Question: I need help calculating the adjusted ROA for the attached homework assignment. Compute and Analyze Measures for DuPont Disaggregation Analysis The 2 0 1 8

I need help calculating the adjusted ROA for the attached homework assignment. Compute and Analyze Measures for DuPont Disaggregation Analysis

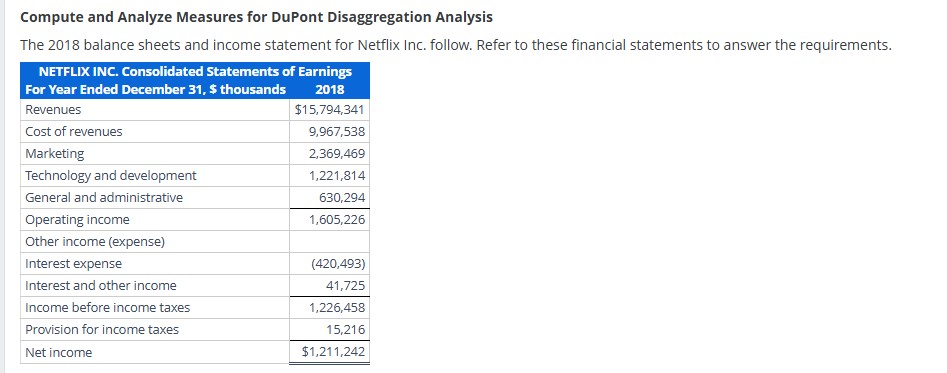

The balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements.NETFLIX INC. Consolidated Statements of Earnings For Year Ended December $ thousands begintabularlll

hline multicolumncNETFLIX INC. Consolidated Balance Sheets

hline in thoustands, except par value & &

hline Current assets & &

hline Cash and cash equivalents & $ & $

hline Current content assets, net & &

hline Other current assets & &

hline Total current assets & &

hline Noncurrent content assets, net & &

hline Property and equipment, net & &

hline Other noncurrent assets & &

hline Total assets & $ & $

hline Current liabilities & &

hline Current content liabilities & $ & $

hline Accounts payable & &

hline Accrued expenses & &

hline Deferred revenue & &

hline Total current liabilities & &

hline Noncurrent content liabilities & &

hline Longterm debt & &

hline Other noncurrent liabilities & &

hline Total liabilities & &

hline Stockholders' equity & &

hline Preferred stock, $ par value & &

hline Common stock, $ par value & &

hline Accumulated other comprehensive loss & &

hline Retained earnings & &

hline Total shareholders' equity & &

hline Total liabilities and shareholders' equity & $ & $

hline Combined federal and state statutory tax rate & &

hline

endtabular a Compute ROE and ROA for

b Confirm that ROE equals ROE computed using the component measures for profit margin, assets turnover, and financial leverage: ROE PM times AT times FL

ROE may be different due to rounding

c Compute adjusted ROA assume a statutory tax rate of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock