Question: I need help answering E16-7 Ending Work in Process Beginning Work in Process Conversion Units Conversion Cost% Cost% Units Transferred Out Units Month 60 2,000

I need help answering E16-7

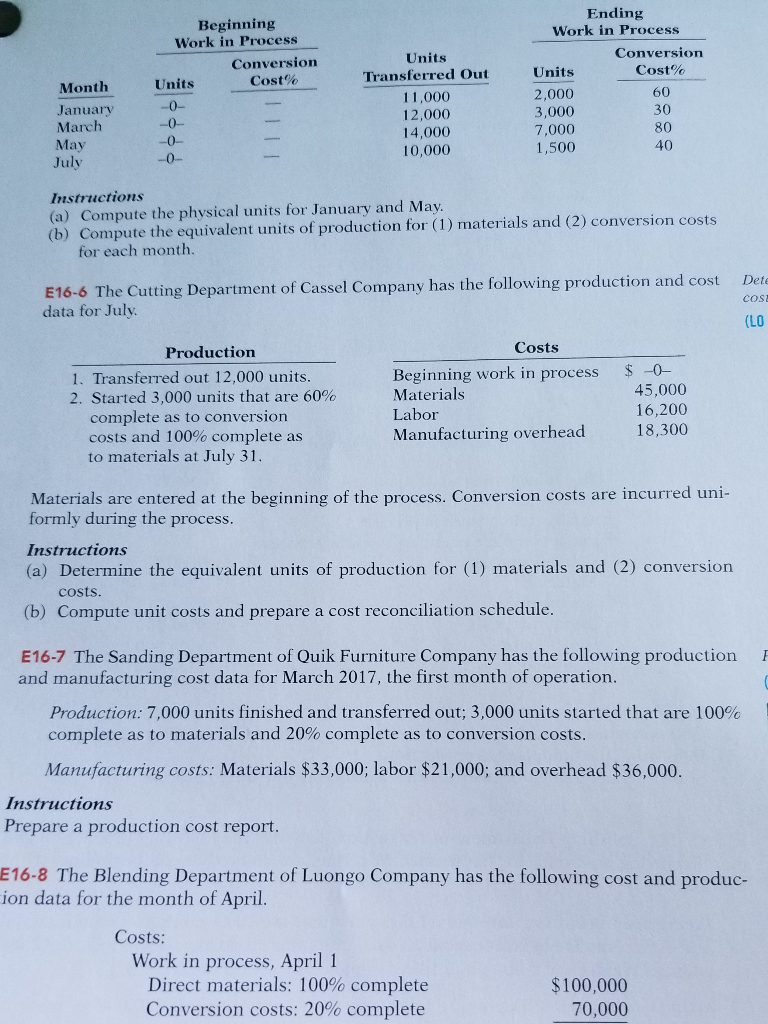

Ending Work in Process Beginning Work in Process Conversion Units Conversion Cost% Cost% Units Transferred Out Units Month 60 2,000 11,000 -0- January 30 3,000 12,000 -0- March 80 7,000 14,000 -0- May 40 1,500 10,000 -0- July Instructions (a) Compute the physical units for January and May. (b) Compute the equivalent units of production for (1) materials and (2) conversion costs for each month. E16-6 The Cutting Department of Cassel Company has the following production and cost data for July Det cos (LO Costs Production Beginning work in process Materials $ -0- 1. Transferred out 12,000 units. 2. Started 3,000 units that are 60% complete as to conversion costs and 100% complete as to materials at July 31 45,000 16,200 18,300 Labor Manufacturing overhead Materials are entered at the beginning of the process. Conversion costs are incurred uni- formly during the process. Instructions (a) Determine the equivalent units of production for (1) materials and (2) conversion costs. (b) Compute unit costs and prepare a cost reconciliation schedule. E16-7 The Sanding Department of Quik Furniture Company has the following production and manufacturing cost data for March 2017, the first month of operation. F Production: 7,000 units finished and transferred out; 3,000 units started that are 100% complete as to materials and 20 % complete as to conversion costs. Manufacturing costs: Materials $33,000; labor $21,000; and overhead $36,000 Instructions Prepare a production cost report. E16-8 ion data for the month of April. e Blending Department of Luongo Company has the following cost and produc- Costs: Work in process, April 1 Direct materials: 100 % complete Conversion costs: 20% complete $100,000 70,000 I ITT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts