Question: I need help asap please . they asking to calculare 11 commonly reported financial ratios for the year ending january 2021 for target and walmart.

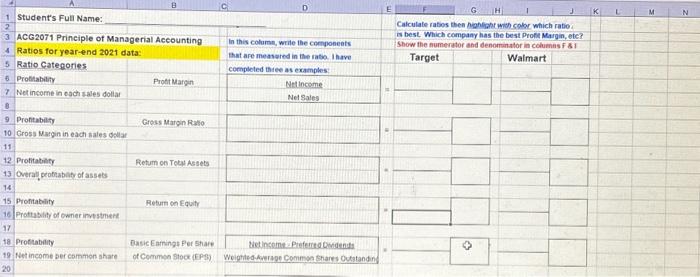

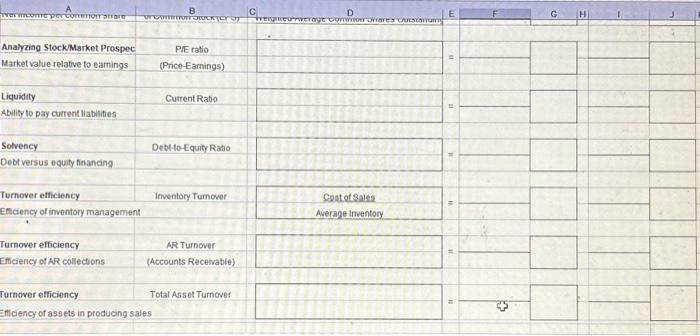

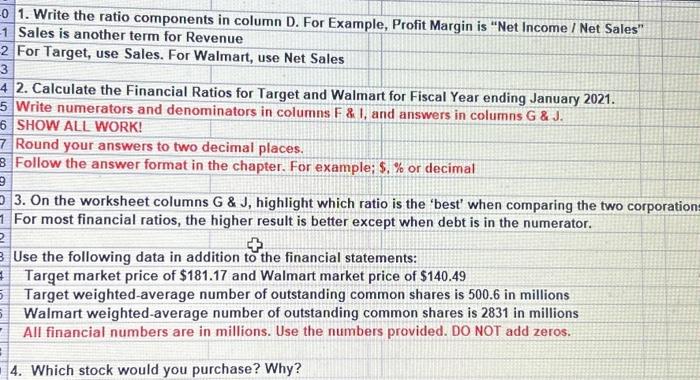

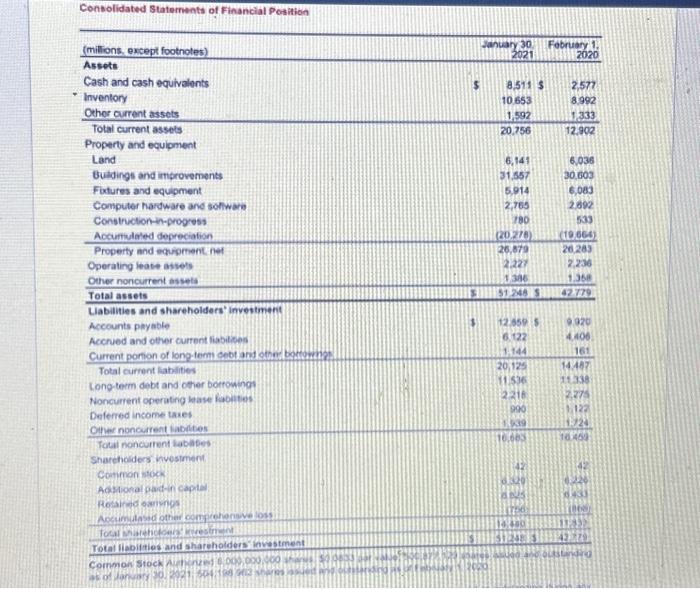

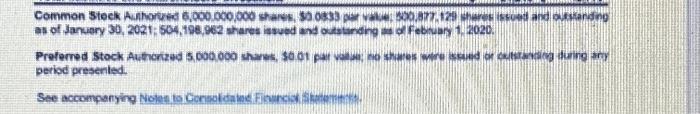

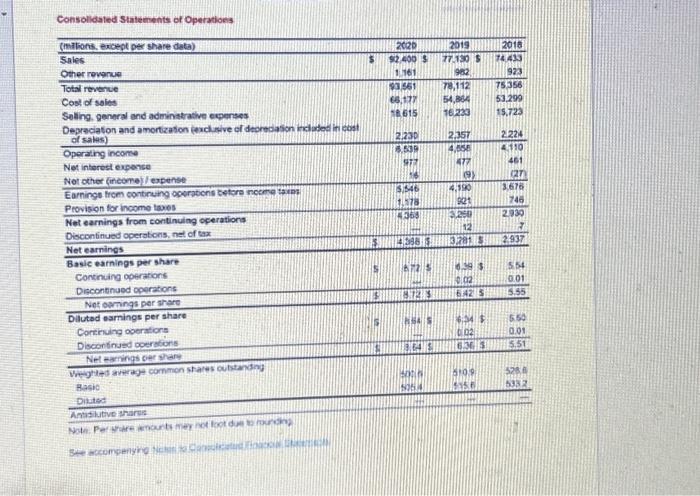

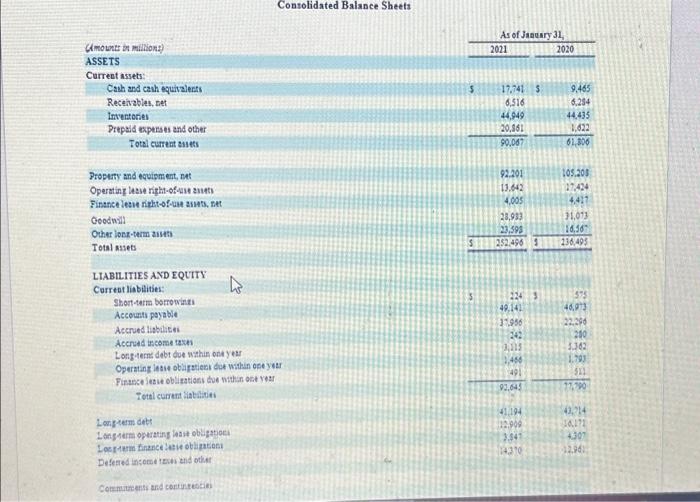

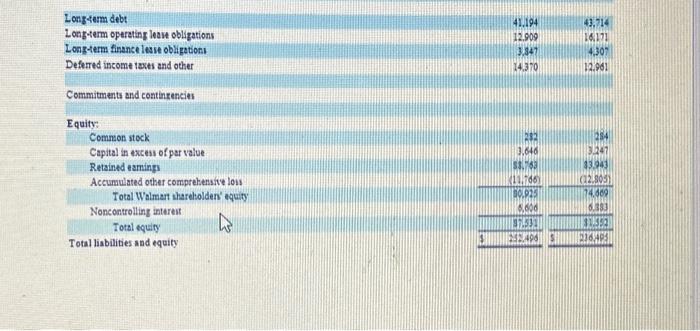

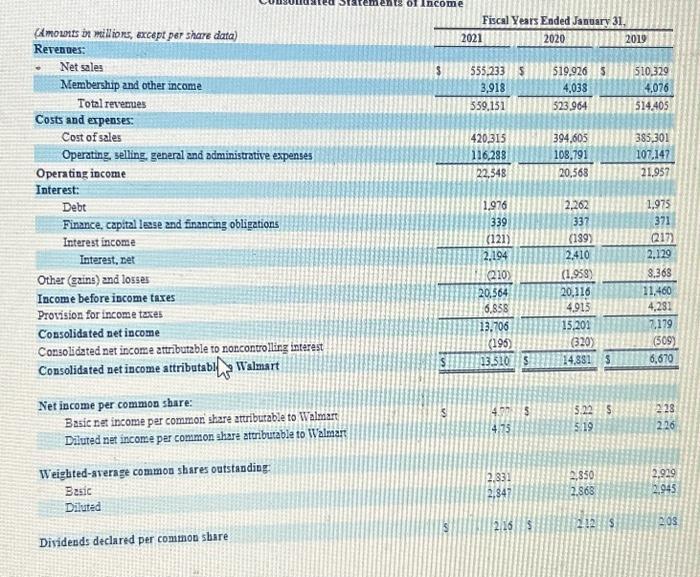

1 Student's Full Name: 3 ACG2071 Principle of Managerial Accounting 4 Ratios for year-end 2021 data: 5 Ratio Categories 6 Protitabitity 7 Net incorne in esch sales dollat 8 9 Prontabity 10 Cross Margin in each sales odllat 11. 12. Protitabiey 13 Overal, peoterabefy of assets 14. 15 Pronitablity 16. Prottability of owner investmert 17 18 Protabaity B C2 In this column, wille the cemponeats But are measered in the rato. I have Protit Margen completed thee as examples: Netincome Gress Margin Rato Retum on Toly Assets Return on Equitr Dasie Earnings for Share Calculate rabis then hehfoht with cobor which ratio: is best Which company has the best Profe Margin, ete? Show the numerator and denominator in columns f \& 1 Target Walmart = 19. Net income ber common share 20 1. Write the ratio components in column D. For Example, Profit Margin is "Net Income / Net Sales" Sales is another term for Revenue 2 For Target, use Sales. For Walmart, use Net Sales 4. Calculate the Financial Ratios for Target and Walmart for Fiscal Year ending January 2021. 5 Write numerators and denominators in columns F \& I, and answers in columns G \& J. 6 SHOW ALL WORK! 7 Round your answers to two decimal places. 8 Follow the answer format in the chapter. For example; $.% or decimal 3. On the worksheet columns G&J, highlight which ratio is the 'best' when comparing the two corporation For most financial ratios, the higher result is better except when debt is in the numerator. Use the following data in addition to the financial statements: Target market price of $181.17 and Walmart market price of $140.49 Target weighted-average number of outstanding common shares is 500.6 in millions Walmart weighted-average number of outstanding common shares is 2831 in millions All financial numbers are in millions. Use the numbers provided. DO NOT add zeros. 4. Which stock would you purchase? Why? Consolidated Staternents of Financial Pestion as of Januery 30, 2021; 504,198,962 shares istued and outstinding an of February 1, 2020. period presented. Consollasted Statements of Operstions Consolidated Balance Sheets Longterm debt Longterm operating leav obligations Longterm finance lesue obligation: Deferred income taxts and other \begin{tabular}{|rr} 41.194 & 43.716 \\ 12.909 & 18.171 \\ 3.347 & 4.307 \\ 14.370 & 12.961 \end{tabular} Commitments and continsencies Equity: Comnson stock Capital in excess of par value Retained eaming Accumulated other comptehensive loss Total Walmart thareholden' equity Noncontrolling intereit Total equity Total liabilities and equity (A mounts in millions, except per share data) Rerenues: - Net sales Nembership and other income Total reverues Costs and expenses: Cost of sales Operating, selling, general and administrative expenses Operating income Interest: Debt Finance, capital lease and financing obligations Interest income Interest, net Other (gains) and losses Income before income taxes Provision for income taxes Consolidated net income Consolidated net income attributable to noncontrolling intarast Consolidated net income attributabl fo Walmart Net income per common share: Basic net income par common hare atributable to Walmart Diluted net income per conimon ahare attributable to Walman? Weighted-arerage common shares outstanding: Basic Diluted Fiscal Years Ended January 31. Dividends declared per common sbare

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts