Question: I need help answer this question. Thank you! Question 7 0 I 1 point Following set of questions will walk you through the construction of

I need help answer this question. Thank you!

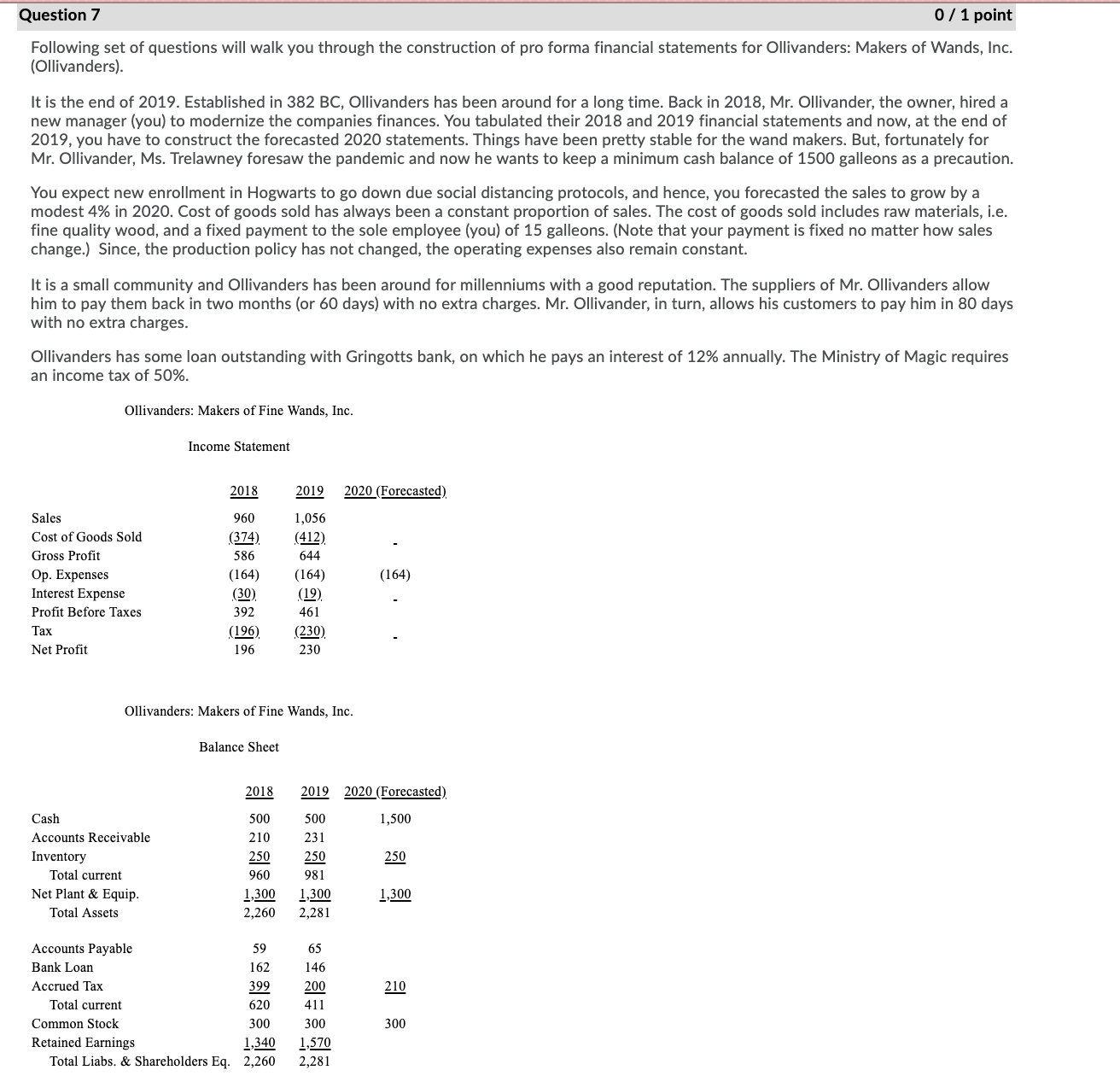

Question 7 0 I 1 point Following set of questions will walk you through the construction of proforma financial statements for Ollivanders: Makers of Wands, Inc. [Ollivandersl. It is the end of 2019. Established in 382 BC, Ollivanders has been around for a long time. Back in 2018, Mr. Ollivander, the owner, hired a new manager (you) to modernize the companies finances. You tabulated their 2018 and 2019 financial statements and now, at the end of 2019, you have to construct the forecasted 2020 statements. Things have been pretty stable for the wand makers. But, fortunately for Mr. Ollivander, Ms. Trelawney foresaw the pandemic and now he wants to keep a minimum cash balance of 1500 galleons as a precaution. You expect new enrollment in Hogwarts to go down due social distancing protocols, and hence, you forecasted the sales to grow by a modest 4% in 2020. Cost of goods sold has always been a constant proportion of sales. The cost of goods sold includes raw materials, i.e. fine quality wood, and a fixed payment to the sole employee (you) of 15 galleons. (Note that your payment is fixed no matter how sales change.) Since, the production policy has not changed, the operating expenses also remain constant. It is a small community and Ollivanders has been around for millenniums with a good reputation. The suppliers of Mr. Ollivanders allow him to pay them back in two months (or 60 days) with no extra charges. Mr. Ollivander, in turn, allows his customers to pay him in 80 days with no extra charges. Ollivanders has some loan outstanding with Gringotts bank, on which he pays an interest of 12% annually. The Ministry of Magic requires an income tax of 50%. Ollivanders: Makers of Fine Wands, Inc. Income Statement 2018 2019 2020 (Forecasted). Sales 900 1,056 Cost of Goods Sold IE4), PM). _ Gross Prot 586 644 Op. Expenses (154] (154) (154] Interest Expense CE), ,1 L91 _ Prot Before Taxes 392 461 Tax (). 1&3). _ Net PfDt 196 230 Ollivanders: Makers of Fine Wands, Inc. Balance Sheet 2018 2019 2020 (Forecasted). Cash 500 500 1,500 Accounts Receivable 210 231 Inventory m w E Total current 960 981 Net Plant 3: Equip. gm LM gm Total Assets 2,260 2,281 Accounts Payable 59 65 Bank Loan 162 146 Accrued Tax 2 M E Total current 620 411 Common Stock 300 300 300 Retained Earnings LE LE Total Liana. 8r. Shareholders Eq. 2,260 2,281 What are the sales forecast for 2020? (Hint: Use the forecasted sales growth for 2020} (Note: If your answer does not exactly match the options, choose the option that is closest to your answer.)