Question: I need help because I don't understand why my answer is incomplete. What is missing from my answers? I need help finding out what is

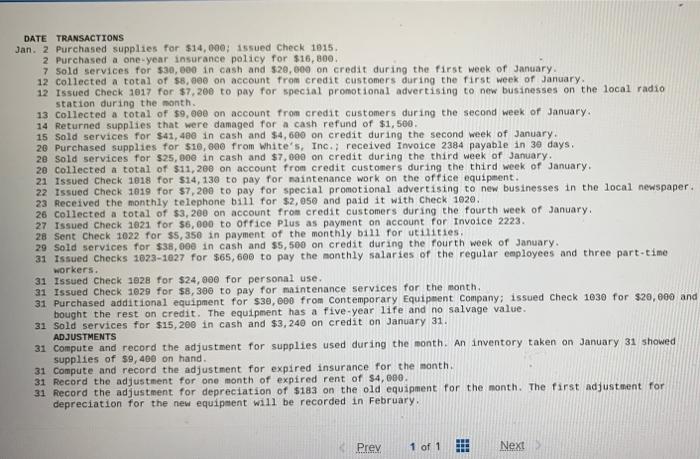

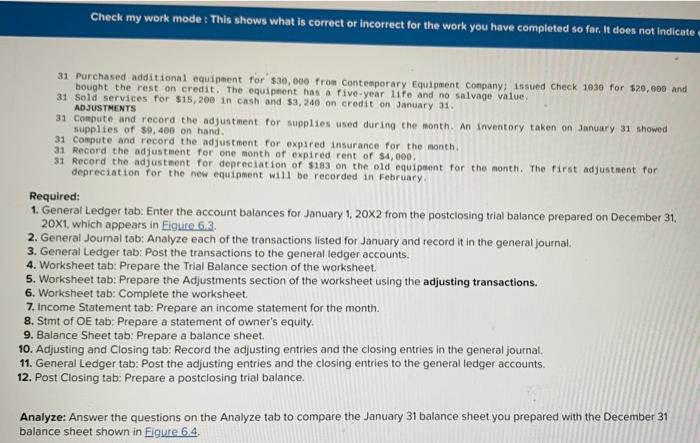

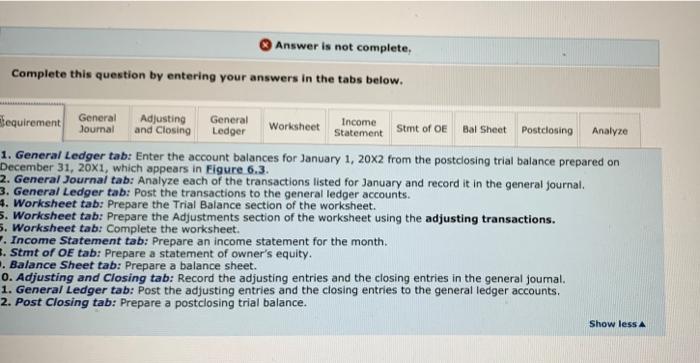

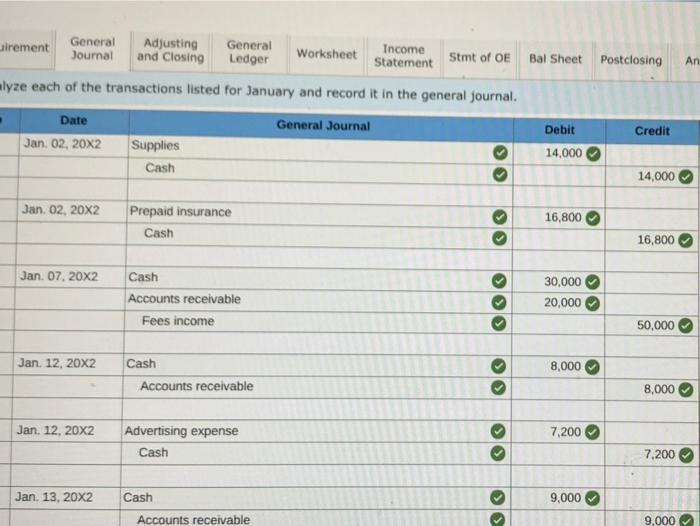

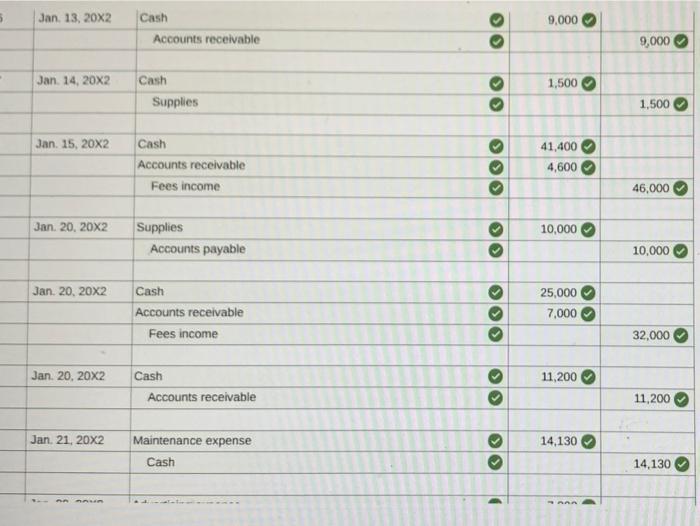

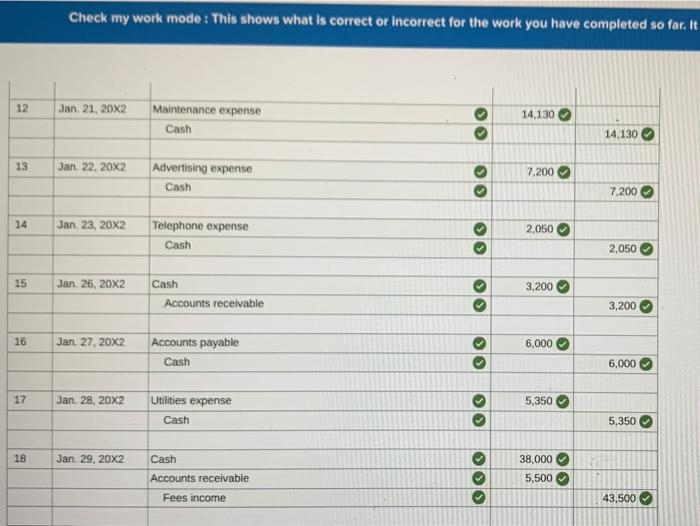

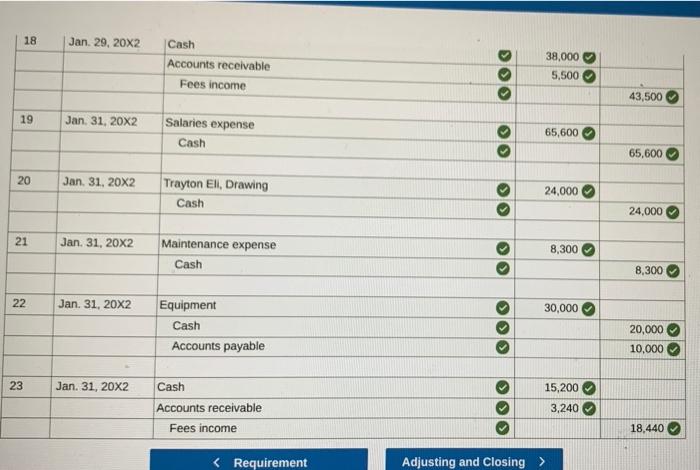

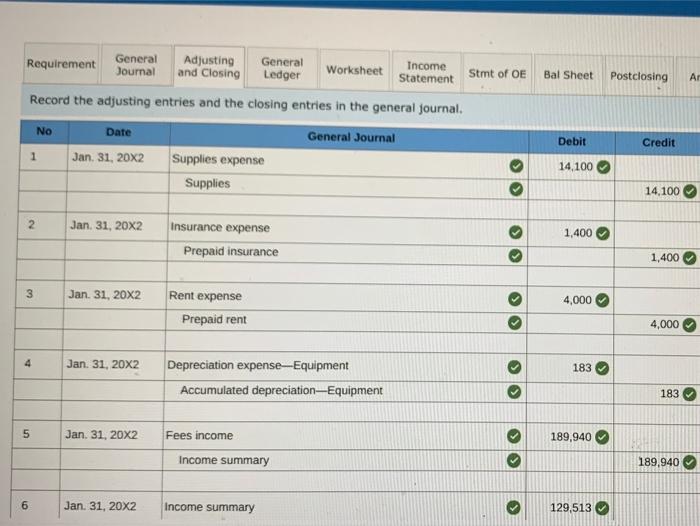

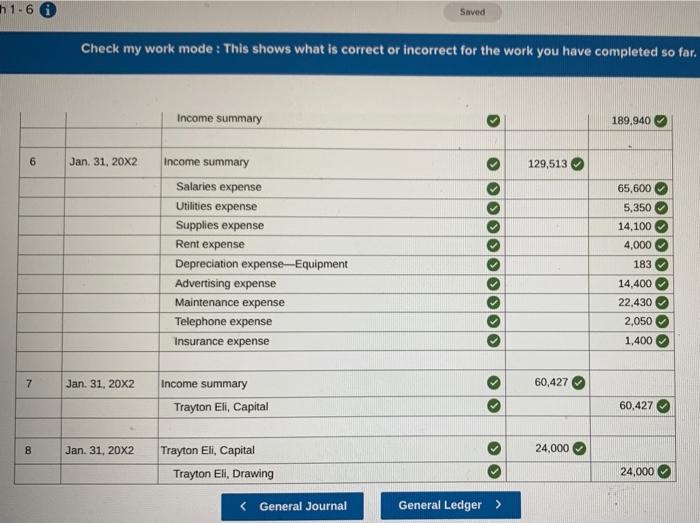

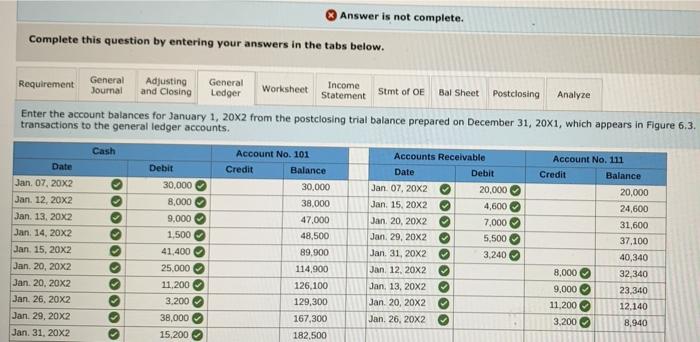

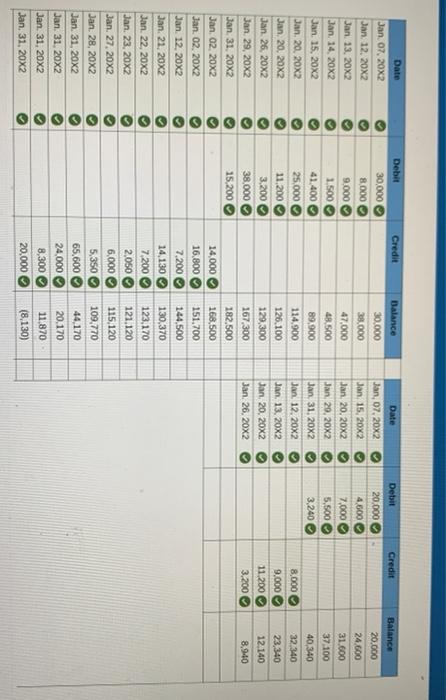

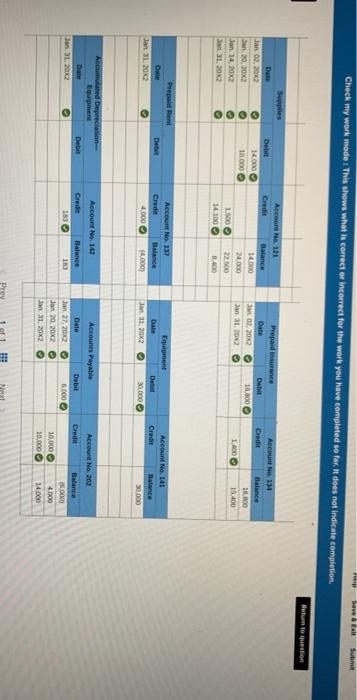

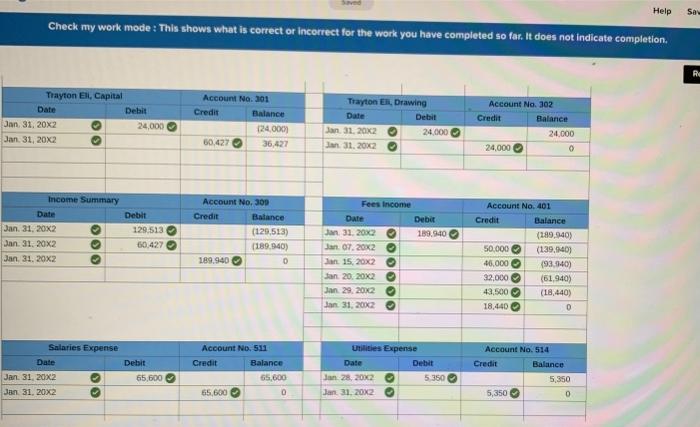

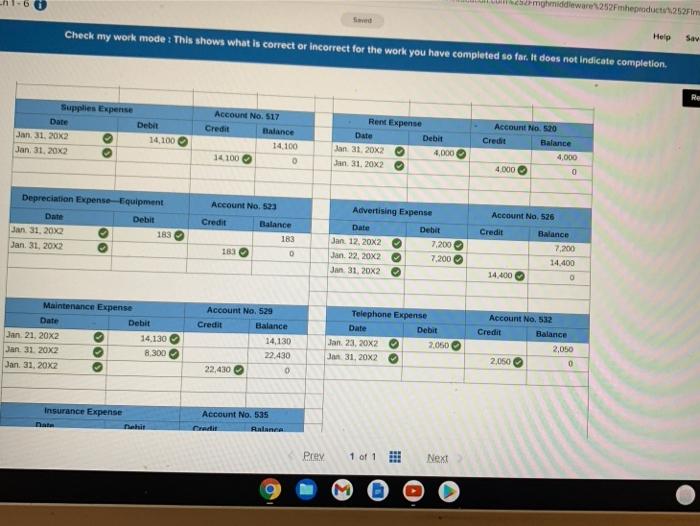

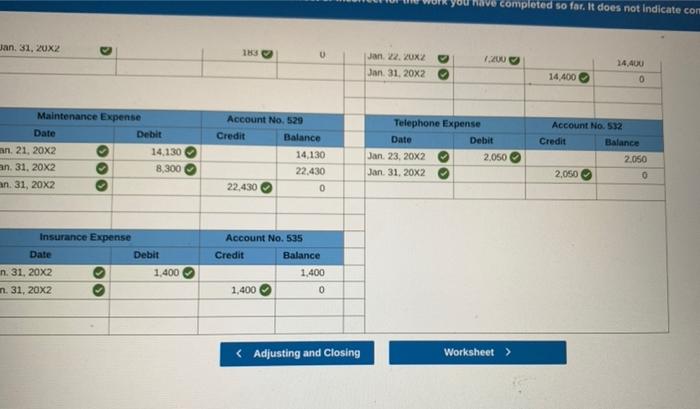

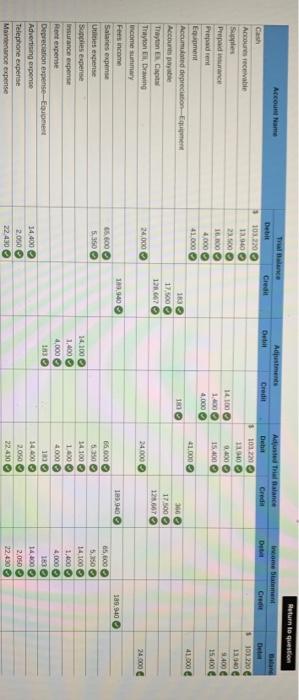

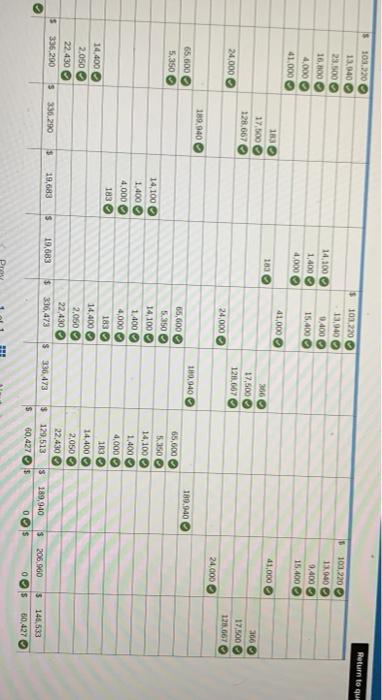

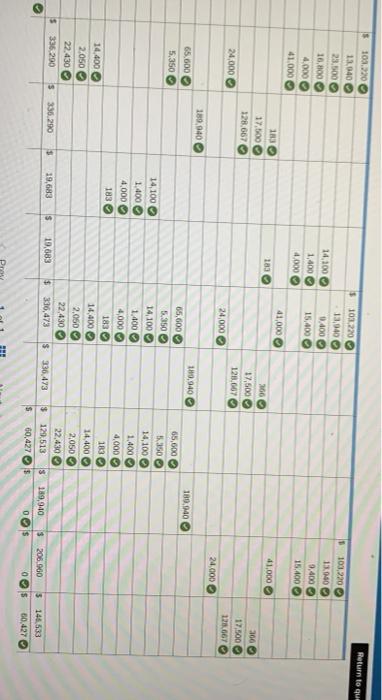

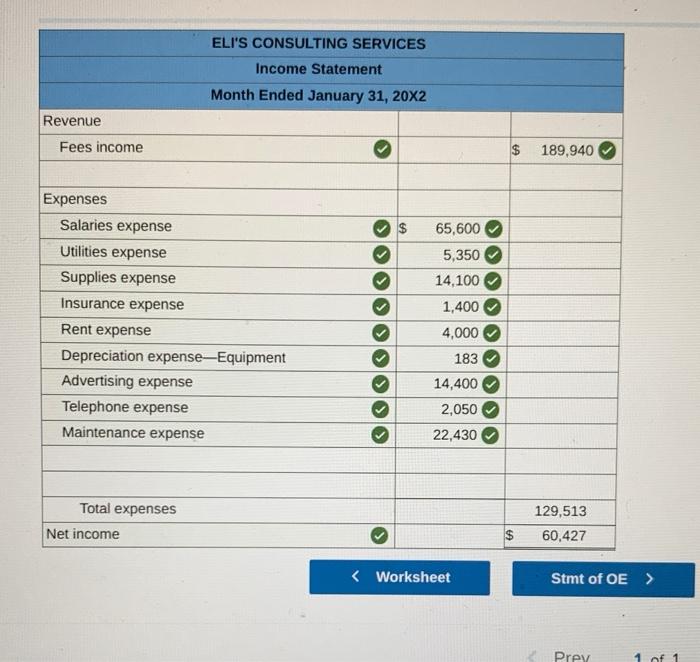

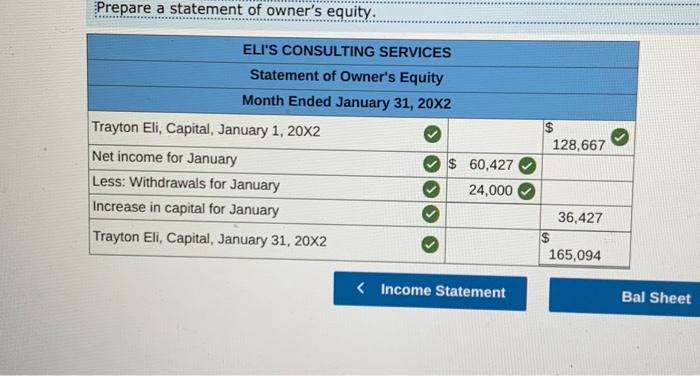

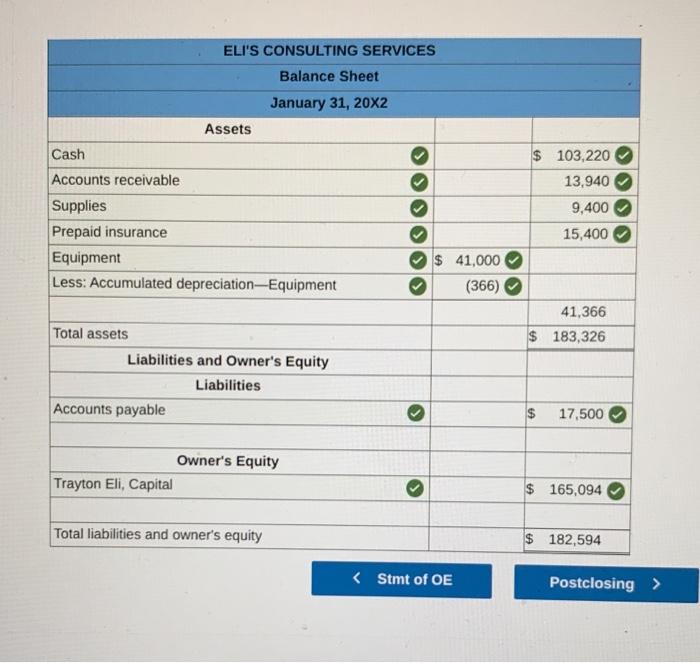

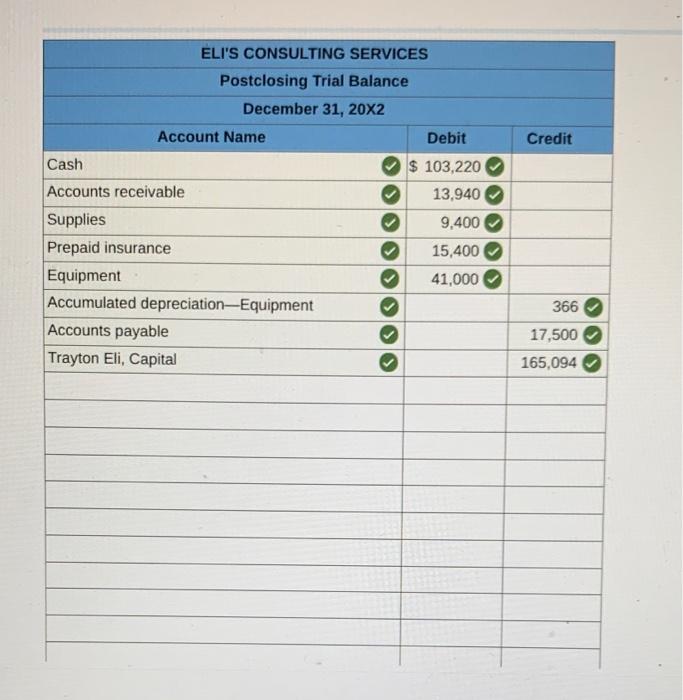

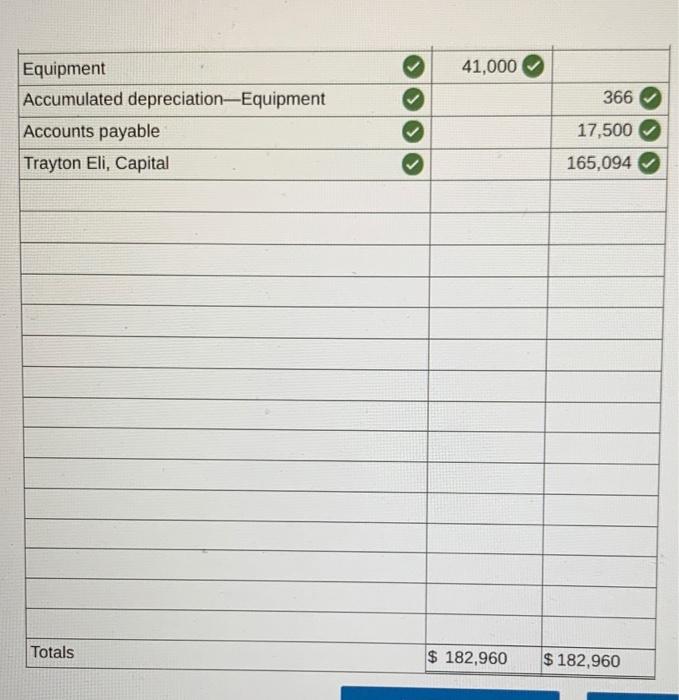

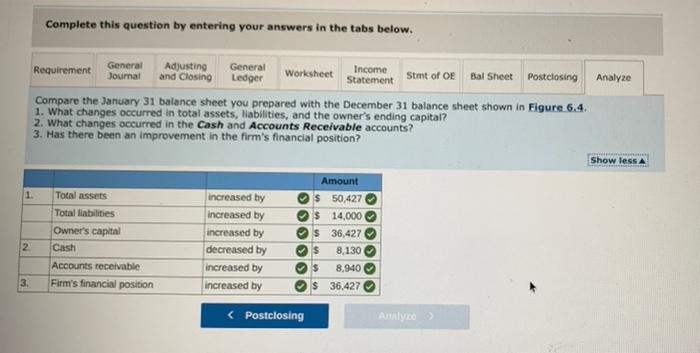

DATE TRANSACTIONS Jan. 2 Purchased supplies for $14,000, issued Check 1015. 2 Purchased a one-year insurance policy for $16,800 7 Sold services for $30,000 in cash and $20,000 on credit during the first week of January 12 collected a total of $8,000 on account from credit customers during the first week of January 12 Issued Check 2017 for $7,200 to pay for special promotional advertising to new businesses on the local radio station during the month. 13 Collected a total of $9,000 on account from credit customers during the second week of January. 14 Returned supplies that were damaged for a cash refund of $1,500 15 Sold services for $41, 400 in cash and $4,600 on credit during the second week of January 20 Purchased supplies for $10,000 from White's, Inc., received Invoice 2384 payable in 30 days. 2e sold services for $25,000 in cash and $7,000 on credit during the third week of January 20 Collected a total of $11, 208 on account fron credit customers during the third week of January. 21 Issued Check 1018 for $14, 130 to pay for maintenance work on the office equipment. 22 Issued Check 1019 for $7,200 to pay for special promotional advertising to new businesses in the local newspaper. 23 Received the monthly telephone bill for $2,058 and paid it with Check 1020. 26 collected a total of $3,200 on account from credit customers during the fourth week of January 27 Issued Check 1021 for $6,000 to office Plus as payment on account for Invoice 2223 28 Sent Check 1022 for $5,350 in payment of the monthly bill for utilities, 29 sold services for $38,000 in cash and $5,500 on credit during the fourth week of January. 31 Issued Checks 1023-1027 for $65,600 to pay the monthly salaries of the regular employees and three part-time workers. 31 Issued Check 1028 for $24,000 for personal use. 31 Issued Check 1029 for $8,380 to pay for maintenance services for the month. 31 Purchased additional equipment for $30,000 from Contemporary Equipment Company, issued Check 1030 for $20,000 and bought the rest on credit. The equipment has a five-year life and no salvage value. 31 Sold services for $15, 200 in cash and $3,240 on credit on January 31. ADJUSTMENTS 31 compute and record the adjustment for supplies used during the month. An inventory taken on January 31 showed supplies of $9, 400 on hand. 31 Compute and record the adjustment for expired insurance for the month 31 Record the adjustment for one month of expired rent of $4,000. 31 Record the adjustment for depreciation of $183 on the old equipment for the month. The first adjustment for depreciation for the new equipment will be recorded in February Prev 1 of 1 !!! Next Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate 31 Purchased additional equipment for $30,000 from Contemporary Equipment Company issued Check 1930 for $20,000 and bought the rest on credit. The equipment has a five-year life and no salvage value. 31 Sold services for $15, 200 in cash and $3,240 on credit on January 31. ADJUSTMENTS 31 Compute and record the adjustment for supplies used during the month. An inventory taken on January 31 showed supplies of 39, 400 on hand 31 compute and record the adjustment for expired insurance for the month 31 Record the adjustment for one month of expired rent of $4,000. 31 Record the adjustment for depreciation of $183 on the old equipment for the month. The first adjustment for depreciation for the new equipment will be recorded in February Required: 1. General Ledger tab: Enter the account balances for January 1, 20x2 from the postclosing trial balance prepared on December 31 20x1, which appears in Eigure 6.3 2. General Joumal tab: Analyze each of the transactions listed for January and record it in the general journal. 3. General Ledger tab: Post the transactions to the general ledger accounts. 4. Worksheet tab: Prepare the Trial Balance section of the worksheet. 5. Worksheet tab: Prepare the Adjustments section of the worksheet using the adjusting transactions. 6. Worksheet tab: Complete the worksheet 7. Income Statement tab: Prepare an income statement for the month. 8. Stmt of OE tab: Prepare a statement of owner's equity. 9. Balance Sheet tab: Prepare a balance sheet. 10. Adjusting and Closing tab: Record the adjusting entries and the closing entries in the general Journal 11. General Ledger tab: Post the adjusting entries and the closing entries to the general ledger accounts. 12. Post Closing tab: Prepare a postclosing trial balance. Analyze: Answer the questions on the Analyze tab to compare the January 31 balance sheet you prepared with the December 31 balance sheet shown in Figure 6.4. Answer is not complete, Complete this question by entering your answers in the tabs below. Income Statement Bal Sheet Requirement General Adjusting General Journal and Closing Ledger Worksheet Stmt of OE Postclosing Analyze 1. General Ledger tab: Enter the account balances for January 1, 20x2 from the postclosing trial balance prepared on December 31, 20x1, which appears in Figure 6.3. 2. General Journal tab: Analyze each of the transactions listed for January and record it in the general Journal 3. General Ledger tab: Post the transactions to the general ledger accounts. 4. Worksheet tab: Prepare the Trial Balance section of the worksheet. 5. Worksheet tab: Prepare the Adjustments section of the worksheet using the adjusting transactions. 5. Worksheet tab: Complete the worksheet. Income Statement tab: Prepare an income statement for the month. 5. Stmt of OE tab: Prepare a statement of owner's equity. . Balance Sheet tab: Prepare a balance sheet. 0. Adjusting and Closing tab: Record the adjusting entries and the closing entries in the general journal. 1. General Ledger tab: Post the adjusting entries and the closing entries to the general ledger accounts. 2. Post Closing tab: Prepare a postclosing trial balance. Show less General Adjusting General Lirement Income and Closing Worksheet Journal Ledger Stmt of OE Statement alyze each of the transactions listed for January and record it in the general journal. Bal Sheet Postclosing An . Date General Journal Credit Jan 02, 20x2 Supplies Cash Debit 14,000 14,000 Jan 02, 20X2 Prepaid insurance Cash 16,800 16,800 Jan. 07, 20X2 Cash Accounts receivable Fees income 30,000 20,000 >> 50,000 Jan 12, 20X2 Cash 8,000 Accounts receivable O 8,000 Jan. 12. 20x2 7,200 Advertising expense Cash >> 7,200 Jan. 13, 20X2 Cash 9,000 Accounts receivable O 9,000 5 Jan 13, 20X2 9,000 Cash Accounts receivable 9,000 Jan 14, 20X2 1,500 Cash Supplies 1,500 Jan 15, 20X2 Cash Accounts receivable Fees income 41,400 4,600 46,000 Jan. 20. 20x2 10,000 Supplies Accounts payable 10,000 Jan 20, 20X2 Cash 25,000 7,000 Accounts receivable Fees income 32,000 Jan. 20, 20X2 11,200 Cash Accounts receivable 11,200 Jan 21, 20X2 Maintenance expense 14,130 Cash 14,130 D AA Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It 12 Jan 21, 20X2 Maintenance expense 14,130 Cash 14,130 13 Jan 22, 20X2 > Advertising expense Cash 7,200 7,200 14 Jan 23, 20x2 Telephone expense Cash 2,050 9 2,050 15 Jan 26, 20X2 3,200 Cash Accounts receivable 3,200 16 Jan. 27. 20X2 6,000 Accounts payable Cash 6,000 17 Jan 28, 20X2 Utilities expense 5,350 Cash 5,350 18 Jan 29, 20X2 Cash Accounts receivable 38,000 5,500 Fees income 43,500 18 Jan. 29, 20X2 Cash Accounts receivable Fees income 38,000 5,500 43,500 19 Jan 31, 20X2 Salaries expense Cash > 65,600 65,600 20 Jan. 31, 20X2 Trayton Ell, Drawing Cash 24,000 24,000 21 Jan. 31, 20X2 Maintenance expense Cash 8,300 8,300 22 Jan 31, 20X2 30,000 Equipment Cash Accounts payable 20,000 10,000 23 Jan. 31, 20X2 15,200 Cash Accounts receivable Fees income 3,240 18,440 Stmt of OE Bal Sheet Postclosing Ar General Requirement Adjusting General Journal Income and Closing Ledger Worksheet Statement Record the adjusting entries and the closing entries in the general journal. No Date General Journal 1 Jan 31, 20X2 Supplies expense Supplies Debit Credit 14,100 14,100 2 Jan 31, 20X2 Insurance expense Prepaid insurance 1,400 1,400 3 Jan 31, 20X2 4,000 Rent expense Prepaid rent 4,000 4 Jan 31, 20X2 183 Depreciation expense-Equipment Accumulated depreciation-Equipment 183 un Jan 31, 20X2 189,940 Fees income Income summary 189,940 on Jan. 31, 20X2 Income summary 129,513 h 1-6 Saved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. Income summary 189,940 6 Jan 31, 20X2 129,513 65,600 Income summary Salaries expense Utilities expense Supplies expense Rent expense Depreciation expense-Equipment Advertising expense Maintenance expense Telephone expense Insurance expense 5,350 14,100 4,000 183 14,400 O 22,430 2,050 1,400 7 Jan. 31, 20X2 60,427 Income summary Trayton Ell, Capital 60,427 8 Jan. 31, 20X2 24,000 Trayton Ell, Capital Trayton Eli, Drawing 24,000 Answer is not complete. Complete this question by entering your answers in the tabs below. Requirement General Adjusting General Income Journal and Closing Ledger Worksheet Stmt of OE Statement Bal Sheet Postclosing Analyze Enter the account balances for January 1, 20x2 from the postclosing trial balance prepared on December 31, 20x1, which appears in Figure 6.3. transactions to the general ledger accounts. Cash Date Jan. 07, 20X2 Jan. 12. 20X2 Jan 13, 20X2 Jan 14, 20X2 Jan 15, 20X2 Jan. 20, 20X2 Jan 20, 20X2 Jan 26, 20X2 Jan. 29, 20X2 Jan. 31, 20X2 Debit 30,000 8,000 9,000 1,500 41,400 25.000 11.200 3.200 38,000 15,200 Account No. 101 Credit Balance 30.000 38,000 47.000 48,500 89.900 114,900 126,100 129,300 167,300 182.500 Accounts Receivable Date Debit Jan 07, 20X2 20.000 Jan. 15. 20X2 4,600 Jan 20, 20X2 7.000 Jan. 29, 20x2 5,500 Jan 31, 20X2 3,240 Jan. 12. 20x2 Jan 13, 20X2 Jan 20, 20X2 Jan 26, 20X2 Account No. 111 Credit Balance 20,000 24,600 31,600 37.100 40,340 8,000 32,340 9,000 23,340 11,200 12.140 3.200 8,940 Credit Credit Debit 30,000 8,000 9.000 1.500 41.400 25.000 11.200 3.200 38,000 15.200 Date Jan, 07. 20X2 Jan 15, 20x2 Jan 20, 20X2 Jan 20, 20X2 Jan 31, 20X2 Jan. 12. 20X2 Jan 13, 20X2 Jan 20, 20X2 Jan 26, 20X2 OOOOOO Detit 20.000 4,000 7,000 5,500 3.240 Balance 20.000 24,600 31.600 37.100 40,340 32 340 23,340 12.140 8.940 8,000 9.000 11.200 3.200 Date Jan 07, 20X2 Jan. 12. 20X2 Jan 13, 20x2 Jan 14, 20X2 Jan 15, 20X2 Jan 20, 20X2 Jan 20, 20X2 Jan 26, 20x2 Jan. 29, 20X2 Jan 31, 20X2 Jan. 02. 20x2 Jan 02, 20X2 Jan 12, 20X2 Jan 21, 20X2 Jan 22, 20X2 Jan 23, 20X2 Jan 27, 20X2 Jan 28, 20X2 Jan 31, 20X2 Jan 31, 20X2 Jan 31, 20X2 Jan. 31, 20X2 14,000 16.800 7.200 14,130 7,200 2,050 6,000 5,350 65,600 24.000 Balance 30.000 38.000 47.000 48.500 89.900 124.900 126,100 129,300 167,300 182.500 168,500 151.700 144,500 130,370 123,170 121,120 115,120 109.770 44.170 20.170 11.870 (8.130) 8,300 20.000 Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion, Save Sum Date Jan 03, 2010 Jan 20, 20X2 Jan 14, 20x2 31. 20X2 Account No. 134 Credit Balance 14.000 10.000 00 OOOO Account No. 121 Credit Balance 14.000 2000 1.500 22.500 14100 8.400 Prepaid instance Date Debi 20x2 18.00 Jan 3120K 2 1.000 15.100 Prepaid Rent Die Jan 31 20 Debat Account No 137 Credit Balance 4.000 14.000 Equipment Date Jan 21 22 Det 30,000 Account No. 141 Credit Balance 30.000 Account No. 1 Acum Depreciation Equipment Date Debe 31, 2012 Credit 13 Balance 13 Accounts Payable Date Debit Jan 27.2002 6.000 Jan 20, 20x2 Jan 120X2 Account No. 203 Credit Balance 6.000 10,000 4.000 10.000 14.000 Prey Ne Help Say Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. R Trayton Ell, Capital Date Debit Jan 31, 20x2 24,000 Jan 31, 20x2 Account No. 301 Credit Balance 124.0001 50.427 36,427 Trayton ER, Drawing Date Debit Jan 31, 20x2 24,000 Jan 31, 20X2 Account No. 302 Credit Balance 24.000 24,000 0 Income Summary Date Jan. 31. 20X2 Jan. 31. 20X2 Jan. 31. 20X2 OOO Debit 129.513 60.427 Account No. 300 Credit Balance (129,513) (189.940) 189.940 D Fees Income Date Debit Jan 31, 2030 159.940 Jan 07.2002 Jan 15, 20X2 Jan 20, 20x2 Jan 29, 20x2 Jan 31, 2002 Account No. 401 Credit Balance (189.940) 50,000 (139.140) -16.000 (93.940) 32.000 (61.940) 43,500 (18,440) 18.440 D Salaries Expense Date Debit 65,600 Account No. 511 Credit Balance 65.600 65,600 0 Utilities Expense Date Debit Jan 28, 2002 5.350 Jan 31, 20X2 Account No. 514 Credit Balance 5,350 5,350 0 Jan 31, 20X2 OO Jan 31, 20X2 (mgmiddleware252Fhproduct252Fm Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Help Say Re Supplies Expense Date Debit Jan 31, 20X2 14,100 Jan. 31. 20x2 . Account No. 517 Credit Balance 14.100 14100 0 Rent Expense Date Debit Jan 31, 20x2 4,000 Jan 31, 20X2 Account No. 520 Credit Balance 4,000 4.000 0 Account No. 523 Depreciation Expense-Equipment Date Debit Jan 31, 20X Jan 31, 20X2 Credit Balance 183 Advertising Expense Date Debit Jan. 12. 20x2 7,200 Jan 22, 20X2 7.200 Jan 31, 20X2 183 0 Account No. 526 Credit Balance 7,200 14.400 14.400 0 183 Maintenance Expense Date Debit Jan 21, 20X2 14.130 Jan 31, 20X2 8.300 Jan 31, 20x2 OOO Account No. 529 Credit Balance 14,130 22.430 22.430 0 Telephone Expense Date Debit Jan 23, 20x2 2.050 Jan 31, 20X2 Account No. 532 Credit Balance 2,050 2,050 0 Insurance Expense hat Dahit Account No. 535 Rain Prey 1 of 1 Next M you have completed so far. It does not indicate com Jan. 31, 20X2 123 1200 Jan. 22. ZUX Jan. 31. 20x2 14.400 0 14.400 Maintenance Expense Date Debit an 21, 20X2 14.130 an. 31. 20x2 8,300 an 31, 20X2 Account No. 529 Credit Balance 14,130 22.430 22.430 0 Telephone Expense Date Debit Jan 23, 20X2 2.050 Jan 31, 20x2 Account No. 532 Credit Balance 2.050 2.050 0 Insurance Expense Date Debit n. 31, 20X2 1.400 n. 31, 20X2 Account No. 535 Credit Balance 1.400 1.400 0 Account Name Credit Adhestments Det Credit 103.220 12.30 23.500 16.00 4.000 41.000 Adjusted nalance Daha Crede 103 21 10 400 15.400 Noturn to question www.mement Balans Det Crew Det 103.20 1314 9.400 15400 001 TI 1.00 4,000 21,000 41.000 e 180 160 17.500 128.667 360 17.500 12.67 OOO 24,000 24000 24.000 Acours receivable Supples Prepaid Preparent Equment Accumulated depreciation Account Tryton E Cat Truyton Drawing income su may Fees income Salaries expense Us expense Suppliese pense Insurance expense Rent expense Depreciation expense-Equipment Advertising expense Telephone expense Maintenance expense 13.540 189940 189.940 6.00 5.350 14100 1,400 4.000 OOOO 66.000 5.350 14100 1400 4000 10 34.400 2.050 22.410 65,000 5,50 14100 1,400 4,000 DWT 14.400 2,050 22.430 OOO 14200 2,050 22.430 Return toque 103.220 13,040 101220 100.220 13.040 23.500 16.100 4,000 41.000 1100 14.100 1,400 4.000 BO 15.400 9.400 15.400 41,000 Ocet 41.000 13 17.500 128.667 . OOO 350 17,500 128.667 306 17.500 12.667 24,000 > 24,000 24.000 180,940 1180,940 189,040 65.000 5,350 14.100 1.400 4.000 183 OBOS 65,600 5.350 14,100 1.400 4,000 183 14.400 2,060 22,430 $ 336,473 BOOOOOO 65,600 5.350 14,100 1.400 4,000 183 14.400 2,050 22.430 129,513 60,427 OOOOOOOO 14.400 2.050 22.430 336,200 $ s 336.290 3 19,683 $ 19,683 $ 336.473 $ 3 $ 206.900 5 189,940 OS 146.533 50,427 0 Return toque 103.220 13,940 100.220 13.040 23.500 16.800 4.000 41.000 101220 OOO 400 14,100 1,400 4,000 15.400 1300 9.400 15.400 41,000 183 41.000 13 17.500 128.667 OOO 266 17,500 128.667 BO 300 17,500 121.667 24,000 > 24,000 24.000 180.940 180,940 189.240 65.000 5,350 14,100 1.400 4.000 183 OBOS 65,600 5.350 14,100 1,400 4,000 183 14.400 2,060 22,430 $336,473 BOOOOOO 14.400 2.050 22.430 336.200 65,600 5.350 14,100 1.400 4.000 183 14.100 2,050 22,430 129513 60,427 $ s 336.290 $ 19,683 $ 19,683 $ 336.473 $ 205.000 5 146, 533 189,940 OS 5 Os 60,427 ELI'S CONSULTING SERVICES Income Statement Month Ended January 31, 20X2 Revenue Fees income $ 189,940 Expenses Salaries expense Utilities expense Supplies expense Insurance expense Rent expense Depreciation expense-Equipment Advertising expense Telephone expense Maintenance expense 65,600 5,350 14,100 1,400 4,000 183 14,400 2,050 22,430 Total expenses Net income 129,513 60,427 $ Prey 1 Prepare a statement of owner's equity. ELI'S CONSULTING SERVICES Statement of Owner's Equity Month Ended January 31, 20X2 Trayton Eli, Capital, January 1, 20X2 128,667 Net income for January Less: Withdrawals for January Increase in capital for January $ 60,427 24,000 Trayton Eli, Capital, January 31, 20X2 36,427 $ 165,094 Credit ELI'S CONSULTING SERVICES Postclosing Trial Balance December 31, 20X2 Account Name Debit Cash $ 103,220 Accounts receivable 13,940 Supplies 9,400 Prepaid insurance 15,400 Equipment 41,000 Accumulated depreciation-Equipment Accounts payable Trayton Eli, Capital 366 17,500 165,094 41,000 366 Equipment Accumulated depreciation Equipment Accounts payable Trayton Eli, Capital 17,500 165,094 Totals $ 182,960 $ 182,960 Complete this question by entering your answers in the tabs below. Requirement General Adjusting General Journal Income and Closing Worksheet Ledger Stmt of OE Bal Sheet Postclosing Statement Analyze Compare the January 31 balance sheet you prepared with the December 31 balance sheet shown in Figure 6.4. 1. What changes occurred in total assets, liabilities, and the owner's ending capital? 2. What changes occurred in the Cash and Accounts Receivable accounts? 3. Has there been an improvement in the firm's financial position? Show less Total assets Total liabilities Owner's capital Cash Accounts receivable Firm's financial position increased by increased by increased by decreased by Increased by increased by Amount $ 50,427 $ 14,000 $ 36,427 $ 8,130 s 8,940 $ 36,427 2 3.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts