Question: I NEED HELP AS SOON AS POSSIBLE PLEASE Exercise 14-21 (Part Level Submission) Buffalo Company owes $172,000 plus $14,900 of accrued interest to Carla State

I NEED HELP AS SOON AS POSSIBLE PLEASE

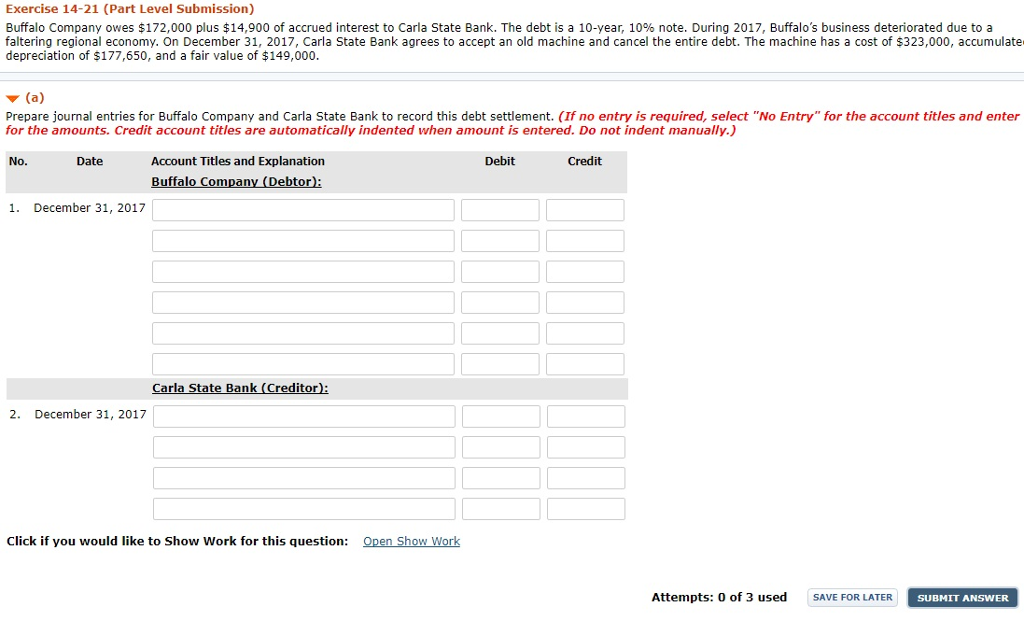

Exercise 14-21 (Part Level Submission) Buffalo Company owes $172,000 plus $14,900 of accrued interest to Carla State Bank. The debt is a 10-year, 10% note. During 2017, Buffalo's business deteriorated due to a faltering regional economy. On December 31, 2017, Carla State Bank agrees to accept an old machine and cancel the entire debt. The machine has a cost of $323,000, accumulate depreciation of $177,650, and a fair value of $149,000. (a) Prepare journal entries for Buffalo Company and Carla State Bank to record this debt settlement. (If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Date Account Titles and Explanation Buffalo Company (Debtor): No. Debit Credit 1. December 31, 2017 Carla State Bank (Creditor: 2. December 31, 2017 Click if you would like to Show Work for this question: Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts