Question: I need help; 7.5 pts Question 25 Squid Inc. just paid a $3.00 per share dividend. It is expected that dividends will grow at 10.00%

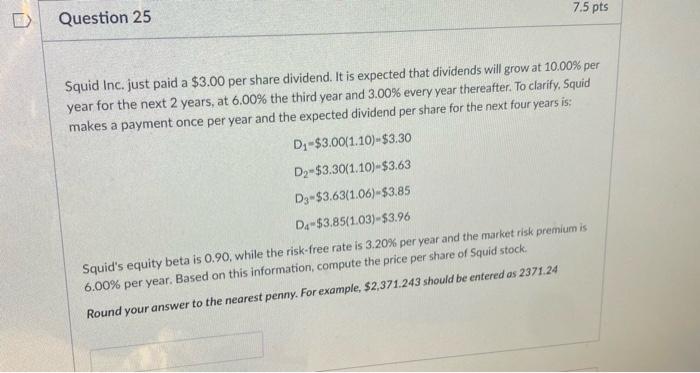

7.5 pts Question 25 Squid Inc. just paid a $3.00 per share dividend. It is expected that dividends will grow at 10.00% per year for the next 2 years, at 6.00% the third year and 3.00% every year thereafter. To clarify, Squid makes a payment once per year and the expected dividend per share for the next four years is: D-$3.00(1.10-$3.30 D2-$3.30(1.10)-$3.63 D3-$3.63(1.06)-$3.85 D4-$3.85(1.03)-$3.96 Squid's equity beta is 0.90, while the risk-free rate is 3.20% per year and the market risk premium is 6.00% per year. Based on this information, compute the price per share of Squid stock. Round your answer to the nearest penny. For example, $2,371.243 should be entered as 2371.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts