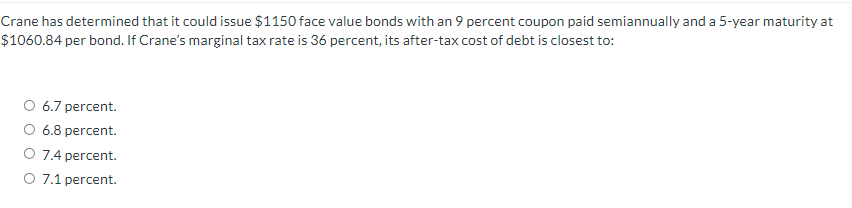

Question: i need help 1 fCrane has determined that it could issue $1 150 face value bonds with an 9 percent coupon paid semiannuallyr and a

i need help

1

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock