Question: I need help answering questions 10-12 Case 3 Case 93 Electro Technology Corporation Entrepreneurship Directed Electro Technology Corporation (ETC) was founded five years ago by

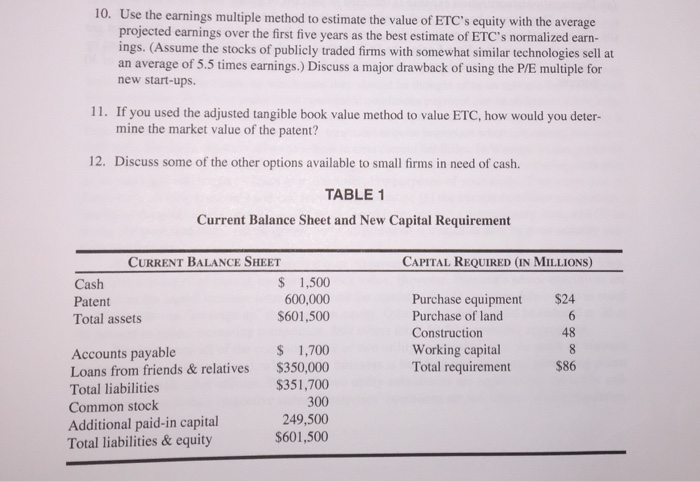

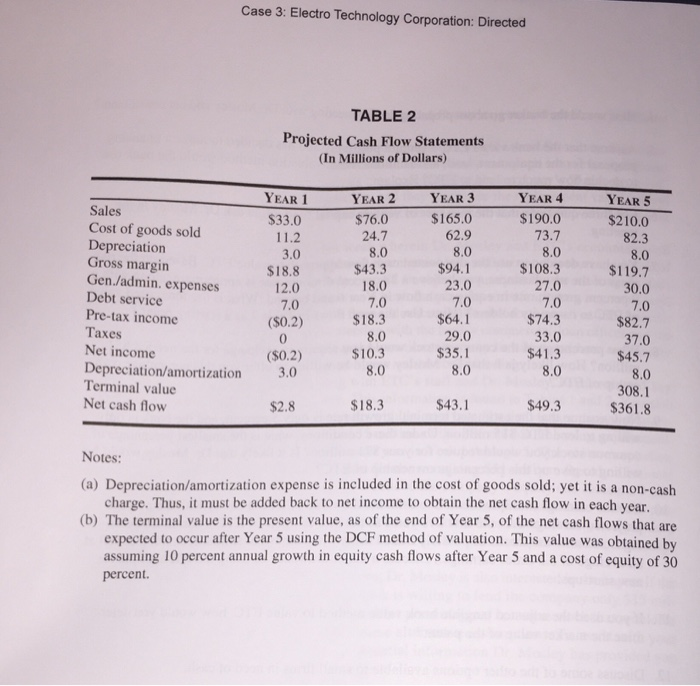

Case 3 Case 93 Electro Technology Corporation Entrepreneurship Directed Electro Technology Corporation (ETC) was founded five years ago by Dr. Sara Mosley to develop a new direct-current electro drilling system for boring deep, directional, and horizontal shafts. After completing her Master's degree in Mining Engineering and Ph.D. in Mechanical Engineer- ing. Dr. Mosley went to work for Oceanna Corporation, a marine survey and drilling operation that specialized in offshore oil and gas exploration. Through her work she became familiar with electro drilling systems as an alternative to rotary, turbo, and positive displacement drilling systems. The electro drilling systems are more accurate and less expensive to operate. Also, they can be more eas- ily adapted for long-distance transmissions. For example, electro drilling can operate with alternate types of energy and, therefore, can be used with automated technologies and remote control. Dr. Mosley believed she could develop an improved version of the electro drilling system. With this goal, she left her position with Oceanna, started her new company, and devoted herself to developing the new system. She used a government grant, personal funds, and loans from friends and relatives as seed money to finance her company, and she was the sole stockholder. She and her two-member staff worked feverishly for three years and, at the beginning of the fourth year, they made a major breakthrough. Their research led to the development of a new direct-current version of the electro drilling system. The new system was more reliable, compact, and efficient, and pro- vided a higher-powered process with a smooth speed adjustment. ETC received a patent from the U.S. Patent Office for Dr. Mosley's unique drilling system. After delivering a presentation explaining her process to an international mining association, Mosley was inundated with requests for information. With this level of interest, she decided that ETC should produce the system and expand sales markets to include coal, general mining, construction, and ot industries. However, this plan required a substantial amount of capital, and Dr. Mosley had exhausted her personal financial resources. Therefore, she began a series of discussions with ETC's accountants and bankers. Both sets of advisors stated that the first step toward attaining outside capital is to develop a business plan Case 3: Electro Technology Corporation: Directed value. Clearly, a great deal of judgment is req conclusions. uired, and different experts will reach very different it is appropriate to analyze different groups of a I company may have diversified outside of its core bu firm's assets differently. For exam- siness (steel) into several different At times, ple, a stee industries such as oil and chemicals. Analysts may conc exceeds its value as a conglomerate co that the company's "break-up value" ion, and they might use the replacement value method h flow method to evaluate the core evaluate the chemical and oil divyisi and the discounted cash flow methodto chemical and oil divisions steel business meeting has been scheduled next week wherein Dr. Mosley and ETC'S the company's plans with several bank commercial loan officers accountant will l fund ng. In gen segments, and enture. Specifi- and venture capita discuss representatives. You have been hired to help prepare an objective analysis for the meeti eral, Dr. Mosley is interested in your views on a business plan, its most important the steps that should be taken in getting the financial resources needed for a new cally, she is interested in preparing for the meeting with the bank's commercial-loan off venture capital fund manager by anticipating the questions that may be asked and how value the company and determine appropriate types and levels of funding each might To prepare for the meeting you, along with ETC's staff and Dr. Mosley, h ave extracted key and 2. You also financial information from the business plan. This information is found in Tables 1 have developed some assumptions that will help with the analysis. For the venture ca is you assume that a bank is willing to lend $35 million of the $86 million financing The debt service requirements are $7 million each year in Year 1 through 5. T are considering providing the equity investment for the remaining $51 million. Base economic analysis and industry projections, you believe the company's equity can sus cent growth rate in Year 6 and beyond. However, because of the high risk assoc ject, you think investors will require a 28 percent rate of return. traded firms of 5.5 times earnings. pitalist an al he venture capitalists d on national tain a 9 iated with the p ro- You have investigated publicly with similar technologies and have found stocks for these companies sell at an averag uncertainty in the assumptions, Dr. Mosley is also interested in the impact if terminal growth rate is only 5 percent and the bank is willing to lend the company only $15 mil- lion. Specifically she also wants to know the smallest percentage of common stock that would be required for the $71 million investment under these alternative assumptions. To assist with your analysis and to assure coverage of at least the essential information Dr. Mosley has provided you with the following questions. 10. Use the earnings multiple method to estimate the value of ETC's equity with the average projected earnings over the first five years as the best estimate of ETC's normalized earn- ings. (Assume the stocks of publicly traded firms with somewhat similar technologies sell at an average of 5.5 times earnings.) Discuss a major drawback of using the P/E multiple for new start-ups. 11. If you used the adjusted tangible book value method to value ETC, how would you deter- mine the market value of the patent? 12. Discuss some of the other options available to small firms in need of cash. TABLE1 Current Balance Sheet and New Capital Requirement CURRENT BALANCE SHEET CAPITAL REQUIRED (IN MILLIONS) Cash Patent Total assets S 1,500 600,000 S601,500 Purchase equipment Purchase of land Construction Working capital Total requirement $24 48 $86 $ 1,700 Accounts payable Loans from friends & relatives Total liabilities Common stock Additional paid-in capital Total liabilities & equity $350,000 $351,700 300 249,500 $601,500 Case 3: Electro Technology Corporation: Directed TABLE 2 Projected Cash Flow Statements (In Millions of Dollars) YEAR 4 $190.0 73.7 8.0 YEAR 2 $76.0 24.7 8.0 $43.3 18.0 7.0 $18.3 8.0 $10.3 8.0 YEAR 5 $210.0 82.3 8.0 $119.7 30.0 7.0 $82.7 37.0 $45.7 8.0 308.1 $361.8 YEAR 3 $165.0 62.9 YEAR 1 Sales Cost of goods sold Depreciation Gross margin Gen./admin. expenses Debt service Pre-tax income Taxes Net income Depreciation/amortization Terminal value Net cash flow S33.0 11.2 $94.1 23.0 7.0 64.1 29.0 $35.1 8.0 $108.3 27.0 7.0 $74.3 33.0 $41.3 8.0 $18.8 7.0 ($0.2) 0 ($0.2) $18.3 $43.1 $49.3 $2.8 Notes: (a) Depreciation/amortization expense is included in the cost of goods sold; yet it is a non-cash (b) The terminal value is the present value, as of the end of Year 5, of the net cash flows that are charge. Thus, it must be added back to net income to obtain the net cash flow in each year. expected to occur after Year 5 using the DCF method of valuation. This value was obtained by assuming 10 percent annual growth in equity cash flows after Year 5 and a cost of equity of 30 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts