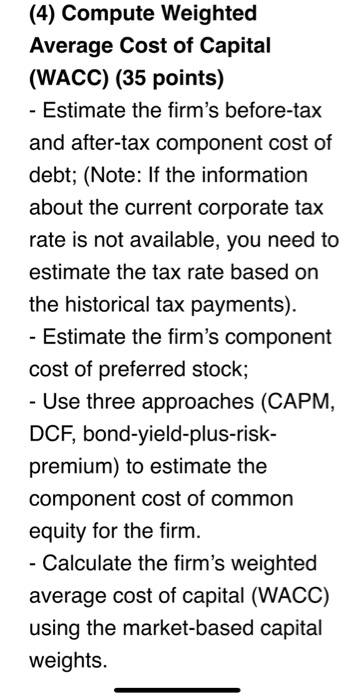

Question: I need help calculating the WACC % for phillips 66 (PSX) using the criteria in the image. (4) Compute Weighted Average Cost of Capital (WACC)

(4) Compute Weighted Average Cost of Capital (WACC) (35 points) - Estimate the firm's before-tax and after-tax component cost of debt; (Note: If the information about the current corporate tax rate is not available, you need to estimate the tax rate based on the historical tax payments). - Estimate the firm's component cost of preferred stock; - Use three approaches (CAPM, DCF, bond-yield-plus-risk- premium) to estimate the component cost of common equity for the firm. - Calculate the firm's weighted average cost of capital (WACC) using the market-based capital weights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts