Question: i need help and explanation The information listed below was obtained from the accounting records of Williams Company as of December 31, 2013, the end

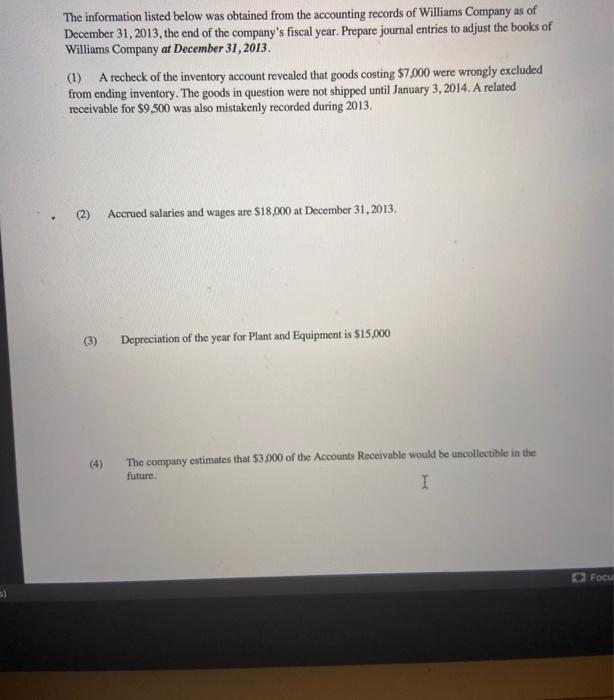

The information listed below was obtained from the accounting records of Williams Company as of December 31, 2013, the end of the company's fiscal year. Prepare journal entries to adjust the books of Williams Company at December 31, 2013. (1) A recheck of the inventory account revealed that goods costing $7.000 were wrongly excluded from ending inventory. The goods in question were not shipped until January 3, 2014. A related receivable for $9,500 was also mistakenly recorded during 2013. (2) Accrued salaries and wages are $18,000 at December 31, 2013. (3) Depreciation of the year for Plant and Equipment is $15.000 4) The company estimates that $3,000 of the Accounts Receivable would be uncollectible in the I future Focu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts