Question: I need help answering these questions. 4-Variable Costing 4-Variable Costing Q-4-1. The difference between contribution margin and gross profit as subtotals on an income statement

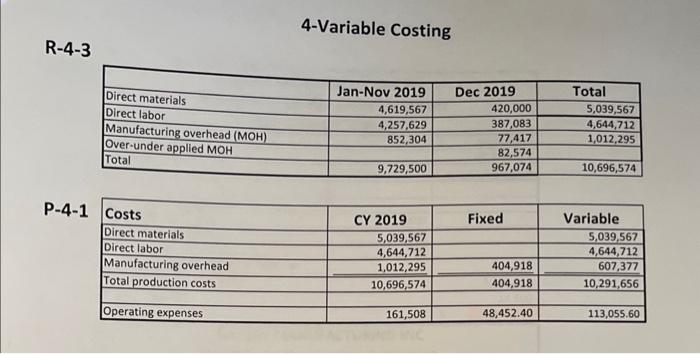

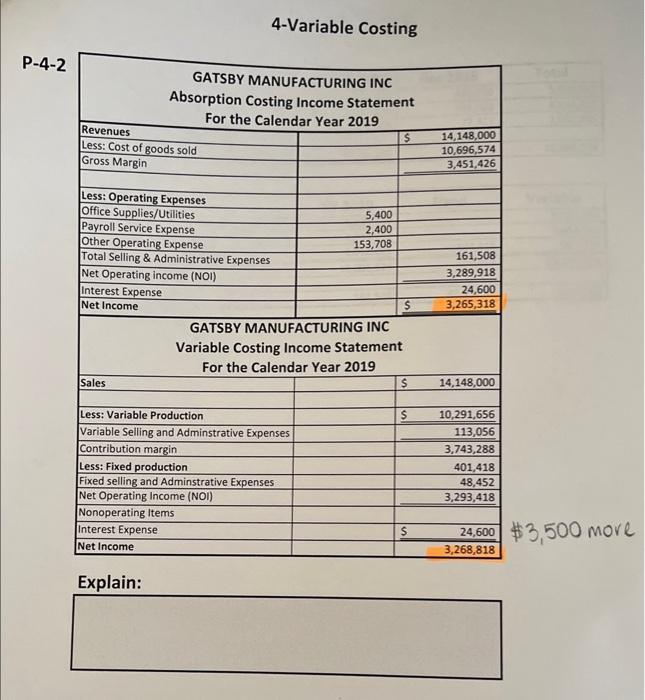

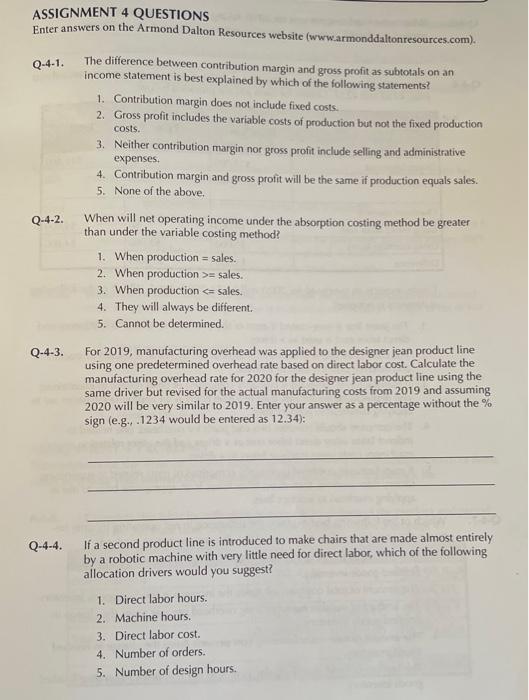

4-Variable Costing 4-Variable Costing Q-4-1. The difference between contribution margin and gross profit as subtotals on an income statement is best explained by which of the following statements? 1. Contribution margin does not include fixed costs. 2. Gross profit includes the variable costs of production but not the fixed production costs. 3. Neither contribution margin nor gross profit include selling and administrative expenses. 4. Contribution margin and gross profit will be the same if production equals sales. 5. None of the above. Q-4-2. When will net operating income under the absorption costing method be greater than under the variable costing method? 1. When production = sales. 2. When production >= sales. 3. When production = sales. 3. When production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts