Question: I need help answering these question parts, please! ( Type ypur answer up so it becomes more clear for me, please) Thank you value: 2

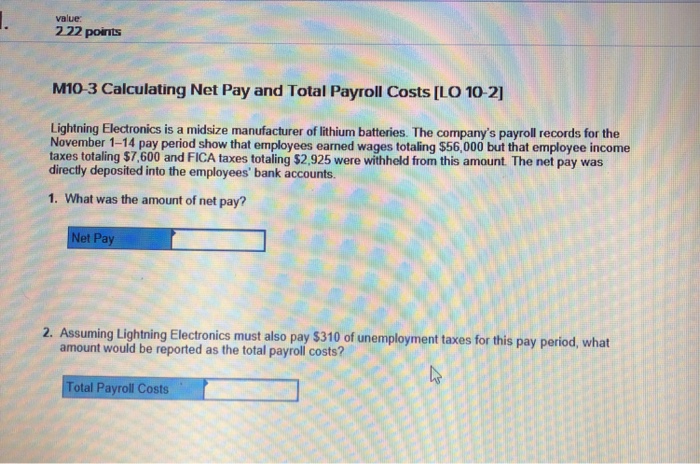

value: 2 22 points M10-3 Calculating Net Pay and Total Payroll Costs [LO 10-21 Lightning Electronics is a midsize manufacturer of lithium batteries. The company's payroll records for the November 1-14 pay period show that employees earned wages totaling $56,000 but that employee income taxes totaling $7,600 and FICA taxes totaling $2,925 were withheld from this amount. The net pay was directly deposited into the employees' bank accounts. 1. What was the amount of net pay? et P 2. Assuming Lightni ng Electronics must also pay $310 of unemployment taxes for this pay period, what amount would be reported as the total payroll costs? otal Payroll Costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts