Question: I need help as soon as possible please! In January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following transactions during the month:

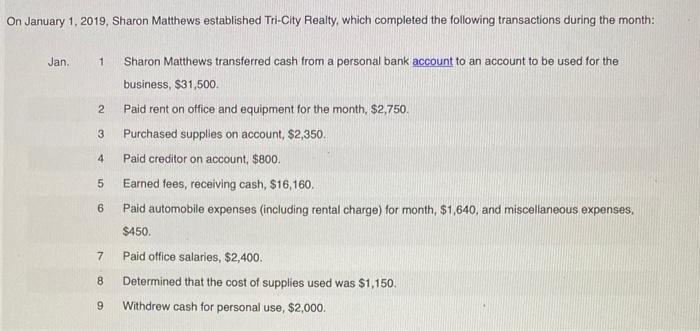

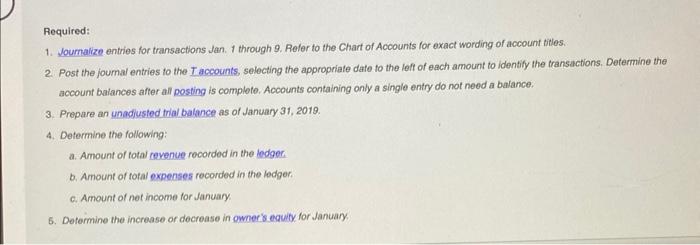

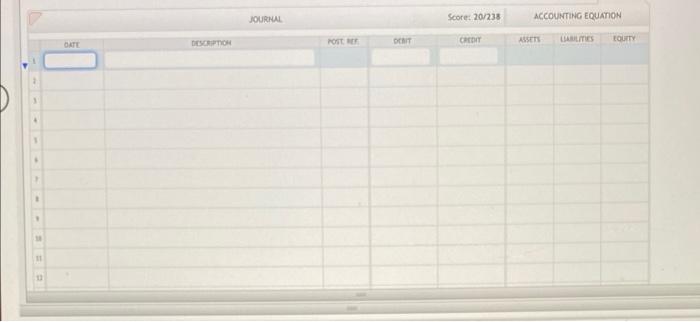

In January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following transactions during the month: Jan. 1 Sharon Matthews transferred cash from a personal bank account to an account to be used for the business, $31,500. 2 Paid rent on office and equipment for the month, $2,750. 3 Purchased supplies on account, \$2,350. 4 Paid creditor on account, $800. 5 Earned fees, receiving cash, $16,160. 6 Paid automobile expenses (including rental charge) for month, $1,640, and miscellaneous expenses, $450. 7 Paid office salaries, $2,400. 8 Determined that the cost of supplies used was $1,150. 9 Withdrew cash for personal use, $2,000. Required: 1. Joumalize entries for transactions Jan. 1 through 9. Reter to the Chart of Accounts for exact wording of account titles. 2. Post the joumal entries to the I accounts, selecting the appropriate dafe fo the left of each amount to identify the transactions. Determine the account baiances affer all posting is complote. Accounts containing only a single entry do not need a baiance. 3. Prepare an unadiusted frial balance as of January 31,2019. 4. Determine the following: a. Amount of total revence rocorded in the ledger. b. Amount of foral expenses rocorded in the ledger: c. Amount of net income for January. 6. Dotermine the increase or docrease in owner's equity for January

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts