Question: I need Help and please show your work on the excel thank you! Score Maximu 1 2 In order to see exact numbers of your

I need Help and please show your work on the excel thank you!

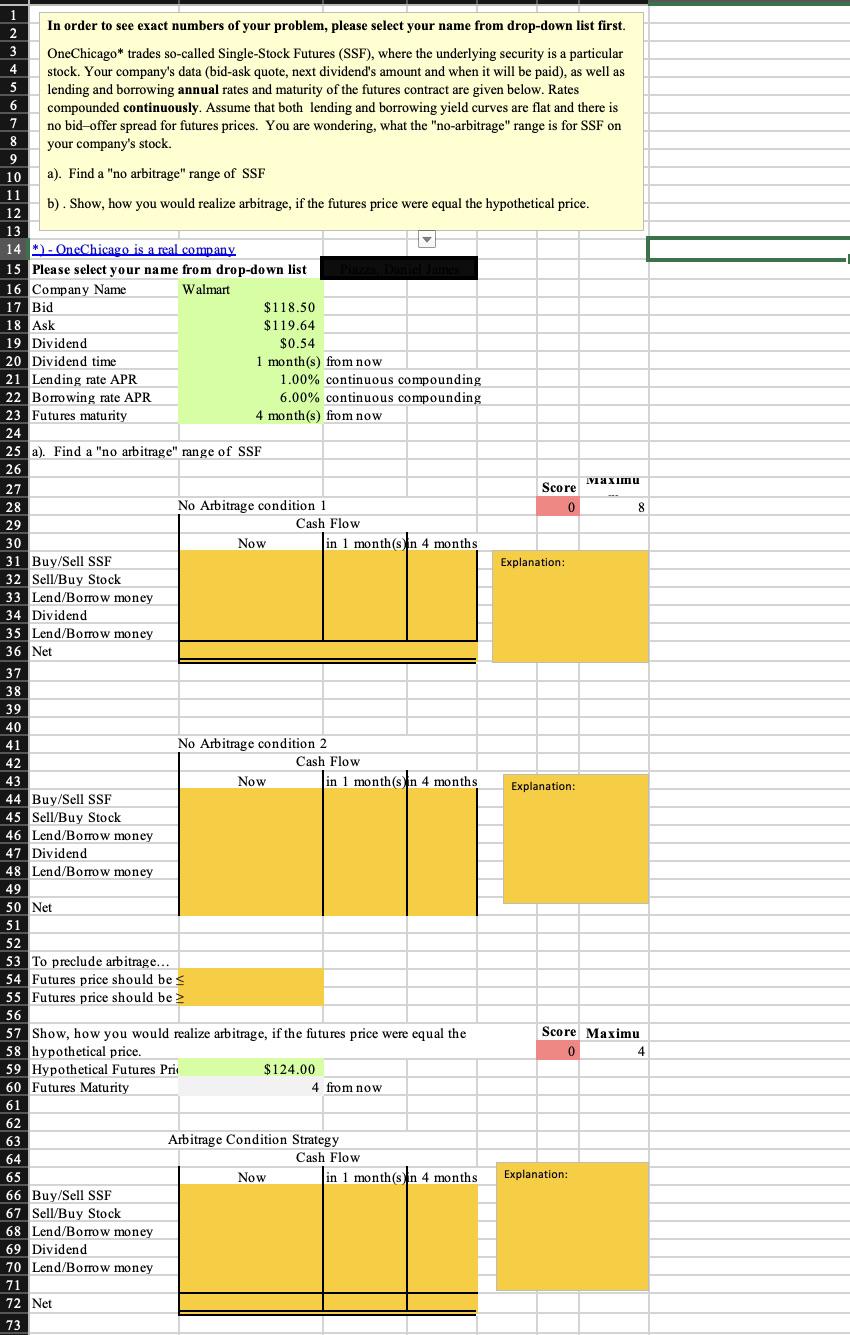

Score Maximu 1 2 In order to see exact numbers of your problem, please select your name from drop-down list first. 3 3 OneChicago* trades so-called Single Stock Futures (SSF), where the underlying security is a particular 4 4 stock. Your company's data (bid-ask quote, next dividend's amount and when it will be paid), as well as 5 lending and borrowing annual rates and maturity of the futures contract are given below. Rates 6 compounded continuously. Assume that both lending and borrowing yield curves are flat and there is 7 7 no bid-offer spread for futures prices. You are wondering, what the "no-arbitrage" range is for SSF on 8 8 your company's stock. 9 10 a). Find a "no arbitrage" range of SSF 11 b). Show, how you would realize arbitrage, if the futures price were equal the hypothetical price. 12 13 14 - OneChicago is a real company 15 Please select your name from drop-down list 16 Company Name Walmart 17 Bid $118.50 18 Ask $119.64 19 Dividend $0.54 20 Dividend time 1 month(s) from now 21 Lending rate APR 1.00% continuous compounding 22 Borrowing rate APR 6.00% continuous compounding 23 Futures maturity 4 month(s) from now 24 25 a). Find a "no arbitrage" range of SSF 26 27 28 No Arbitrage condition 1 0 8 29 Cash Flow 30 Now in 1 month(s In 4 months 31 Buy/Sell SSF Explanation: 32 Sell/Buy Stock 33 Lend/Borrow money 34 Dividend 35 Lend/Borrow money 36 Net 37 38 39 40 41 No Arbitrage condition 2 42 Cash Flow 43 Now in 1 month(sin 4 months Explanation: 44 Buy/Sell SSF 45 Sell/Buy Stock 46 Lend/Borrow money 47 Dividend 48 Lend/Borrow money 49 50 Net 51 52 53 To preclude arbitrage... 54 Futures price should be 55 Futures price should be > 56 57 Show, how you would realize arbitrage, if the futures price were equal the Score Maximu 58 hypothetical price. 0 4 59 Hypothetical Futures Pris $124.00 60 Futures Maturity 4 from now 61 62 63 Arbitrage Condition Strategy 64 Cash Flow 65 Now in 1 month(sin 4 months Explanation: : 66 Buy/Sell SSF 67 Sell/Buy Stock 68 Lend/Borrow money 69 Dividend 70 Lend/Borrow money 71 72 Net 73 Score Maximu 1 2 In order to see exact numbers of your problem, please select your name from drop-down list first. 3 3 OneChicago* trades so-called Single Stock Futures (SSF), where the underlying security is a particular 4 4 stock. Your company's data (bid-ask quote, next dividend's amount and when it will be paid), as well as 5 lending and borrowing annual rates and maturity of the futures contract are given below. Rates 6 compounded continuously. Assume that both lending and borrowing yield curves are flat and there is 7 7 no bid-offer spread for futures prices. You are wondering, what the "no-arbitrage" range is for SSF on 8 8 your company's stock. 9 10 a). Find a "no arbitrage" range of SSF 11 b). Show, how you would realize arbitrage, if the futures price were equal the hypothetical price. 12 13 14 - OneChicago is a real company 15 Please select your name from drop-down list 16 Company Name Walmart 17 Bid $118.50 18 Ask $119.64 19 Dividend $0.54 20 Dividend time 1 month(s) from now 21 Lending rate APR 1.00% continuous compounding 22 Borrowing rate APR 6.00% continuous compounding 23 Futures maturity 4 month(s) from now 24 25 a). Find a "no arbitrage" range of SSF 26 27 28 No Arbitrage condition 1 0 8 29 Cash Flow 30 Now in 1 month(s In 4 months 31 Buy/Sell SSF Explanation: 32 Sell/Buy Stock 33 Lend/Borrow money 34 Dividend 35 Lend/Borrow money 36 Net 37 38 39 40 41 No Arbitrage condition 2 42 Cash Flow 43 Now in 1 month(sin 4 months Explanation: 44 Buy/Sell SSF 45 Sell/Buy Stock 46 Lend/Borrow money 47 Dividend 48 Lend/Borrow money 49 50 Net 51 52 53 To preclude arbitrage... 54 Futures price should be 55 Futures price should be > 56 57 Show, how you would realize arbitrage, if the futures price were equal the Score Maximu 58 hypothetical price. 0 4 59 Hypothetical Futures Pris $124.00 60 Futures Maturity 4 from now 61 62 63 Arbitrage Condition Strategy 64 Cash Flow 65 Now in 1 month(sin 4 months Explanation: : 66 Buy/Sell SSF 67 Sell/Buy Stock 68 Lend/Borrow money 69 Dividend 70 Lend/Borrow money 71 72 Net 73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts