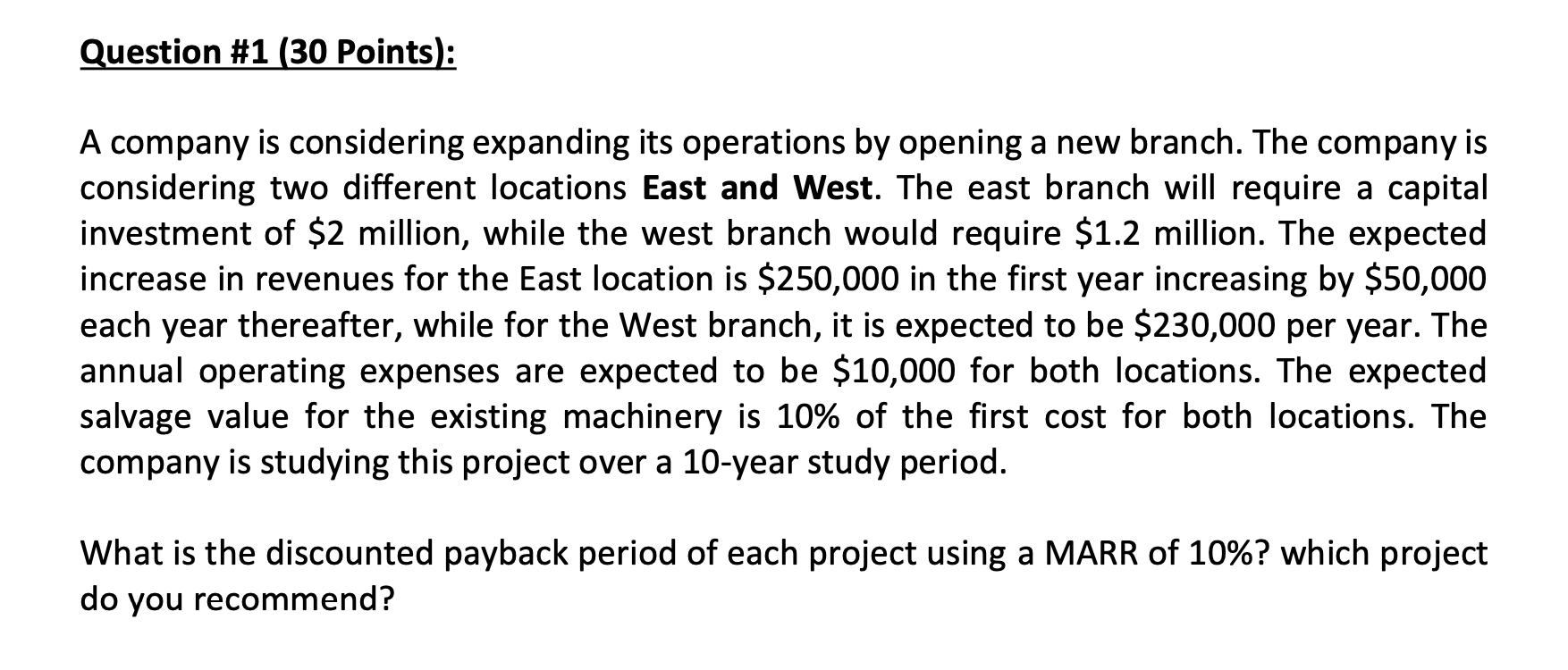

Question #1 (30 Points): A company is considering expanding its operations by opening a new branch. The company is considering two different locations East and West. The east branch will require a capital investment of $2 million, while the west branch would require $1.2 million. The expected increase in revenues for the East location is $250,000 in the first year increasing by $50,000 each year thereafter, while for the West branch, it is expected to be $230,000 per year. The annual operating expenses are expected to be $10,000 for both locations. The expected salvage value for the existing machinery is 10% of the first cost for both locations. The company is studying this project over a 10-year study period. What is the discounted payback period of each project using a MARR of 10%? which project do you recommend? Question #1 (30 Points): A company is considering expanding its operations by opening a new branch. The company is considering two different locations East and West. The east branch will require a capital investment of $2 million, while the west branch would require $1.2 million. The expected increase in revenues for the East location is $250,000 in the first year increasing by $50,000 each year thereafter, while for the West branch, it is expected to be $230,000 per year. The annual operating expenses are expected to be $10,000 for both locations. The expected salvage value for the existing machinery is 10% of the first cost for both locations. The company is studying this project over a 10-year study period. What is the discounted payback period of each project using a MARR of 10%? which project do you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts