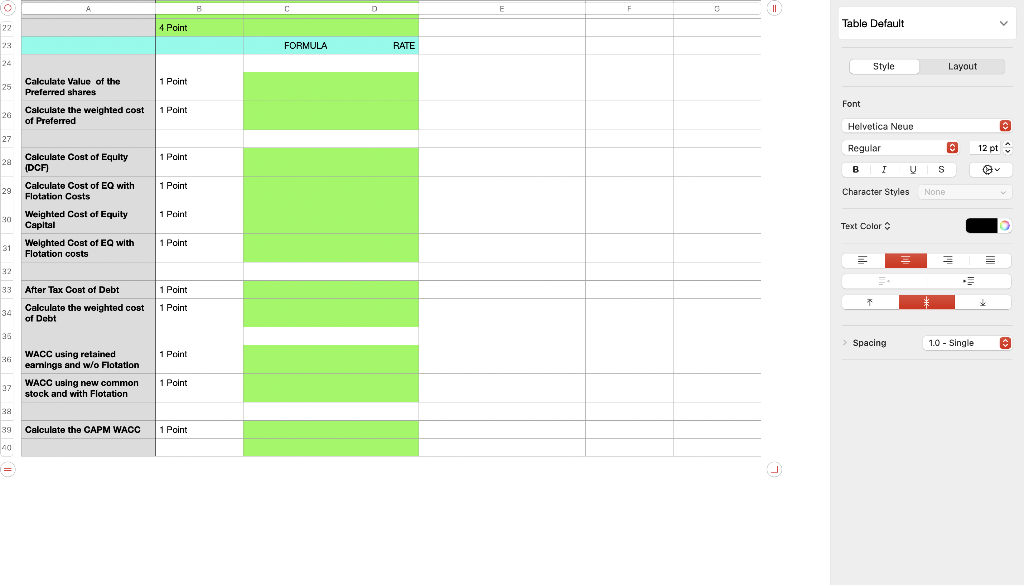

Question: I need help answering this problem, the green part is the answer part. E 22 4 Point Table Default 23 FORMULA RATE Style Layout 1

I need help answering this problem, the green part is the answer part.

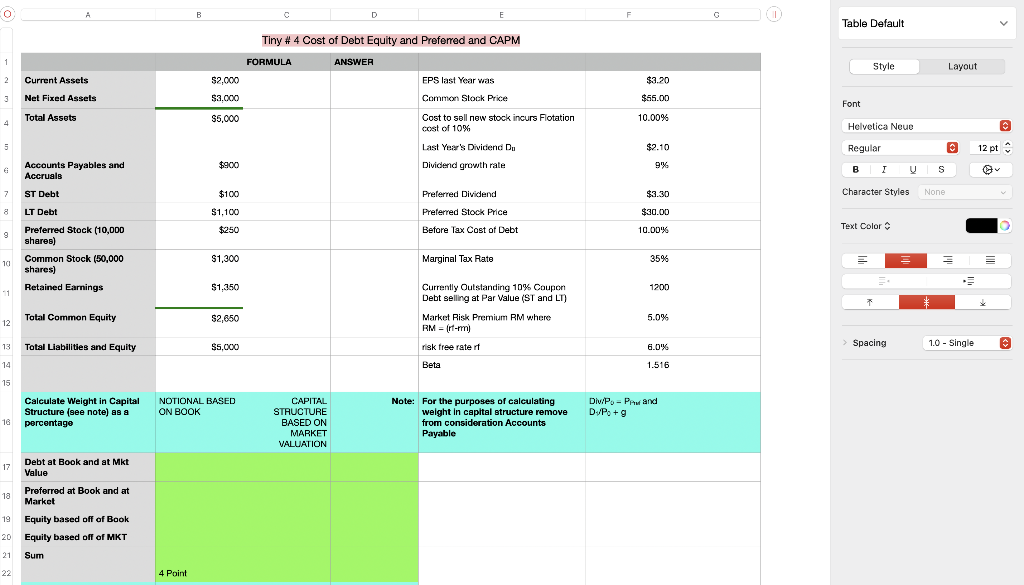

E 22 4 Point Table Default 23 FORMULA RATE Style Layout 1 Point 25 Calculate Value of the Preferred shares Calculate the weighted cost of Preferred Font 1 Point 2G Helvetica Neue 27 Regular 12 pt Calculate Cost of Equity 2a 1 Point (DCF BI S 1 Point 29 Calculate Cost of EQ with Flotation Costs Character Styles None 30 1 Point Text Color Weighted Cost of Equity Capital Weighted Cost of EQ with Flotation costs 1 Point 31 32 1 Point 1 Point > Spacing 1.0 - Single 1 Point 33 After Tax Cost of Debt Calculate the weighted cost 34 of Debt 25 WACC using retained eamings and w/o Flotation WACC using new common 27 stock and with Flotation 38 39 Calculate the CAPM WACC 1 Point 1 Point CO B C D E F Table Default Tiny # 4 Cost of Debt Equity and Preferred and CAPM 1 FORMULA ANSWER Style Layout 2 Current Assets $2,000 EPS last year was Common Stock Price $3.20 $65.00 3 Net Fixed Assets $3.000 Font Total Assets $5,000 4 10.00% Cost to sell new stock incurs Flotation cost of 10% Helvetica Neue 5 $2.10 Regular 12 pt Last Year's Dividend Du Dividend growth rate $900 9% Accounts Payables and Accruals BI S 7 ST Debt $100 $3.30 Character Styles None Preferred Dividend Preferred Stock Price $30.00 $1,100 $250 Text Color 9. Before Tax Cost of Debt 10.00% LT Debt Preferred Stock (10,000 shares) Common Stock (50,000 shares) Retained Earnings $1,300 $ Marginal Tax Rate 35% 101 $1,350 1200 1 Currently Outstanding 10% Coupon Debt selling at Par Value (ST and LT) Market Risk Premium RM where RM - (rt-mm) Total Common Equity $2,650 5.0% 12 13 Total Liabilities and Equity $5,000 6.0% > Spacing 1.0 - Single risk free rate it Beta 14 1.516 15 Calculate Weight in Capital Structure (see note) as percentage NOTIONAL BASED ON BOOK Note: For the purposes of calculating weight in capital structure remove from consideration Accounts Div/P. - Pawand DUP. + CAPITAL STRUCTURE BASED ON MARKET VALUATION 16 Payable 17 Debt at Book and at Mkt Value 18 Preferred at Book and at Market 19 Equity based off of Book 20 Equity based off of MKT 21 Sum 22 4 Point E 22 4 Point Table Default 23 FORMULA RATE Style Layout 1 Point 25 Calculate Value of the Preferred shares Calculate the weighted cost of Preferred Font 1 Point 2G Helvetica Neue 27 Regular 12 pt Calculate Cost of Equity 2a 1 Point (DCF BI S 1 Point 29 Calculate Cost of EQ with Flotation Costs Character Styles None 30 1 Point Text Color Weighted Cost of Equity Capital Weighted Cost of EQ with Flotation costs 1 Point 31 32 1 Point 1 Point > Spacing 1.0 - Single 1 Point 33 After Tax Cost of Debt Calculate the weighted cost 34 of Debt 25 WACC using retained eamings and w/o Flotation WACC using new common 27 stock and with Flotation 38 39 Calculate the CAPM WACC 1 Point 1 Point CO B C D E F Table Default Tiny # 4 Cost of Debt Equity and Preferred and CAPM 1 FORMULA ANSWER Style Layout 2 Current Assets $2,000 EPS last year was Common Stock Price $3.20 $65.00 3 Net Fixed Assets $3.000 Font Total Assets $5,000 4 10.00% Cost to sell new stock incurs Flotation cost of 10% Helvetica Neue 5 $2.10 Regular 12 pt Last Year's Dividend Du Dividend growth rate $900 9% Accounts Payables and Accruals BI S 7 ST Debt $100 $3.30 Character Styles None Preferred Dividend Preferred Stock Price $30.00 $1,100 $250 Text Color 9. Before Tax Cost of Debt 10.00% LT Debt Preferred Stock (10,000 shares) Common Stock (50,000 shares) Retained Earnings $1,300 $ Marginal Tax Rate 35% 101 $1,350 1200 1 Currently Outstanding 10% Coupon Debt selling at Par Value (ST and LT) Market Risk Premium RM where RM - (rt-mm) Total Common Equity $2,650 5.0% 12 13 Total Liabilities and Equity $5,000 6.0% > Spacing 1.0 - Single risk free rate it Beta 14 1.516 15 Calculate Weight in Capital Structure (see note) as percentage NOTIONAL BASED ON BOOK Note: For the purposes of calculating weight in capital structure remove from consideration Accounts Div/P. - Pawand DUP. + CAPITAL STRUCTURE BASED ON MARKET VALUATION 16 Payable 17 Debt at Book and at Mkt Value 18 Preferred at Book and at Market 19 Equity based off of Book 20 Equity based off of MKT 21 Sum 22 4 Point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts