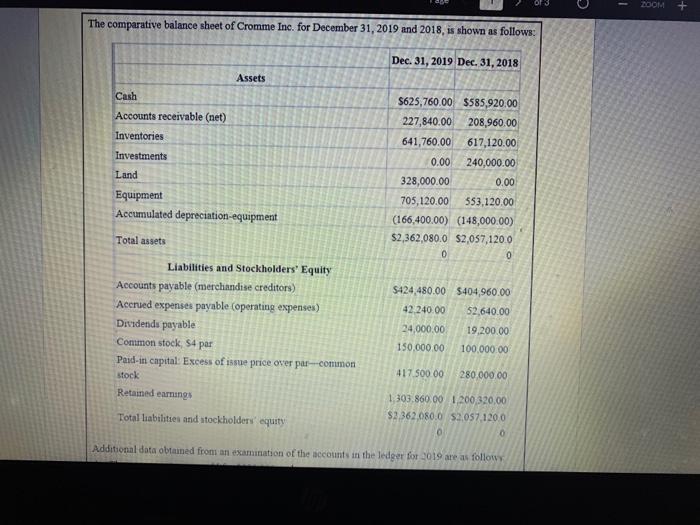

Question: i need help answering this question please The comparative balance sheet of Cromme Inc. for December 31, 2019 and 2018, is shown as follows: Dec.

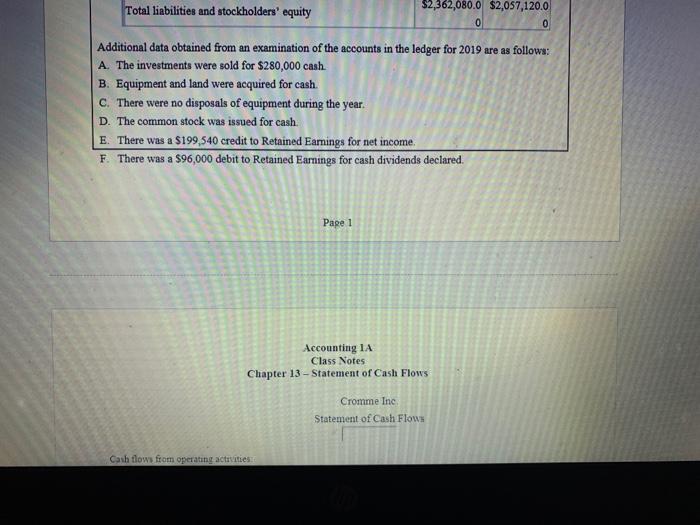

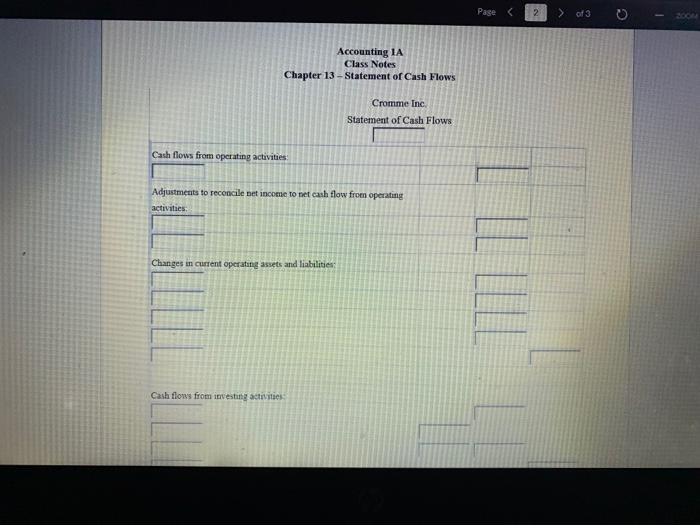

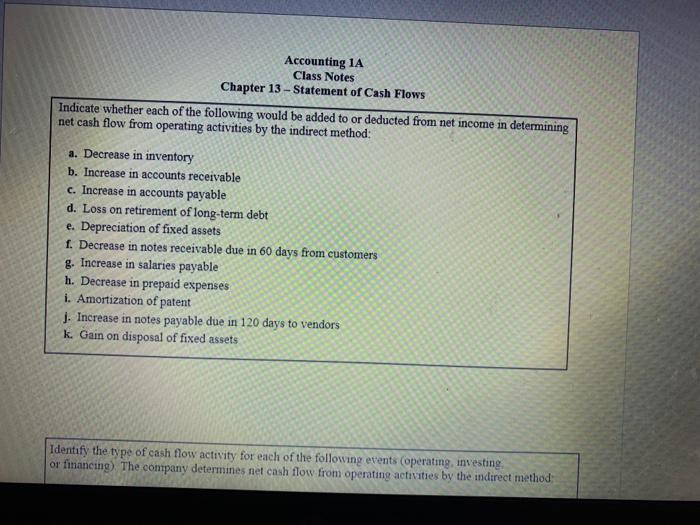

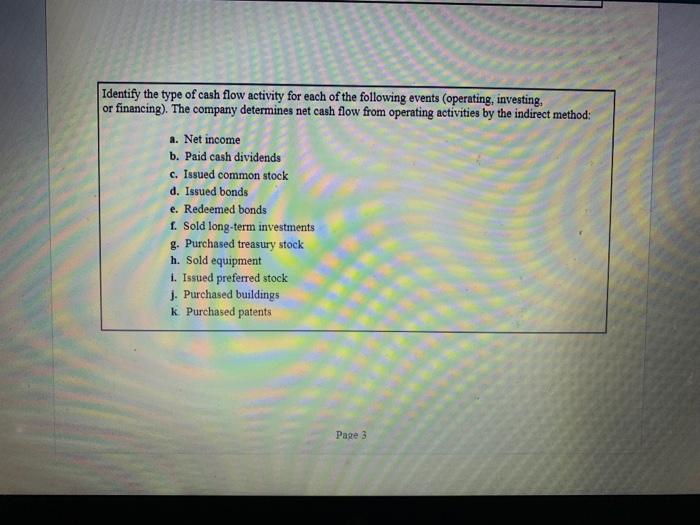

The comparative balance sheet of Cromme Inc. for December 31, 2019 and 2018, is shown as follows: Dec. 31, 2019 Dec. 31, 2018 Assets Cash $625,760.00 $585,920.00 Accounts receivable (net) 227,840.00 208,960.00 Inventories. 641,760.00 617,120.00 Investments 0.00 240,000.00 Land 328,000.00 0.00 Equipment 705,120.00 553,120.00 Accumulated depreciation-equipment (166,400.00) (148,000.00) $2,362,080.0 $2,057,120.0 Total assets 0 0 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $424,480.00 $404,960.00 42.240.00 52,640.00 Accrued expenses payable (operating expenses) Dividends payable 24,000.00 19,200.00 Common stock, $4 par 150,000.00 100,000.00 Paid-in capital: Excess of issue price over par-common stock 417.500.00 280,000.00 Retained earnings 1,303.860.00 1,200,320,00 Total liabilities and stockholders equity $2.362,080.0 $2.057,120.0 0 0 Additional data obtained from an examination of the accounts in the ledger for 2019 are as follows 1 ZOOM + Total liabilities and stockholders' equity $2,362,080.0 $2,057,120.0 0 0 Additional data obtained from an examination of the accounts in the ledger for 2019 are as follows: A. The investments were sold for $280,000 cash. B. Equipment and land were acquired for cash. C. There were no disposals of equipment during the year. D. The common stock was issued for cash. E. There was a $199,540 credit to Retained Earnings for net income. F. There was a $96,000 debit to Retained Earnings for cash dividends declared. Page 1 Accounting 1A Class Notes. Chapter 13-Statement of Cash Flows Cromme Inc. Statement of Cash Flows Cash flows from operating activities: Accounting 1A Class Notes Chapter 13-Statement of Cash Flows Cromme Inc. Statement of Cash Flows Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Cash flows from investing activities Page > of 3 C I Cash flows from investing activities: Cash flows from financing activities: Cash at the beginning of the year Cash at the end of the year Page 2 Accounting 1A Class Notes Chapter 13- Statement of Cash Flows Indicate whether each of the following would be added to or deducted from net income in determining net cash flow from operating activities by the indirect method: a. Decrease in inventory b. Increase in accounts receivable c. Increase in accounts payable d. Loss on retirement of long-term debt e. Depreciation of fixed assets f. Decrease in notes receivable due in 60 days from customers g. Increase in salaries payable h. Decrease in prepaid expenses i. Amortization of patent j. Increase in notes payable due in 120 days to vendors k. Gain on disposal of fixed assets Identify the type of cash flow activity for each of the following events (operating, investing. or financing) The company determines net cash flow from operating activities by the indirect method: Identify the type of cash flow activity for each of the following events (operating, investing, or financing). The company determines net cash flow from operating activities by the indirect method: a. Net income b. Paid cash dividends c. Issued common stock d. Issued bonds e. Redeemed bonds f. Sold long-term investments g. Purchased treasury stock h. Sold equipment i. Issued preferred stock j. Purchased buildings k. Purchased patents Page 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts