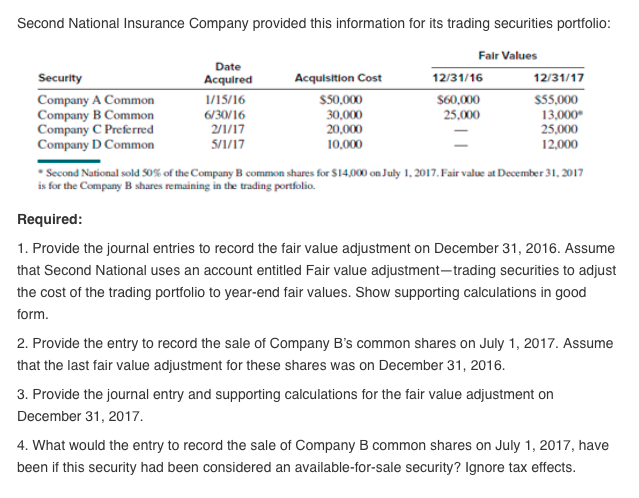

Question: I need help answering the question below. Thank you! Second National Insurance Company provided this information for its trading securities portfolio Fair Values Date Acquired

I need help answering the question below. Thank you!

Second National Insurance Company provided this information for its trading securities portfolio Fair Values Date Acquired 12/31/17 $55,000 13,000 25,000 12.000 Security Acquisition Cost 12/31/16 Company A Common Company B Common Company C Preferred Company D Common $50,000 30,000 20,000 10,000 $60,000 25,000 6/3016 * Second National sold 53% of the Company B common shares for $14,000 on July 1, 2017, Fair value at December 31, 2017 is for the Company B shares remaining in the trading portfolio. Required 1. Provide the journal entries to record the fair value adjustment on December 31, 2016. Assume that Second National uses an account entitled Fair value adjustment-trading securities to adjust the cost of the trading portfolio to year-end fair values. Show supporting calculations in good form 2. Provide the entry to record the sale of Company B's common shares on July 1, 2017. Assume that the last fair value adjustment for these shares was on December 31, 2016 3. Provide the journal entry and supporting calculations for the fair value adjustment on December 31, 2017 4. What would the entry to record the sale of Company B common shares on July 1, 2017, have been if this security had been considered an available-for-sale security? Ignore tax effects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts