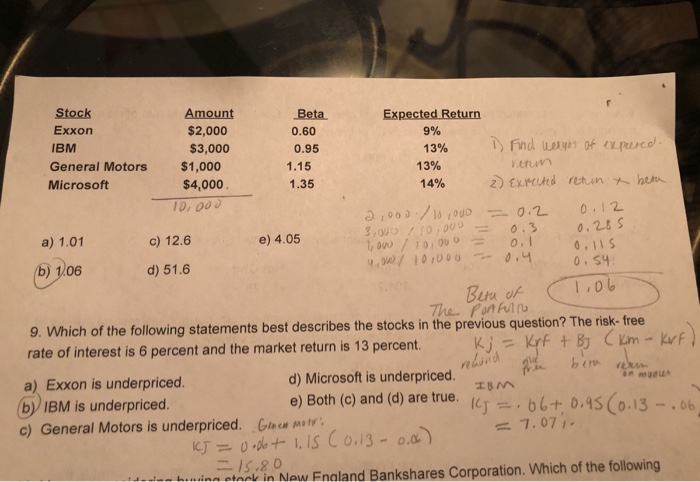

Question: I need help answering #9... I got the 1.06 in the previous question which is the beta of the portfolio. What does that 1.6 mean?

Stock Exxon IBM General Motors Microsoft Amount $2,000 $3,000 $1,000 $4,000 Beta 0.60 0.95 9% 1.15 13% 1.35 10, 00 0.28S 0.11s 0,S4 a) 1.01 O 710, 0.3 c) 12.6 e) 4.05 (6) 7 101000 0,4 06 d) 51.6 9. Which of the following statements best describes the stocks in the previous question? The risk- free rate of interest is 6 percent and the market return is 13 percent. a) Exxon is underpriced. b) IBM is underpriced. re- . d) Microsoft is underpriced. e) Both (c) and (d) are true. T+ 0.4S (0.13-.6 c) General Motors is underpriced. Gt, M.tr: 1.07 1. biming stonk in Now Fnaland Bankshares Corporation. Which of the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts