Question: I need help answering this three part question, it is an Annuity challenger problem which requires some out of the box thinking and i am

I need help answering this three part question, it is an Annuity challenger problem which requires some out of the box thinking and i am stuck, this is from a time value unit, we are allowed to use excel formulas or regular formulas (preferably excel) thanks!

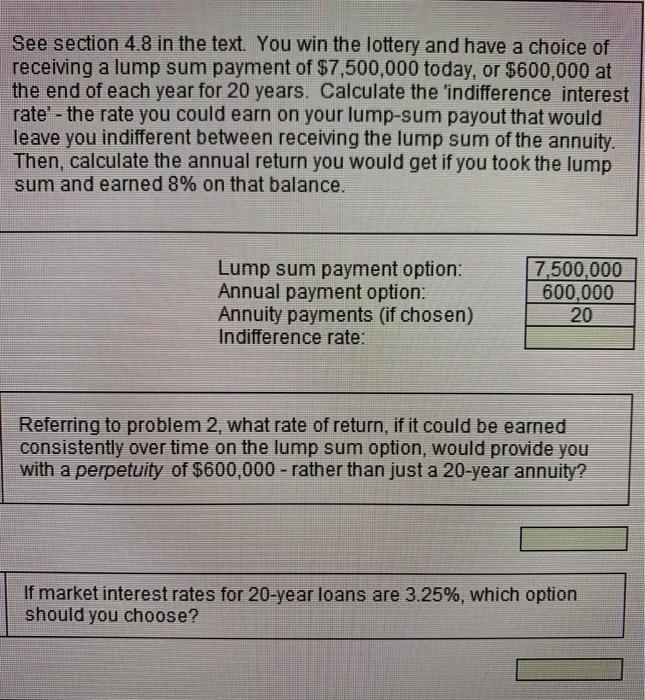

I need help answering this three part question, it is an Annuity challenger problem which requires some out of the box thinking and i am stuck, this is from a time value unit, we are allowed to use excel formulas or regular formulas (preferably excel) thanks! See section 4.8 in the text. You win the lottery and have a choice of receiving a lump sum payment of $7,500,000 today, or $600,000 at the end of each year for 20 years. Calculate the 'indifference interest rate' - the rate you could earn on your lump-sum payout that would leave you indifferent between receiving the lump sum of the annuity. Then, calculate the annual return you would get if you took the lump sum and earned 8% on that balance. Lump sum payment option: Annual payment option: Annuity payments (if chosen) Indifference rate: 7,500,000 600,000 20 Referring to problem 2, what rate of return, if it could be earned consistently over time on the lump sum option, would provide you with a perpetuity of $600,000 - rather than just a 20-year annuity? If market interest rates for 20-year loans are 3.25%, which option should you choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts