Question: I need help answering both questions please 10 Question 2 of 4 1 (2/2) 2 (2) 3 (3) 4 (4/4) A $5,000 bond had a

I need help answering both questions please

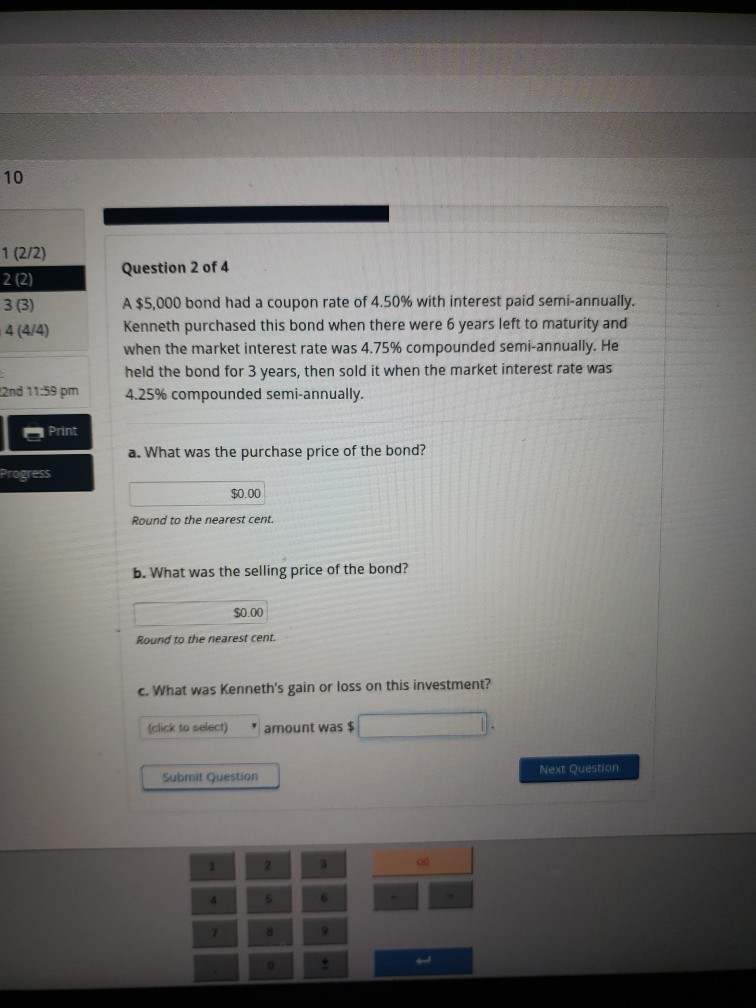

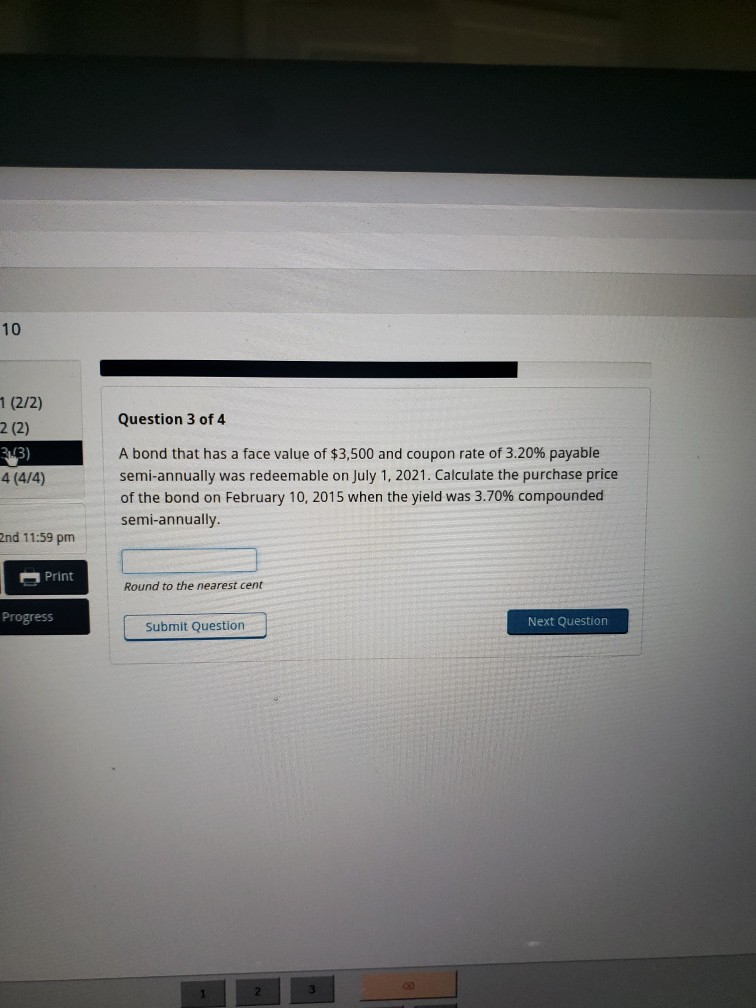

10 Question 2 of 4 1 (2/2) 2 (2) 3 (3) 4 (4/4) A $5,000 bond had a coupon rate of 4.50% with interest paid semi-annually. Kenneth purchased this bond when there were 6 years left to maturity and when the market interest rate was 4.75% compounded semi-annually. He held the bond for 3 years, then sold it when the market interest rate was 4.25% compounded semi-annually. 2nd 11:59 pm Print a. What was the purchase price of the bond? Progress $0.00 Round to the nearest cent. b. What was the selling price of the bond? $0.00 Round to the nearest cent. c. What was Kenneth's gain or loss on this investment? (click to select amount was $ Next Question Submit Question 10 Question 3 of 4 1 (2/2) 2 (2) 3:43) 4 (4/4) A bond that has a face value of $3,500 and coupon rate of 3.20% payable semi-annually was redeemable on July 1, 2021. Calculate the purchase price of the bond on February 10, 2015 when the yield was 3.70% compounded semi-annually. 2nd 11:59 pm Print Round to the nearest cent Progress Submit Question Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts