Question: i need help asap on this question On December 28, 20Y3, Silverman Enterprises sold $18,500 of merchandise to Beasley Co. with terms 2/10, n/30. The

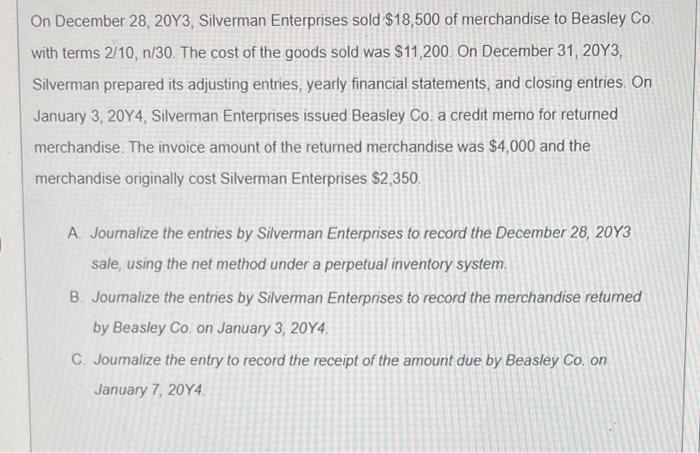

On December 28, 20Y3, Silverman Enterprises sold $18,500 of merchandise to Beasley Co. with terms 2/10, n/30. The cost of the goods sold was $11,200 On December 31, 2013, Silverman prepared its adjusting entries, yearly financial statements, and closing entries On January 3, 2014, Silverman Enterprises issued Beasley Co a credit memo for returned merchandise. The invoice amount of the returned merchandise was $4,000 and the merchandise originally cost Silverman Enterprises $2,350. A. Joumalize the entries by Silverman Enterprises to record the December 28, 20Y3 sale, using the net method under a perpetual inventory system B. Journalize the entries by Silverman Enterprises to record the merchandise returned by Beasley Co on January 3, 20Y4. C. Journalize the entry to record the receipt of the amount due by Beasley Co. on January 7, 2014

Step by Step Solution

There are 3 Steps involved in it

Here are the required journal entries based on the provided details A Journalizing the December 28 20Y3 Sale Net Method Perpetual Inventory System Und... View full answer

Get step-by-step solutions from verified subject matter experts