Question: I need help calculating the missing boxes, everything already in a box is correct. I need help with 7a and 7b. please show calculations. thank

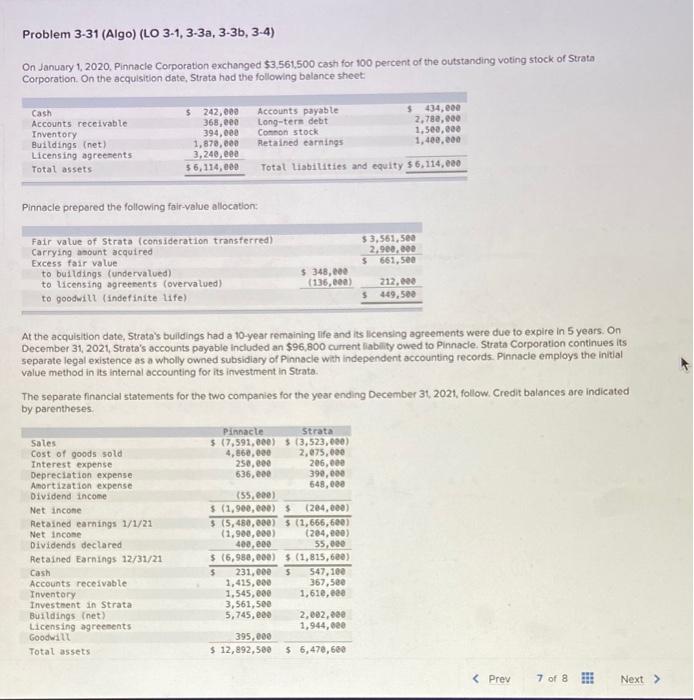

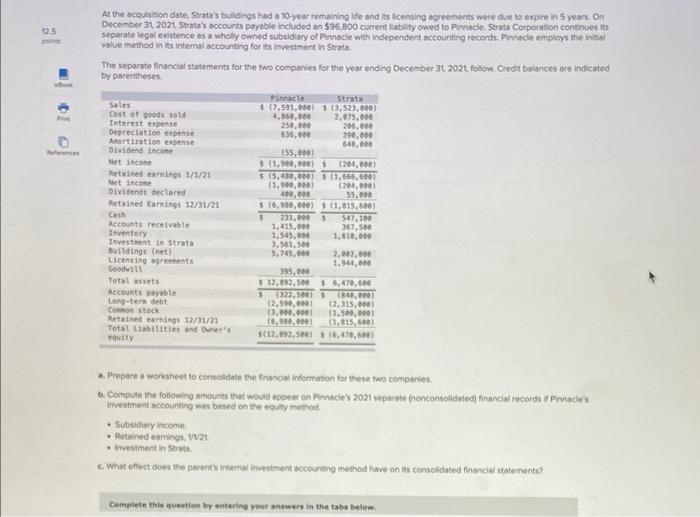

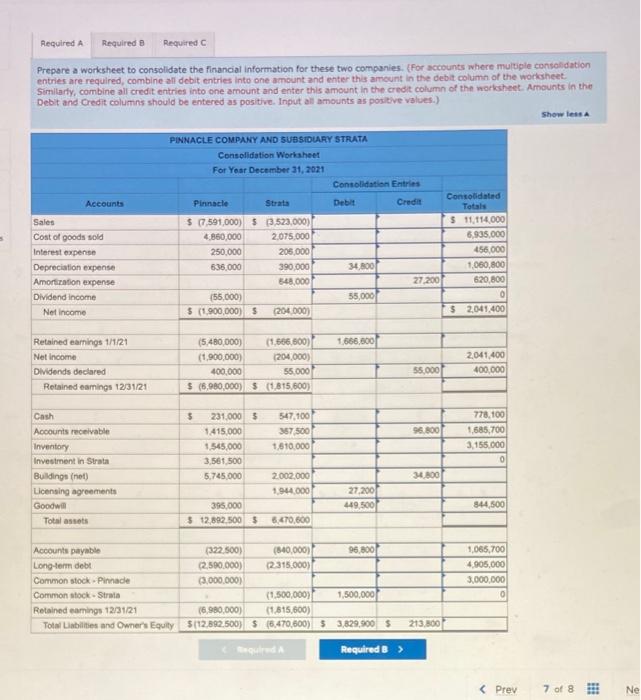

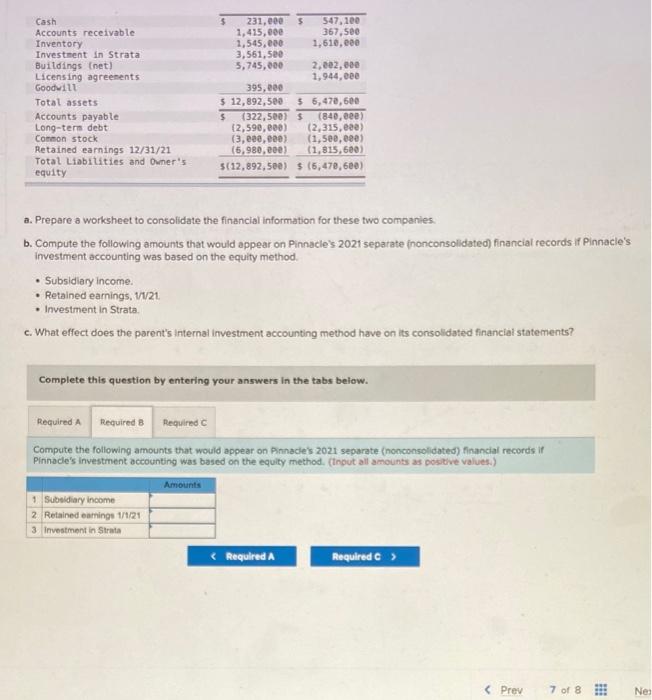

Problem 3-31 (Algo) (LO 3-1, 3-3a, 3-3b, 3-4) On January 1, 2020, Pinnacle Corporation exchanged $3,561,500 cash for 100 percent of the outstanding voting stock of Strata Corporation. On the acquisition date, Strata hod the following balance sheet: Pinnacle prepored the following fair-value allocation: At the acquisition date, Strata's buildings had a 10-year remaining life and its licensing agreements were due to expire in 5 years. On December 31,2021, Strata's accounts payable included an $96.800 current liablity owed to Pinnacle. Strata Corporation continues its separate legal existence as a wholly owned subsidiary of Pinnacle with independent accounting records. Pinnacle employs the initial value method in its internal accounting for its investment in Strata. The separate financial statements for the two companies for the year ending December 31,2021 , follow. Credit balances are indicated by parentheses. At the acquisition date, Strata's buildings had a 10year remaining lfe and its licensing agreements were due to exple in 5 years. On December 3t, 2021, Stratas accounts payable included an $96.800 curent babilify owed to Pinnscie. Strata Corporation continues its sepurate legai existence as a wholy owned subwdiary of Pirnacle with independent accounting records. Pirnacle employs the initial value method in iss internal accounting for its ifvestment in 5 trata. The separate financial ttatements for the two companies for the year ending December 3t 2021, folow. Credi balances are indicated by parentheses. a. Prepare a worksheet to consolidate the financial information for these fwo companses. b. Compuet the following amounts that would npoear on Pimacles 2021 separate (nonconsolidated financial records if Pinnacles: ifvestmeat accounting was besed on the equaty method - Subsidacy income - Reteined eamingu t/2r - Mvesiment in Strata. c. What effect does the parents ineresul investment accounting mehod have on its consolidated financial statements? Cemplete this questien by entering your andwers in the tabs below. Prepare a worksheet to consolidate the financial information for these two companies. \{For accounts where mulugle consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarfy, combine all credit entries into one amount and enter this amount in the credt column of the worksheet. Amounts in the Debit and Credit columns should be entered as positive. Input all amounts as positive values.) a. Prepare a worksheet to consolidate the financial information for these two companies. b. Compute the following amounts that would appear on Pinnacle's 2021 separate (nonconsolidated) financial records if Pinnacle's investment accounting was based on the equity method. - Subsidiary income. - Retained earnings, V/21. - Investment in Strata. c. What effect does the parent's internal investment accounting method have on its consolidated financial statements? Complete this question by entering your answers in the tabs below. Compute the following amounts that would appear on Pinnacle's 2021 separate (nonconsoldated) financial records if Pinnocle's investment accounting was based on the equity method. (thout all amounts as positve values.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts